Many traders struggle when it comes to trading patterns. They don’t know what to look for and this is further compounded by the amount of conflicting information out there.

Some say to buy rising prices and sell higher – others say to buy falling prices and sell higher. Who is correct?

This article will explain why breakout trading is a powerful pattern for traders. The breakout strategy is my tried-and-tested pattern that I use to trade UK listed stocks.

First of all, we need to understand what a breakout is.

What is breakout trading?

Breakout trading is a chart pattern where the price action moves, or ‘breaks out’, above a trading range set from the previous high. Once the price has broken the resistance level, it enters into new territory and the demand has beaten the supply of stock at the price of resistance.

Therefore, a new trend is (in theory) being established.

The breakout strategy gives traders and investors an early signal that can sometimes be the start of a larger move and an increase in volatility. Think about it: every stock that ever made an all time high had to have continuously broken out of previous resistance to get there.

That means there is a huge abundance of breakouts to be traded!

The breakout can be on the daily chart, the weekly chart, the monthly, and it can also be on the 1 minute chart.

We can trade breakouts on all time frames and not just in stocks either – there are many forex traders who utilise breakouts as part of their trading arsenal.

Why trade the breakout?

The breakout offers traders a strategy with plenty of upside and when traded properly reduced downside risk.

Breakouts can take place in all time frames and also in all market conditions. Granted, in a bear market, there will be far less breakouts to trade, but that means the stocks that do break out are showing strength in a weak market. This can be a very powerful signal the stock is ready to move significantly and that traders can take advantage by getting onboard an early trend before the rest of the market has begun to catch up.

The breakout can form also in many types of patterns itself; it is a pattern within a pattern.

Where to find breakouts?

I have found breakouts from previous 52 week and all-time highs to be reliable, and we can also trade breakouts from channels, wedges, head and shoulders, cup and handles. It is a common pattern, and is the bread and butter of my trading.

To filter for stocks trading near their 52 week and all-time highs I use SharePad.

The best breakouts occur from periods of low volume and low volatility, with the breakout occurring on larger than average volume of stock traded. Both technical analysis and the uptrending 200 moving average are useful to spot breakout opportunities and stocks that put in higher lows can be considered breakout candidates.

Here is an example of Bushveld Minerals breaking out after a long period of consolidation:

We can see the volume start to increase (marked with my arrow) and a few days later the stock broke out of its previous high at 11. The stock then doubled within six weeks.

Breakouts on high volume show demand for the stock. It’s this demand that propels the price higher.

Here is another example of a breakout from Best Of The Best.

I was accumulating stock (and highlighted this opportunity in my Facebook group) as the company had made the switch to 100% online revenue rather than the low margin airport and shopping centre sales.

The stock broke out, and quickly ran up to a 200% profit within a few weeks. Unfortunately, I banked this too early as the stock carried on and eventually hit 3,000p.

Notice the low volume and low volatility in the stock before the breakout. When we see tighter trading ranges, this is usually the signal for a larger move. This is known as consolidation when the stock is beginning to resemble a coiled spring. Once there is a release from the trading range the stock can move sharply.

However, there is a risk if you buy before the stock has broken out that the stock doesn’t actually break out! You can be holding onto a dead stock for a while and even lose money.

How to trade the breakout

- Look for breakouts from highs, from trading channels, wedges, head and shoulders, cup and handles

- Check for periods of consolidation where volume decreases and volatility declines – when interest and volumes are low the stock can move quickly when that volume ramps up

- A good charting package such as SharePad will allow you to filter for setups and manage your own watchlist to keep track of stocks that have breakout potential

Breakouts generally work best when emerging from a Stage 1 base or a Stage 2 uptrend. These are covered in detail in my book How to Make Six Figures in Stocks.

Entering the breakout

We want to be entering the stock as it breaks out of the previous high. This is because when the price breaks above the high, in theory there are less likely to be sellers. When a stock breaks the all-time high this means that every single shareholder is now in profit. It is blue sky territory and so there are no trapped buyers or stale bulls exiting the stock.

Do not pre-empt the breakout

We should never attempt to second guess the market unless we have a significant reason to take on that extra risk in a trading opportunity.

We are not gamblers, and we trade only when the risk/reward is in our favour. We’re not here to play every hand; we’re here to make money consistently and sustainably. Gambling is not in my trading arsenal and it shouldn’t be in yours either.

Many stocks will fool us by almost hitting the previous high, only to reverse as sellers dump their stock. The best way to not lose money in this way is simple: wait for confirmation and buy the breakout.

If the stock doesn’t break out, no matter how close it is to the high, then we don’t buy. This simple rule keeps us on the straight and narrow and ensures we only trade when it is advantageous for us to do so.

The breakout retest

The breakout sometimes tends to test the resistance level it has just broken through which now becomes the support level.

Here’s an example:

Notice how De La Rue breaks through its recent closing high but pulls back and retests?

Pullbacks are perfectly normal, and we shouldn’t be worried, as we expect it and have our risk in place. Obviously, we prefer our breakouts to quickly gain new ground without pulling back, but retracements offer a second chance for those who missed the initial breakout to buy on the dip. This means that a breakout that retraces has a high probability of success because of that underlying support.

This is more likely to happen on a stock that has seen an increase in volatility already and a bigger movement that has pushed it through the resistance level. When this happens, breakout traders who did not want to buy an extended move have the opportunity to load the dip. I like this setup a lot and it is a staple in my trading playbook.

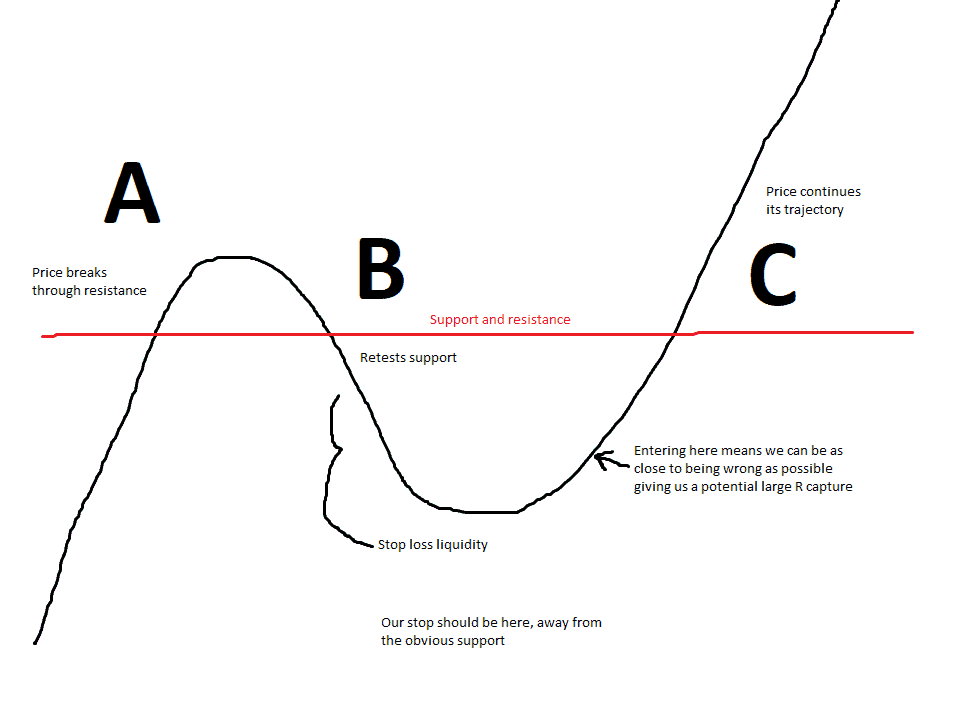

To explain further, with my highly sophisticated Microsoft Paint skills, this is what happened:

Point A is where the price initially broke through resistance, point B is where the price moves back to retest support.

The obvious support and stop loss placement is directly on the support line, where amateurs place their stops, and also underneath the support line in the support zone. This is where we have the potential for a large risk/reward multiple trade. We are entering the stock as close to the danger zone as we can. This means we are entering very close to being wrong, and by doing so we can reduce our risk. This skews our risk/reward ratio very much in our favour as we are optimising our entry.

Point C is where the price has flushed out the weak hands, and liquidity heads towards the breakout and beyond.

What is a false breakout?

A false breakout (or ‘fakeout’ as they are commonly known) where the candles go through the breakout point but quickly reverses and falls back beneath the support level.

Traders should exit false breakouts quickly as the goal is to buy a stock that moves quickly into profit rather than reversing.

Tree shake

In stocks that trade on SETSqx where the stock has made an extended move, the market makers often like to give the tree a shake. I’ve written more about tree shakes in my Level 2 guide. A tree shake is when market makers like to lower their online bid, in order to drag the mid-price of the stock down. This spooks people into selling, giving the market makers shares at a better price for them. Once the market makers have their fill, they simply raise their online bid again back to where the price was originally!

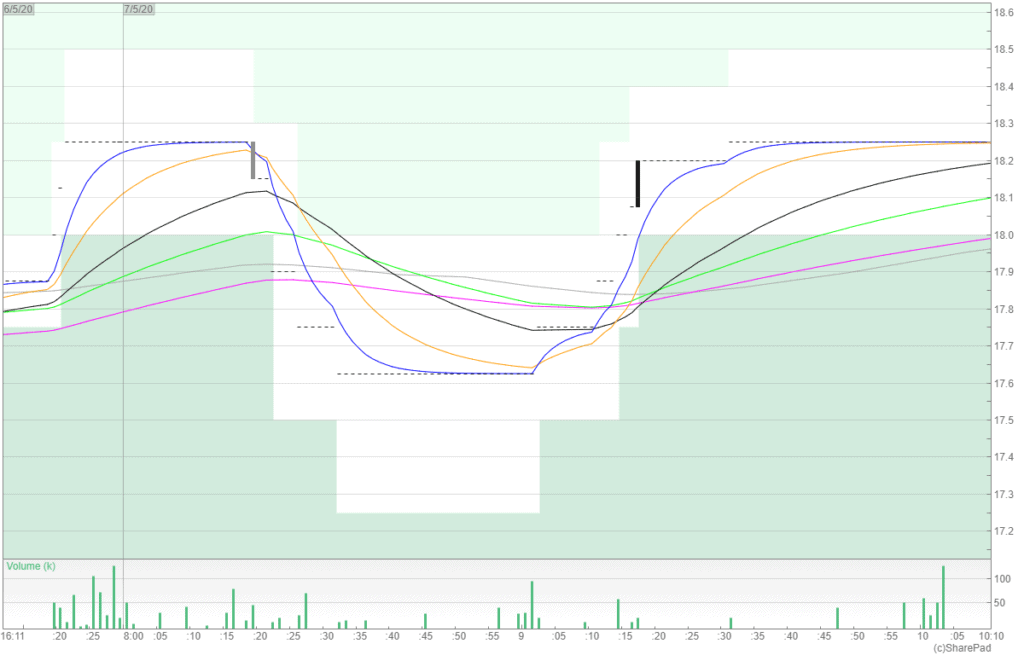

Here is an example of a tree shake in Totally. We can see the price moves from 18.25p at 08:15, falls to 17.6p, then rises back to 18.25 within two hours.

Remember, the market makers are there to make a market, but many of them seem to have added their own extra few words to the phrase: to make a market (for themselves)!

If they need stock, they will shake the tree, jack up the ask price to widen the spread and deter buyers.

Market makers also know where amateurs place their stop loss, and giving the tree a shake gives them the opportunity to flush out a few weak hands and then sell those shares on for a profit. They make a monetary turn on every trade and so they do not care about supply and demand as much as they make money.

It’s wise to be aware of these tactics, but do not allow yourself to run losers because you have convinced yourself “it’s only a tree shake”.

If you find yourself continuously being stopped out or taking small losses, don’t blame the market makers any more than we would blame a scorpion for stinging us. It’s in their nature.

Consult your trading journal, find out what is going wrong, and improve it. Getting a better entry, or reducing position size and increasing the percentage risk taken on the trade, are both two things that we can look at improving.

Step-by-step method for trading breakouts

- Stalk the trade

- Plan your trade and trade your plan

- Get ready to pounce

- Pull the trigger

- Manage the retest

1. Stalk the trade

The best way to trade breakouts is to see them coming and have plenty of time to prepare. Stocks that look like they are now bowling up, or curving upwards, back up to their previous highs are good candidates to stick on our watchlists.

Stocks that also are bumbling around hitting support and resistance in a channel several times are also great; the more confirmed those levels become then the more significant the eventual move is when it breaks out of the range.

2. Plan your trade and trade your plan

The best way to trade is when we are at our most objective. This is when we are flat and do not have any position, long or short, in the stock.

This is the time to plan our trade in advance, knowing our risk, and our profit targets, and then trading simply becomes executing. Real trading is boring. But there’s nothing boring about making money.

3. Get ready to pounce

There are few things more annoying than doing the work only to miss your entry and watch the stock roar 30% above the resistance level you were targeting. We can keep track of stocks by automation and setting alerts when stocks hit key areas. I use SharePad to set alerts on stocks. Be ready, and keep on top of your watchlist.

4. Pull the trigger

You’ve done the hard work, now it’s time to pull the trigger. Execute as planned. We are precision operators, not mindless gamblers.

5. Manage the retest

Understand that stocks retest and be ready for it. If there is a good opportunity to add with a very tight stop loss and that was in your plan, then execute as planned.

The sooner we can get away from our need to be right (our ego) and the need to predict prices, then the sooner we can start to play the cards that are dealt in front of our faces and we start to make money consistently.

The beauty of the breakout is that motion creates emotion. When prices are moving quickly, it stirs panic in people and they rush in haste to jump aboard once the stock has started to and already made a move. These are the people that you and I want to be selling to.

When the stock is 30% up and the fear of missing out is too great, they cave and become liquidity for those who bought at the right time. Our job is to buy the breakout, and not chase. Chasing gives us a poor risk/reward and we want to capture R, not give it away needlessly. A missed stock did not cost us any money.

Concluding breakouts

Breakouts are a great way to trade price action momentum and offer low risk and high reward opportunities to profit from uptrending stocks.

The best breakouts come from stocks with increasing fundamentals with a decisive breakout candle on heavy volume.

Bollinger bands can also be employed to find stocks with low volume and volatility, as this finds stocks with long periods of consolidation.

Finally, be careful of using market orders with breakouts. This is a blank cheque to buy at any price – stop limit orders should be used instead.

My UK Stock Trading Handbook covers all of this in more detail which you sign up for below.

Become a better trader with SharePad. Filter for volume and breakouts using my filters and your own. Use Level 2 to work better entries and exits and see the market in real-time. SharePad gives me an advantage over the market and you can take a risk-free trial through me. Find out more