Many traders open their trades then do nothing until they are closed. This can be not only detrimental to P&L but it can mean that your trading capital is not being worked as hard as it could be.

This article will define trade management and provide six clear and actionable steps in order to manage your trades in the future.

What is trade management?

Trade management is everything a trader does after a trade is open until the trade is closed. By managing trades, traders can increase their profits, whilst minimising risk. Trade management involves tasks such as determining position size, monitoring the trade and executing exits.

Why is trade management important?

When you open a trade one of two things will happen. Either:

- You will close the trade, or

- The trade will close you

Closing the trade on your terms is far more preferable than having the trade closed out because you can’t stomach the loss any more (capitulation) or because you’re margin called and forced out.

This is why managing the trade at all times is necessary if traders want to make more money.

However, you should be careful that you are not ‘over-managing’ your trades. This is when traders are actually causing themselves harm by meddling with trades. By keeping a log of how trades would’ve played out had you not optimised the trade then you can see whether or not your actions and contributing to P&L.

For example, if you are finding that by closing your trades you are costing yourself capital on trades that would be closed at a higher price, then the solution is simple: stop overriding your targets.

Here are six trade management strategies for you to improve your trading.

6 trade management strategies for better results

- Manage your position size

- Focus on your timeframe

- Evaluate potential trading scenarios

- Manage your stop losses and limit orders

- Use different accounts for different trading strategies

- Remove P&L from your trading platform

1. Manage your position size

Your total position size will determine how emotionally attached you are to the trade.

Size too large and you’ll be watching every tick unable to think about anything else. If you’re a full-time trader this will suck up your energy and time for trading other stocks and if you’re employed it will have a detrimental effect on your performance.

But size too small and you won’t be invested enough in the outcome of the trade. This means you’ll be more likely to act sloppy and mismanage the trade.

Your position size needs to be meaningful enough to make a difference and enough to hurt but not so hard you care too much.

Remember, no trade should be large enough to make or break you.

2. Focus on your timeframe

By focusing on the price action in your chosen timeframe you will eliminate the noise.

Lots of traders suffer regret because they sell and the stock continues to print higher. This has happened to me more times than I can remember and I accept it as part of my strategy.

I am often a trader and holding positions either in the intraday window or for a few trading sessions. I am sacrificing a long term gain for short term profits.

Investors need to accept they will miss out on short term profits and watch stocks pullback, which is inevitable with the goal of capturing longer-term moves.

If you miss your entry price, you can always trade the reversal. Breakout trades often offer pullbacks.

The best traders are laser focused on their chosen timeframes as part of their trade management rules.

3. Evaluate potential trading scenarios

Before you press buy or open a position it’s important to have an idea of what can happen on the trade.

Is there upcoming news? Where are the support and resistance zones?

For example, what if you buy and there is a sudden volume spike and the stock jumps 20% only for it to come right back down to breakeven? That would be a 20% move that you didn’t capitalise on.

What if bad news hits and it is a crowded exit to sell?

Look at the chart and identify support and resistance.

If you want to trade around your initial position then you can slice at resistance and try to reload at support.

Scaling in and scaling out at a key level and working your capital harder in this way can generate extra profits from the trade.

You can also use trail stops and set signals to buy and sell, as well as use moving averages as trend lines.

Not every trade is going to be a winner but being prepared will stand you in good stead.

4. Manage your stop losses and limit orders

Once a stock is nicely in profit it should never become a loser and be closed at a loss. Order management is a key part of trading.

There should only be three outcomes of your trades. A small win, a small loss, and a big win. Big losses should not be showing up in your trading results.

When a trade moves into a big profit you should take steps to profit it. First of all, it is demoralising watching a large profit turn into a small loss, and secondly, small losses deplete your trading capital.

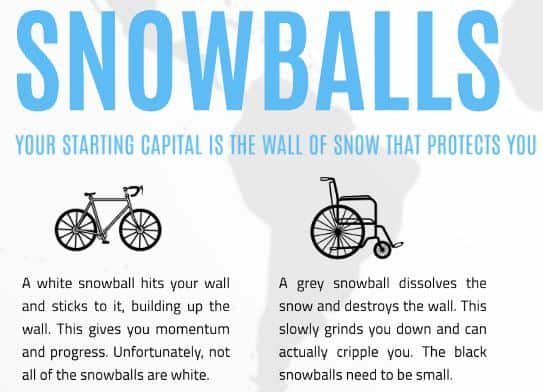

We can think of our trading capital as a big wall of snow. White snowballs (positive trade) add to our wall of snow. Grey snowballs dissolve our wall and put us further back.

It is clear that by avoiding big losses we can grow our accounts and compound our profits year on year.

You can also use trailing stops to squeeze out more profits from winning trades. These are stops that trial a certain amount below the trade and is automatically moved up as the stock moves up higher.

If you’re in doubt of taking profits in a stock – you can also sell half and run the remainder of the position.

By selling half you lock in profits on half of the position and still retain any potential upside. It also offers the opportunity to widen your stop (if that’s what you want to do) on the second half of the trade as you have derisked the trade.

If you trade derivatives of the underlying stock then guaranteed stops can also be used as a part of your trading methodology.

5. Use different accounts for different trading strategies

Unless you’re able to mentally separate different positions for different strategies you should consider using different accounts for various strategies.

For example, if you’re scalping, swing trading, and trend trading in one account, it can get confusing or even tempted to hold a scalp for a swing or a trend trade. Likewise, holding trend trades in a scalping account can tempt you to scalp what should be a long term trade.

By having several accounts and capital allocated for each strategy then this removes both confusion and temptation.

6. Remove P&L from your trading screens

Money makes people do silly things. They see a big gain and want to close it and prove themselves right.

They see £ losses and immediately want to hold instead of closing the trade as per their strategy.

Percentages strip out the emotion.

Removing P&L from your trading screen is the best way to avoid trading your P&L.

Here’s a screenshot from one of my spread bet accounts with IG Markets below.

You can see I’ve unticked “Profit/Loss” so this doesn’t show up in my account.

I’m not interested how much I’m up on every tick. You don’t look at the scoreboard whilst you’re still playing football.

As the late Kenny Rogers would say: “There’ll be time enough for countin’.. When the dealin’s done”.

Final thoughts on trade management

Managing your trades is just as important as planning them. A good trade management system will never be reliant on any single trade, and use technical analysis for a good entry point, with a focus on consistency over the entire system.

It’s the cumulative end result of your trades that will affect your P&L.

Succumbing to emotions such as greed have been the ruin of many – especially those that use leverage. Instead of getting FOMO, ensure you have the right confirmation for your stock position and manage any potential reversal in the stock price.

Therefore, it’s vital that you are in control of your trades at all times. Always use an initial stop loss and trailing stop losses regardless of the asset classes you trade – volatile stocks need to be handled with care.