Many private investors don’t understand how to read a balance sheet.

This causes many problems as they are unable to assess the company’s financial health and make accurate investment decisions by reading the financial statements.

Furthermore, not being able to understand the financial statements can also mean an investor doesn’t spot the red flags that a bad balance sheet will typically show. Investing in a bad company can see a private investor lose all of their money.

This article will show you how a balance sheet is laid out, how to understand it, and how to use the information to make informed decisions based on the balance sheet.

How to read a balance sheet for beginners

- Understand how a balance sheet works

- Read the assets on the balance sheet

- Read the liabilities on the balance sheet

- Read the equity on the balance sheet

- Read the balance sheet with ratios

- Make important balance sheet spot checks

Click the links above to jump to each section.

1. How a balance sheet works

A balance sheet works as a reference point for the company’s financial health at a single point in time. This is why it can be useful to check balance sheets from prior years in order to spot material changes.

A balance sheet is laid out in three sections:

- Assets

- Liabilities

- Equity

Let’s explore what each of these actually mean – beginning with assets…

Assets

The assets of a company belong to both the liability holders and the equity holders. They are resources that belong to the company, and can be both intangible (such as the Coca-Cola brand) and tangible (such as a property, plant, and equipment).

Types of assets

- Current assets: A current asset is an asset which can be sold for cash, consumed, or used within the current financial year. Cash, trade receivables, and inventory are examples of current assets

- Non-current assets: A non-current asset is an asset which is not expected to be sold or converted into cash within the current financial year. Investments in other companies, property, plant, and equipment, as well as intellectual property, are all examples of non-current assets

Liabilities

The liabilities are what the company owes. This can be payment for a service that the company received but has not paid for yet (trade payables) or it can be a loan from the bank (bank debt).

The bank would provide a loan against the assets of a company – either the company pays the bank back, or if the company is no longer able to, the bank seizes the company’s assets.

This is no different to the bank taking back your house if you stop paying the mortgage.

Types of liabilities

- Current liabilities: A current liability is a liability which needs paying within the current financial year. Trade debtors, accounts payable, short-term debt, as well as any tax owed are all examples of current liabilities.

- Non-current liabilities: Non-current liabilities are liabilities that do not need paying within the current financial year. Long-term loans such as a mortgage for property or equipment, deferred tax liabilities, and long-term lease obligations are all examples of non-current liabilities

PRO TIP: If current liabilities outweighs the current assets of a company then there could be a cash call on the company. It’s worth checking payment terms of creditors and debtors too as sometimes a net current liability position is not always a red flag.

Equity

Equity is what is left for the shareholders of the company. When a company goes bankrupt, the creditors take priority and so it is the liabilities that are taken care of first from the assets.

Only then are equity holders paid out with whatever is left from the company, if anything.

Those who own claims to the company’s assets through providing debt have limited upside, because debt holders are always guaranteed to be paid out first.

Equity holders take the risk of receiving nothing, but they get to partake in the profits of the company, which is potentially limitless!

As shareholders, it is the equity that we are always interested in.

The total of assets and liabilities will always equal the equity. This is a fundamental principle in accounting called the accounting equation, or the balance sheet equation.

The balance sheet equation

The balance sheet represents the accounting equation, and as we know in equations both sides of the equals sign in an equation must balance.

Assets = Liabilities + Equity

As the assets of a company are split up between those who are owed (liabilities) and those who own (equity) we can further simplify the accounting equation.

Assets = Liabilities + Equity

Assets = Claims

Therefore, assets = claims.

Both the liability holders and equity holders have claims over the assets of the company.

Balance sheets must be balanced

As the assets of a company are claimed by either the liability holders or the equity holders, whenever the value of an asset goes up or down this must be reflected in the liability or equity section on the balance sheet.

Let’s say we create a company…

We input £10,000 of our own cash, and borrow £10,000 from the bank. This would be our balance sheet below.

On the left is our assets, and as assets equals claims we have the liability holders and the equity holders on the right to balance.

Now, let’s say we bought a workshop for £5,000 in cash.

Is the workshop a liability?

No, it’s an asset. So, we need to decrease cash by £5,000 and add the value of the workshop to our balance sheet as we do below…

We can see that the balance sheet still balances.

All that has happened is our cash has decreased due to the payment of our workshop in cash. The bank’s claim over the assets is still the same. As there has been no profit or loss recorded shareholder equity stays the same too.

If we were to sell the workshop a year later without having done anything else for £10,000, then our cash would increase to £25,000, and the profit would be added to shareholder equity.

2. How to read assets on the balance sheet

So we can understand how to read a balance sheet, Let’s look at a typical balance sheet, the first part of which consists of assets.

We can see three columns for three different sets of results. On the right, we can see the audited results up to the six month period up to 31 March (this was pulled from the half-year report).

Audited means that the results have been verified by the company’s external accountants (the auditors), so we can be reasonably sure that management has not just made the figures up out of thin air.

Only fraudulent management teams make the numbers up out of thin air and then they have to fool the auditors (if they can fool them then they will probably fool you and I).

The other two are the half-year results from the same period in 2017 and 2018 unaudited.

Here we can see for comparison the financial state of the company from the same period in two different years.

We can see that of the non-current assets there are two intangible assets listed on the balance sheet.

Goodwill is the result of paying more than the fair value of the company’s identifiable assets, or as cynics would say: how much we overpaid!

The book value is what the business would be worth if it were to stop trading tomorrow and be liquidated for its value.

It is rare that anyone is ever able to buy a business with potential for the sum of the parts price. It costs less than £1 for all the ingredients for a Big Mac, yet we do not expect to pay the book value for that!

Inventory is the materials needed for the company to produce their final product (this includes both work in progress, or WIP, and finished goods).

Some companies (such as software companies) may not own any inventory and so each balance sheet will be different.

In this case, the cosmetics company needs to buy the chemicals and materials required to create the product and store it. Everything tangible that is required to create the final product is listed under inventory.

Trade and other receivables is cash the company is owed. It may have completed their service or made the sale and charged the revenue to the income statement, but the company has not yet collected the cash.

When we go to the cinema, we pay up front before we receive the service. The cinema collects our cash beforehand.

However, in many restaurants in Europe, we eat first and then pay for the service after.

Until we have paid the restaurant, the restaurant would have the revenue charged to us on their income statement and our unpaid cash would be on their balance sheet as trade and other receivables.

Once we have paid, the value of our meal would be removed from trade and other receivables and added to cash on the balance sheet.

Cash and cash equivalents are the cash and liquid assets that are available quickly. These are needed for the business to carry out its ordinary operating activities.

3. How to read liabilities on the balance sheet

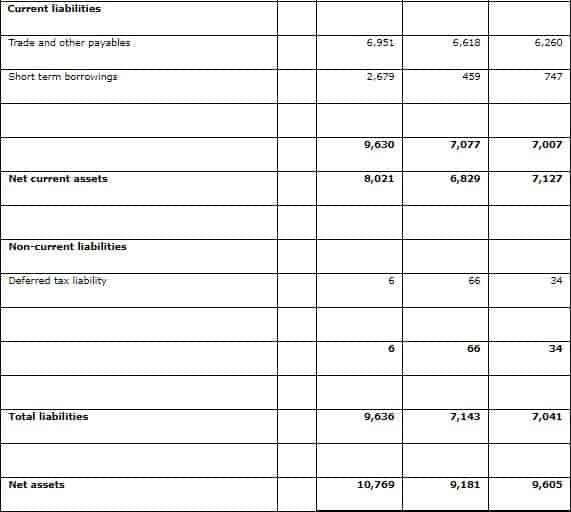

Here is the second part of the same balance sheet that covers liabilities…

We can see that the company has received a service and not yet paid for it, which comes under trade and other payables. Imagine that we are in the restaurant again and have not yet paid – this payable amount would be on our balance sheet!

The company has some short term borrowings which will need to be paid back at some point within the financial year as they are in current liabilities, but other than that the liabilities section is relatively clean in this example.

Companies that carry burdensome debt well in excess of their market cap should be questioned, because if the company goes bust the equity holders will lose everything.

There is a non-current deferred tax liability, which is tax that will need to be paid, but this is only small and does not need to be paid in the current financial year.

Net assets at the bottom tells us the amount of assets left over when we take away the total liabilities from the total assets, which should equal the same as shareholder equity.

4. How to read equity on the balance sheet

Finally, we come to the part of the balance sheet that tells us what we get…

The total equity attributable to the equity shareholders is what is left after the liabilities have had their claim over the assets, and as we can see this equals the net assets calculation.

We should always check for debt because the best way to avoid a company going bankrupt is to buy a company with no debt. A company that owes nothing to anyone cannot go bust overnight as there is nobody to call in the debt and pay back.

That doesn’t mean that a company with no debt will never go bust, because some companies do suffer from accounting fraud, but it does eliminate the chances of a company not going bust because it cannot pay its debt.

Debt is not necessarily a bad thing, as it can be used for the tax shield. The tax shield is when a company financially leverages itself and can reduce its income tax because interest on debt is a tax-deductible expense.

Sometimes debt for more capital is much better than diluting existing shareholders for cash, as long as the interest repayments are low and the company is able to pay off the debt sustainably from its own internally generated cash flow (we can see this from the cash flow of operations which we look at here

5. Reading a balance sheet with ratios

We can use various ratios that can be calculated from the balance sheet. This gives us an idea of the company’s financial health.

We can use the following ratios to work out the valuation metrics below or we can use SharePad that calculates all of the ratios for us as well as presents all of the company’s financial statements in a single place.

We will look at two types of ratio here:

- Solvency ratios

- Leverage ratios

Solvency ratios

Solvency ratios are both quick and easy to calculate.

The objective of solvency ratios is to give us an idea of the company’s solvency and whether it can continue its operations without running into financial difficulties.

Quick ratio

The quick ratio measures a company’s ability to meet its short-term liabilities with its current assets.

Quick ratio = (current assets – inventory) / current liabilities

The higher the ratio, the more financially stable the company.

Current ratio

The current ratio is a simpler variant of the quick ratio and it is used by investors to determine the capability of the company to pay back its short-term liabilities. This is a popular ratio.

Current ratio = current assets / current liabilities

If the ratio is below 1 then it’s a sign that the company may struggle to meet its short-term financial commitments.

However, if a company collects its cash faster than it pays cash out to its suppliers, the company could have a current ratio below 1 but there is a perfectly normal reason for it.

Ratios should be used as quick measures for further research.

Leverage ratios

Leverage ratios are the ratios that measure how a company finances itself. A high ratio can mean that the company has been financing itself via debt.

However, debt is not always a bad thing. If a company is able to borrow at an interest rate of 2% but uses that capital to generate at 8% return, then clearly shareholders would prefer the company to finance itself via debt rather than equity dilution.

The company can also take advantage of the tax shield. The tax shield is the reduction in corporation tax due to the interest expense being tax deductible.

Debt should always be evaluated as too much debt that the company may struggle to pay back in hard times is clearly a red flag.

Short-term debt / equity ratio

The short-term debt / equity ratio takes all of the total liabilities and divides this by equity.

Current liabilities / shareholder equity

Long-term debt / equity ratio

The long-term debt / equity ratio is more conservative than the short-term debt / equity ratio and takes all of the non-current liabilities and divides this by shareholder equity.

Non-current liabilities / shareholder equity

Total debt / equity ratio

The total debt / equity ratio is the most conservative of all ratios and takes into account all of the company’s debt and factors this into the ratio divided by shareholder equity.

(Current liabilities + non-current liabilities) / shareholder equity

6. Balance sheet spot checks

Below are four important spot checks I always make sure to check when analysing a company’s balance sheet for my investments and trades…

- Does the company have enough cash to conduct its normal operations?

- How much of the company’s assets are current and tangible?

- Does the company have debt? If so, how much? (As a general rule of thumb I believe any company that has twice as much debt as their revenue should be considered with caution)

- Are trade receivables growing a lot faster than trade payables? (This can mean cash is leaving the business a lot quicker than it is coming in and could be a potential problem)

Wrapping it up

Balance sheets are important to understand because we need to know the financial health of potential investments. Being able to understand a balance sheet means we may avoid a discounted placing because we could see the company was low on cash.

Understanding the solvency and leverage ratios can provide a useful guide as to the company’s ability to pay its short-term obligations as well as how it is financing its future growth and operations.