The importance of risk management is often underappreciated – many traders lose money without knowing where they are going wrong. This problem is further compounded by the amount of information noise in the trading industry.

This article on trading risk management will provide you with tangible and actionable takeaways that will improve your trading results and ultimately make you more money.

Here are 10 tips for managing your risk, and we will cover each in detail below…

Top 10 tips for trading risk management

- Position size appropriately

- Adjust size for risk

- Stagger your stops

- Scale up when winning

- Set realistic profit targets

- Use stop losses sensibly

- Control your emotions

- Don’t trade your P&L

- Plan the trading day and trade your plan

- Review each trading session

1. Position size appropriately

The most important piece of advice anyone can give for a trading strategy is to position size appropriately.

Far too many trading accounts are blown due to overexposure in a single trade, huge price moves, or a potential cocktail of the two.

This is because retail traders are focused on the upside. Amateur traders think about how much money they can make. Professional traders think about how much money they can lose.

There is a clear difference here and those who are able to manage their money effectively will succeed in this business.

For example, if you have 40% of your account in a single stock, and that stock is suspended due to fraud and delisted, then that position will be written down to 0p. I talk about my experience with this in my TEDx talk.

Many trading gurus suggest that all position sizes should be the same. However, that is a myth. Profitable traders adjust their position sizes for risk.

2. Adjust position size for risk

Adjusting position sizes for risk means we can work better trades.

We pick a monetary amount we are happy to risk rather than focusing on the position size. We then use this monetary amount in order to calculate our position size.

The calculation to do this is:

Monetary risk / Risk per share = Number of shares

Monetary risk is our capital risk. For example, let’s say we are happy to risk losing £500 on this particular trade. Our monetary risk would be £500.

The risk per share is our entry price minus our stop price.

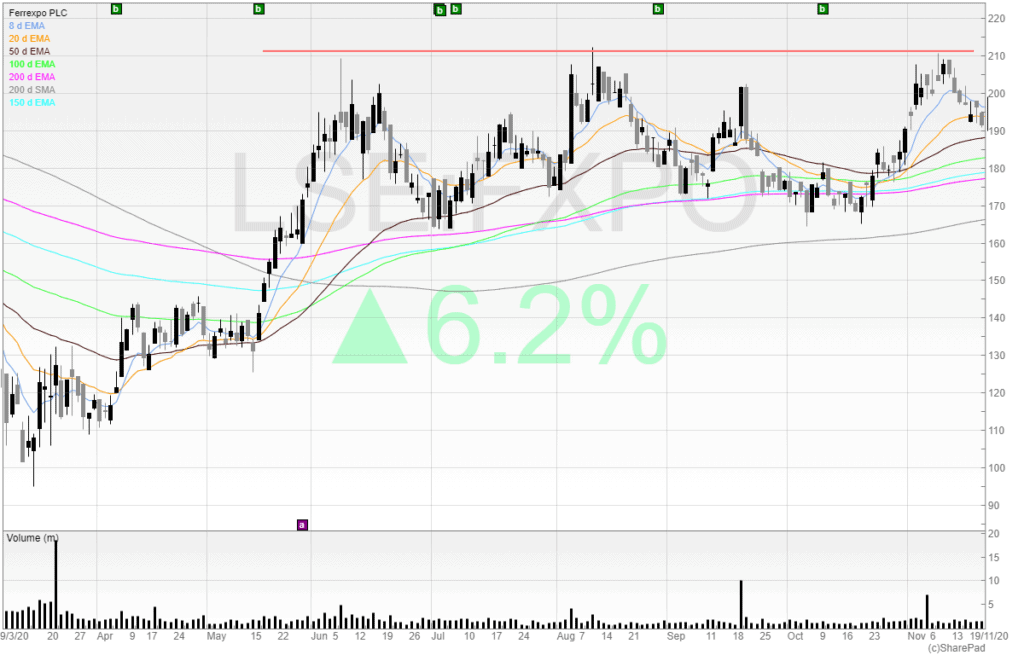

Let’s look at an example chart taken from SharePad:

We have noticed that Ferrexpo (FXPO) has tested a level around 210p three times now.

The iron ore price is on the rise, and Ferrexpo produces iron ore pellets. Commodities are booming and so we take a view that we want to buy the breakout if the stock breaks out of the 210p level.

However, we don’t want to wait around in the stock if it pulls back. Cutting losses ruthlessly is a habit of successful traders, so if we were to enter at 210p we would look to kill the trade for a small loss at 198p.

We now have all three components required for the equation.

Our monetary risk is £500, and our risk per share is our entry price of 210p minus our stop price of 198p.

Therefore:

£500 / 12p (210p – 198p) = 4,166.67, or 4,167 shares

This means our position size would be 4,167 x 210p = £8,750.70, and our risk would be £500. I’ve created a position size calculator tool on my website to help you quickly make this calculation.

I highlighted this trade in my Investors Chronicle column, and readers who followed me into the trade profited nicely.

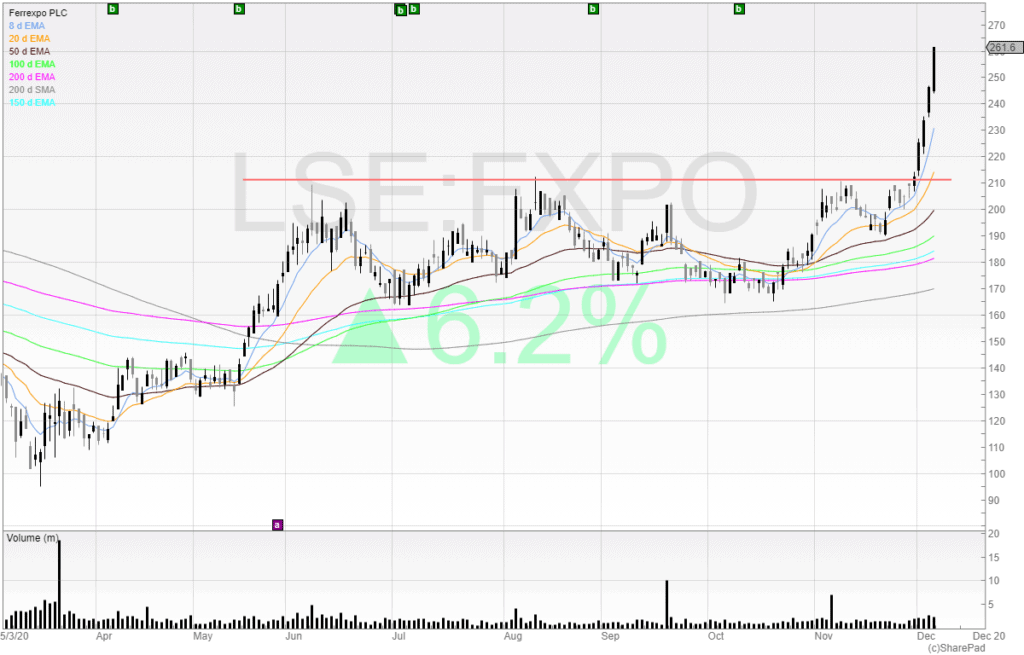

Here is the chart showing the breakout:

A position size of 4,667 shares at the closing price of 261.6p is £12,208.87 – up from £8,750.70 at the breakout price of 210p.

Not every trade will work out as well as this, but by adjusting our position size for risk we can ensure we are taking on multi-R opportunity trades.

3. Stagger your stops

Staggering stops is an advanced trading method for volatile markets.

We split our original stop loss into three mini stops. This means we increase the chances of remaining in the position if we are expecting volatility.

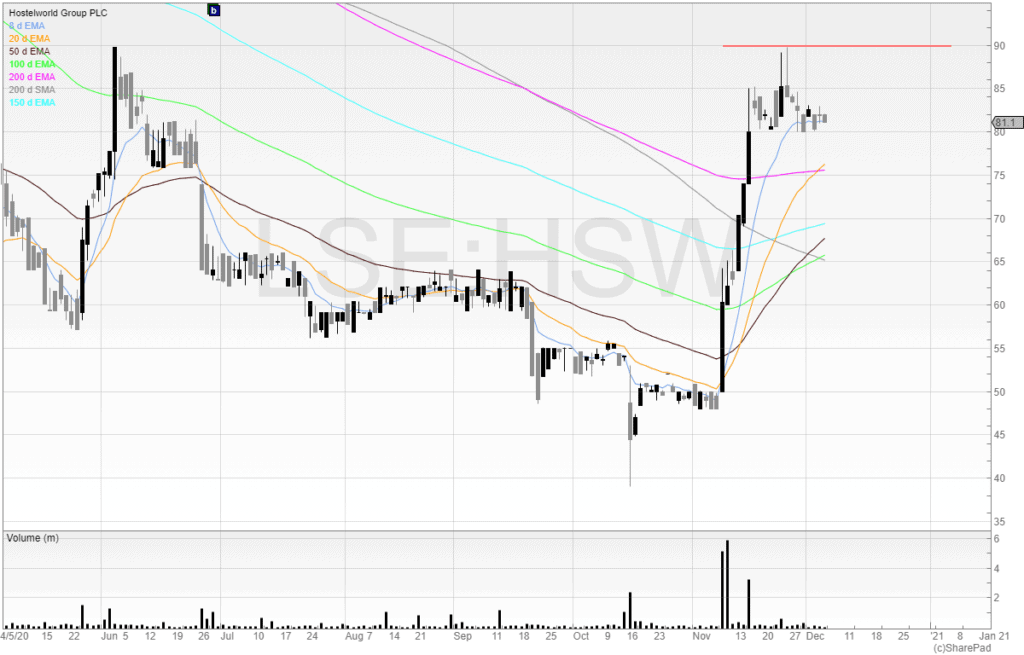

For example, we want to take a position in Hostelworld (HSW) if it breaks out of the resistance line I’ve drawn at 90p:

We would like to buy 10,000 shares @ 90p, which gives us a quantum of £9,000.

We want to risk 10% on this trade and so our monetary risk, or R, is £900.

With a standard stop of 10% we would place our stop loss at 81p. However, we can see the stock is currently trading around 81p and so there is a risk of getting stopped out too easily.

Therefore, we want to stagger our stops and give us an increased chance of staying in the trade.

To do this, we break down our £9,000 position into three lots of £3,000. Rather than having a 10% stop on each, we switch up the stops as shown below:

- £3,000 @ 5% stop loss = £150

- £3,000 @ 10% stop loss = £300

- £3,000 @ 15% stop loss = £450

Despite having three positions now our R is still £900 with a 10% stop on the entire position.

But by splitting the position into three and making one stop tighter we are able to widen the last third of the position to 15%.

This means that if the stock retraces 12% before rebounding then we are still in the trade with a third of our position despite two stops being knocked out.

Our total risk or maximum loss is still 1R (£900) and so we have increased our chances of making money for the same amount of risk.

Staggering stops should be utilised for a robust risk management strategy. It also reduces slippage and potential losses as we are spreading our stops across several price levels.

4. Scale up when winning

…but scale down when losing too.

Many traders don’t consider the risk they’re taking on when using consistent position sizes.

Let’s assume you have a £50,000 account and your risk per trade is £2,000. That’s 4% account risk, and so five losing trades would see your account down 20%.

Instead, you run your risk per trade at £1,000 which is 2% account risk. This is more realistic. However, you go on a run of 10 profitable trades and 20 losing trades.

This brings your account down to £40,000.

If we keep the same £1,000 risk per trade – the account risk at £40,000 is now 2.5%.

This means the risk has actually increased despite us losing materially.

To keep the risk in line, we would need to scale down our risk per trade to £800 in order to keep the account risk at 2% per trade.

You should consider scaling down further when losing to protect your trading account and scale up higher when winning too.

5. Set realistic take profit levels

Being realistic about profit targets is an excellent way to manage risk. Far too many traders have idiotic risk/reward ratios such as risking 1 to make 50.

All that is going to happen in that trade is that they are repeatedly stopped out and eventually give up.

Risking 1 to make 2 or even 3 is a good strategy, and even risking 1 to make 1 if that particular trade is profitable most of the time. You should know your numbers and know your trades using technical analysis.

Some platforms such as IG offer trailing stop losses which automatically take profits on a position if it falls a certain amount of points from the high.

6. Use stop losses sensibly (avoid breakeven)

We’ve looked at two methods of stop losses in this article so far and this one is about using stops sensibly.

First of all, we want to avoid the breakeven trade. This is when traders move their stop to the breakeven point once they are in profit. This is stupid for two reasons:

- Moving the stop to breakeven reduces the room the trade might need to breathe

- There is no such thing as a risk-free trade

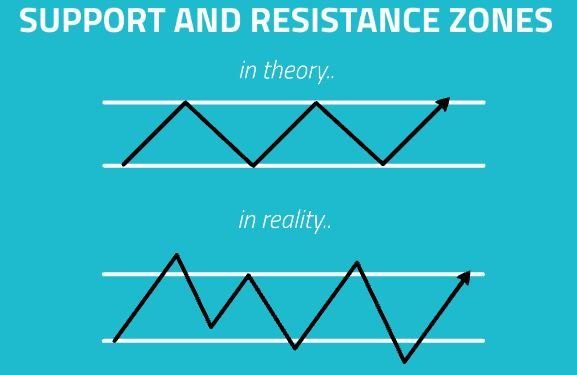

Here is a screenshot from my UK Stock Trading Course:

It shows the theory of support and resistance – how many armchair traders think the market moves.

In reality, the market is random, and instead there are no support and resistance lines but rather support and resistance zones.

The price will often test the liquidity above the resistance line and below the support line because this is where stop losses will be triggered and also new orders to enter positions.

Anyone with a ‘stop to breakeven’ trade will see themselves cleaned out.

Secondly, there is no such thing as a risk-free trade. Risk is inevitable when profit-seeking.

Moving stops to breakeven will see you stopped out without losing but you will unnecessarily close yourself out of potential winning trades without even giving them a proper chance.

This is especially true in forex trading, as major currencies such as EUR/USD see huge liquidity and stops often gunned down.

7. Control your emotions

Emotions are dangerous in trading. Leave your ego at the door, because overconfidence in one’s own abilities and greed will destroy you if you let it.

It sounds dramatic, but I’ve seen people lose hundreds of thousands of pounds in the market.

I’ve had emails from one person telling me they’ve gambled their partner’s money away; another had invested their house deposit and lost it.

People can make life-changing amounts of money in the UK stock market. But they can also lose it.

8. Don’t trade your P&L

Emotions can cause havoc in our trading capital also just by having our P&L available to view. It is a good idea to try to remove this and hide it as much as you can, and show your positions in terms of percentages.

As a friend of mine who ran his own hedge fund once said:

“You tell someone they’re up £5m you’ll blow their mind – but 5% is always 5%”

Thinking in terms of percentages makes it far easier to scale up your trading account. It removes the psychological attachment to money.

Hiding your P&L also means you won’t trade it. Seeing a quick jump of money in your account can mean you bank it quickly and snatch at profits – when that wasn’t in your trading plan…

9. Plan the trading day and trade your plan

One of the biggest mistakes new traders make is failing to prepare. They don’t have a plan.

When the market opens and the lights begin to flash, they are the rabbit in the headlights and either they get FOMO (Fear Of Missing Out) or do something silly.

Planning your trades in advance ensures you enter the open prepared and also by doing the work upfront you have removed the subjectivity of the trade.

Once we are in a trade, we have an invested interest in being right not just for money but because we want to be right. By looking at our downside and knowing where we will get out before we get in, we can protect our account.

Short-term or Intraday traders (also known as day traders) should know what they will be doing before the market opens, as very often the first few minutes of the day are where the money is made.

Prices can move quickly both ways and so stop-loss orders should be used appropriately.

Traders who use Contracts For Differences (CFDs) need to tread with extra caution as CFDs are leveraged products. Most traders lose when trading with leverage and so demo accounts should be taken advantage of before trading with a real account balance.

10. Review each trading session

Finally, trading is a business, so we must treat it like one. Hobbies are fun, and done at leisure, whereas trading is not always fun and must be done diligently.

If we do not put in the work to improve, then how can we expect our results to improve and to make more money?

It’s important to acknowledge successes but also identify failures, and more importantly, work out what can be done to improve in the future.

Did you override your stop loss? If so, why? Did you chase a position that didn’t meet your entry criteria? What are you going to do about it?

Trading is a continuous process of refining and self-improvement.

Conclusion

Risk management is necessary for all traders in the financial markets.

Experienced traders know that risk management rules should be a fundamental part of a trading system and that smart money management keeps them in business.

A trader’s profitability depends on how well they manage their risk. High-risk trades can pay off but these are earned as you gain trading experience.

Chart patterns are also a good way of understanding a trend; I use moving averages and volume in my trading in order to trade with the trend.

My stock trading course is a full video walkthrough of how I trade the UK stock market (see more information).

DISCLAIMER: This article is the opinion of the author only and not intended as (nor should it be used as such) investment advice. It is for educational purposes only.