Indices are a measurement of the price performance of a basket of shares from a specific exchange. For example, the FTSE 100 presents a weighted average of the 100 most valuable companies on the London Stock Exchange (LSE).

By trading indices you can get exposure to an large amount of a country or sector whilst only needing to open one position.

Indices trading example

Indices trading means that instead of buying and selling individual company shares, you trade an index, or compilation of shares.

Investors can gain exposure to financial markets without having to research and invest in company stocks directly.

The most well-known stock exchange in the UK is the FTSE 100 . The share index acts as an indicator of how businesses regulated by company law in the U.K are performing. The index measures the performance of some of the largest companies by market cap. We also have the FTSE 250 and the FTSE 350.

However, the FTSE 250 measures the next 250 most valuable companies after the FTSE 100, and the FTSE 350 is both the FTSE 100 & FTSE 250 together.

Other stock exchanges have their own indices too. The better-known ones include Wall Street (also known as US30, Dow Jones 30, DJ30, or simply the Dow), NASDAQ 100, S&P 500 and the Nikkei 225.

What is a stock index?

A stock index is essentially a group of shares which are used to get an understanding of how a particular sector, exchange or economy is doing. It’s usually comprised of a set number of the top shares from any given exchange.

It doesn’t have any intrinsic value. However, an index will move in points and reflect the stock prices of all of its underlying assets. Some stock indices give equal weight to all the stocks they contain. Others give larger prominence to stocks that have a bigger market cap.

Which indices are the most profitable historically?

One of the most popular indices is the S&P 500 in the US. This contains many of the largest 500 individual stocks in the United States (such as Apple and Amazon) and is available to buy on most platforms. Another one is the Dow Jones Industrial Average. Both of these are generally a bellwether for the US economy.

The UK100 or FTSE 100 in the UK has typically lagged because of the old-economy make up. The top companies in the FTSE 100 are banks, oil companies, and pharmaceutical companies. No exciting tech!

And in Germany, there is the Dax 30. The CAC is the index for France, and each country has its own constituents. Many traders like to trade stocks in Canada and Hong Kong but I prefer to focus on UK stocks because of the regulation around brokers.

For example, the regulation in Cyprus, Iran, and even North Korea is not as strict as the UK.

Many consider stocks to be high risk but setting up a direct debit on a trading platform to automatically buy a low cost passive tracker fund ETF is the most accessible way into the stock market and getting exposure to a basket of blue-chip companies.

Why trade indices?

In order to be able to trade a stock index traders have to use either:

- a tracking fund

- a derivative like a spread bet, CFD, future or ETF

These products all offer different methods of trading which are based on the price movements of stock indices, without having to buy multiple stocks at once.

Factors which influence stock market behaviour include interest rate changes, national budgets, political events, announcements related to trade and political performances plus numerous other factors. This is why it’s so difficult to predict which way the market will go.

Trading indices means you buy a basket of stocks rather than a single company or stock.

However, derivatives (leveraged products) are complex instruments and if you want to trade CFDs you should understand the risks involved.

Day traders like to trade major stock indices because of the liquidity they provide.

How do you trade indices?

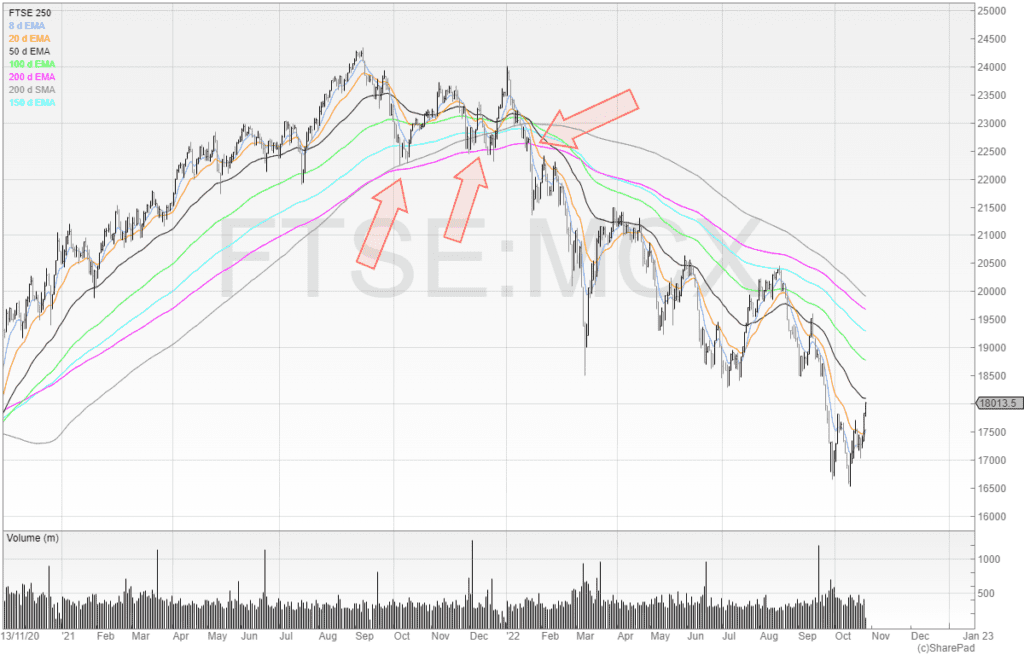

Here’s a chart of the FTSE 250 index on the London Stock Exchange.

We can see that the stock bounced off the pink line (200 EMA) twice which confirmed this as support.

However, when the price broke down through support, it continued to fall.

Shorting the breakdown in this instance would’ve been a profitable trade.

You can use this support and resistance zones strategy to trade indices.

Step 1: Identify support & resistance zones

The first step to trading this strategy is to find support and resistance zones. Stocks that have bounced repeatedly from a level or failed to break out are good potential areas to trade from.

Should the price break those levels, it’s the market telling you that the price is ready to trend.

Step 2 Set alerts and alarms

Once you’ve identified support and resistance zones to trade from, you can use SharePad to set up alerts and alarms.

Technical indicators can also be used as well as the simple support and resistance zone strategy.

Other Types of Indices

Whilst stock market indices are the most well-known and commonly traded, there are other types of indices including volatility indices, different sector indices and fixed income. Some indices allow you to track and trade the performance of different sectors whilst others allow you to trade the performance of different equity and stock markets.

How are indices calculated?

Let’s look at the FTSE 100. The FTSE 100 is compiled from the 100 largest companies (aka blue chip companies) listed on the London Stock Exchange, measured by the market capitalisation (or ‘market cap’). That is, the number of shares they’ve issued, multiplied by the price of those shares. The level of an index is calculated by reflecting the aggregate price changes in a number of points and it is also expressed as a percentage.

The London Stock Exchange also has smaller companies indices such as the FTSE 250 or FTSE 350, which are compiled in a similar fashion.

Other indices uses a similar approach. For example, S&P 500 includes the 500 largest companies listed on the NYSE or the NASDAQ and the DOW is based on the 30 largest stocks which are listed on the same exchanges.

Depending on whether their market cap rises or falls, companies join and are dropped from an index. To ensure that the constituent index companies qualify to be included in an index, they are reviewed from time to time.

What are the most traded indices?

The top 5 traded indices are as follows:

- FTSE 100 – the share index of the 100 companies listed on the UK London Stock Exchange with the largest market cap. It is often seen as an indicator of prosperity for businesses regulated by UK law.

- Wall Street – this is one of the most well known stock market indices in the world.. It measures the value of the 30 largest blue-chip stocks in the US. It’s also known as Wall Street 30, Dow Jones 30, or the Dow.

- S&P 500 – American stock market index which is based on the market capitalisation of the largest 500 companies listed on the NYSE or the NASDAQ.

- NASDAQ 100 (US Tech 100) – the stock market index is made up of 103 equities issued by 100 of the largest US technology companies.

- DAX – this the German stock market index that comprises of the 30 major German companies trading on the Frankfurt Stock Exchange.

How do you invest in indices?

If you want to invest in an index, you can buy into a (‘tracker’) fund that holds the same stocks in proportion to the way the index is compiled.

The process is managed by Investment funds (which includes mutual funds), who invest on behalf of their investors. They also collect the dividends paid on the shares for the investors and distribute them (or reinvest them).

An Exchange-Traded Fund (ETF) is an increasingly popular form of index investment. This is because the charges levied by managers of ETFs are much lower. Also, the process of buying into them or selling is much quicker and easier.

An ETF is essentially an investment fund that holds assets such as stocks, commodities, bonds, or foreign currency. It is traded like a stock throughout the trading day at fluctuating prices. They often track indexes, such as the Nasdaq, the S&P 500, the Dow Jones, and the Russell 2000. Investors in these funds do not directly own the underlying investments, but instead, have an indirect claim and are entitled to a portion of the profits and residual value in case of fund liquidation. Their ownership shares or interest can be readily bought and sold in the secondary market.

There are also a number of derivative products that ‘derive’ from indices. You can buy options or futures on stock market indices such as the FTSE 100 and or S&P 500. These are tools essentially for either hedging against fluctuations in the level of the indices, or betting on whether they will rise or fall. This obviously depends upon what you’re looking to achieve with your investment.

What are the benefits of indices trading?

The benefits of indices trading are as follows:

- Liquidity – as they are highly liquid this gives traders tight spreads and clear chart patterns.

- Volatility – as indices represent the health of the economy they track, changes in the economy can cause the indexes volatility to increase. This leads to great trading opportunities.

- Opportunity – as Indices allow traders to bet on the price of the index going up and down this leads to more opportunities because traders can capture the upside and downside of a movement.

- Variety – as there are different indices for different industries and sectors so traders can gain exposure to indices that match their individual preferences.

Indices trading vs Forex

When it comes to trading, should you choose between indices trading or Forex?

If you’re new to trading or prefer simplicity, then indices trading will probably suit you better. Trading can be very simple and straightforward when it comes to stock indices.

Most people have a basic understanding of how stock markets work and analysing stock indices requires less in depth knowledge and a less tactical approach than Forex trading which is much more complex.

However, there are pros and cons to both markets. As a stock trader, they are both outside of my expertise and I focus on what I know.

SHAREPAD GREY BOX CTA

Become a better trader with SharePad: 1-month risk-free trial here