Standard deviation is a fundamental concept in statistics that plays a crucial role in measuring the spread or variability of data. As a finance expert, I believe it is essential for anyone involved in the business world to have a firm grasp on this concept, as it can provide valuable insights into investment opportunities, risk assessment, and decision-making processes.

What is Standard Deviation?

At its core, standard deviation quantifies how much individual data points deviate from the mean or average value of a dataset. It allows us to understand the dispersion or scattering of data points and provides a measure of uncertainty or risk in a given set of observations.

Standard deviation is a fundamental concept in statistics that is widely used in various fields, including finance, economics, and science. It provides valuable insights into the variability and distribution of data, helping us make informed decisions and draw meaningful conclusions.

The Concept of Standard Deviation

Imagine we have data points that represent the performance of a particular stock over a period of time. The standard deviation allows us to assess the volatility or fluctuation of the stock’s price. When the standard deviation is high, it indicates a wider range of price movements, implying greater risks.

For example, let’s consider two stocks, Stock A and Stock B. Both stocks have an average annual return of 10%. However, Stock A has a higher standard deviation of 15%, while Stock B has a lower standard deviation of 5%. This means that Stock A is more volatile and has a higher level of risk compared to Stock B.

Understanding the concept of standard deviation is crucial for investors and financial analysts as it helps them evaluate the potential risks and rewards associated with different investment options.

Importance of Standard Deviation in Statistics

In finance, standard deviation is a critical component of many statistical models that help investors make informed decisions. It enables us to compare the risk and return profiles of different investment options, allowing us to assess the level of risk we are willing to assume based on our investment goals.

Moreover, standard deviation plays a significant role in hypothesis testing and confidence intervals. It helps us determine the reliability and significance of statistical results by measuring the spread of data around the mean. A smaller standard deviation indicates that the data points are closely clustered around the mean, while a larger standard deviation suggests a wider dispersion of data.

Additionally, standard deviation is used in quality control processes to assess the consistency and reliability of manufacturing processes. By analyzing the standard deviation of product measurements, companies can identify variations and make necessary improvements to ensure consistent product quality.

Furthermore, standard deviation is widely employed in scientific research to analyze experimental data. It allows researchers to evaluate the reliability and reproducibility of their results, ensuring that any observed effects are not due to random variation.

In summary, standard deviation is a powerful statistical tool that provides valuable insights into the variability and dispersion of data. It is an essential concept in various fields, helping us make informed decisions, assess risks, and draw meaningful conclusions from data analysis.

The Mathematical Foundation of Standard Deviation

To calculate standard deviation, we utilize a mathematical formula that takes into account the variance of individual data points from the mean. The variance measures the dispersion of data points around the average, and the standard deviation is simply the square root of the variance.

When analyzing a dataset, it is often important to understand how spread out the data points are from the mean. This is where standard deviation comes into play. By calculating the standard deviation, we can quantify the amount of variability or dispersion within the dataset.

The Formula for Standard Deviation

The formula for standard deviation is as follows:

sd = sqrt((sum((x – mean)^2)) / (n – 1))

where sd represents the standard deviation, x denotes the individual data points, mean indicates the average value, and n represents the total number of data points.

Let’s break down the formula further to understand each component:

- x: Each individual data point in the dataset.

- mean: The average value of the dataset, calculated by summing all the data points and dividing by the total number of data points.

- n: The total number of data points in the dataset.

By subtracting the mean from each data point (x – mean), we obtain the difference between each data point and the average. Squaring this difference ((x – mean)^2) ensures that all values are positive, as we are only interested in the magnitude of the difference, not the direction. Summing up all these squared differences (sum((x – mean)^2)) gives us the total variability within the dataset.

Finally, dividing the sum of squared differences by (n – 1) and taking the square root of the result gives us the standard deviation. The division by (n – 1) instead of just n is known as Bessel’s correction, which is used to provide an unbiased estimate of the population standard deviation when working with a sample rather than the entire population.

Understanding Variance in Standard Deviation

Variance is a fundamental concept associated with standard deviation. It represents the average squared difference between each data point and the mean of the dataset. By taking the square root of the variance, we obtain the standard deviation, which allows us to interpret the dispersion of data points more easily.

When the variance is high, it indicates that the data points are spread out over a wider range, resulting in a larger standard deviation. Conversely, when the variance is low, the data points are clustered closer to the mean, resulting in a smaller standard deviation.

By calculating the standard deviation, we gain valuable insights into the variability of the dataset. This information can be used to make informed decisions, identify outliers, or compare different datasets.

It is worth noting that standard deviation is just one of many statistical measures used to analyze data. Depending on the nature of the dataset and the specific research question, other measures such as range, interquartile range, or coefficient of variation may also be employed.

Interpreting Standard Deviation Values

When it comes to interpreting standard deviation values, there are a few important factors to consider.

Standard deviation is a statistical measure that quantifies the amount of variation or dispersion in a dataset. It provides valuable insights into the spread of data points around the mean, allowing us to understand the distribution and characteristics of a dataset.

The Rule of Thumb for Standard Deviation

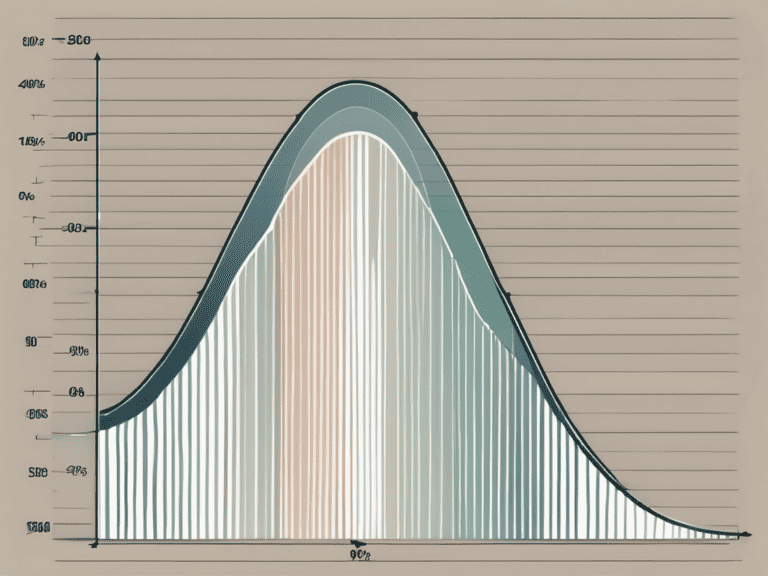

A widely used rule of thumb is the empirical rule, also known as the 68-95-99.7 rule. It states that approximately 68% of observations fall within one standard deviation of the mean, around 95% lie within two standard deviations, and about 99.7% are within three standard deviations.

This rule helps us gauge the likelihood of a data point falling within a certain range from the mean. For example, if a dataset follows a normal distribution, we can expect that the majority of data points will be within one or two standard deviations from the mean.

Understanding this rule of thumb is particularly useful in various fields, such as finance, where it can help investors assess the risk associated with different investment options. By analyzing the standard deviation of historical returns, investors can gain insights into the volatility and potential fluctuations of an asset’s value.

Standard Deviation and Normal Distribution

Standard deviation plays a crucial role in understanding the characteristics of a normal distribution. It allows us to assess how closely a dataset follows a bell-shaped curve, providing valuable insights into the behavior and volatility of various financial assets.

In a normal distribution, the mean, median, and mode are all equal, and the data points are symmetrically distributed around the mean. The standard deviation helps us quantify the spread of data points, indicating how tightly or loosely they cluster around the mean.

By analyzing the standard deviation of a dataset, we can determine the level of dispersion or variability present in the data. A smaller standard deviation suggests that the data points are closely packed around the mean, indicating less variability. On the other hand, a larger standard deviation indicates greater variability, with data points spread out over a wider range.

Understanding the relationship between standard deviation and normal distribution is essential in various fields, including quality control, manufacturing, and scientific research. It allows us to assess the consistency and reliability of processes, identify outliers, and make informed decisions based on the distribution of data.

Practical Applications of Standard Deviation

Standard deviation finds extensive applications in various finance-related fields. Let’s explore a couple of practical examples where standard deviation plays a significant role.

Standard Deviation in Finance

In finance, standard deviation provides a measure of risk and volatility associated with investment portfolios or individual stocks. By analyzing the standard deviation, investors can gauge the potential returns and ascertain the level of risk they are comfortable with.

For example, consider two investment portfolios. Portfolio A has an average annual return of 10% with a standard deviation of 5%, while Portfolio B has an average annual return of 10% with a standard deviation of 15%. Although both portfolios have the same average return, the higher standard deviation of Portfolio B indicates a greater level of risk and volatility. Investors who are risk-averse may prefer Portfolio A, which has a lower standard deviation and thus a more predictable return.

Furthermore, standard deviation is used in the calculation of various financial ratios such as the Sharpe ratio and the Sortino ratio. These ratios help investors evaluate the risk-adjusted returns of investment options and make informed decisions.

Standard Deviation in Quality Control

Standard deviation is not limited to finance; it also plays a crucial role in quality control. In manufacturing processes, standard deviation helps determine the consistency and reliability of products.

For instance, a company producing electronic devices may use standard deviation to assess the uniformity of product specifications such as battery life, screen brightness, or audio quality. By calculating the standard deviation of these parameters, the company can identify any variations or deviations from the desired standards. Smaller deviations indicate higher consistency, while larger deviations may indicate defects or variations in quality.

Moreover, standard deviation is utilized in statistical process control (SPC) techniques to monitor and improve manufacturing processes. By continuously measuring the standard deviation of key process variables, such as temperature, pressure, or speed, companies can identify any changes or abnormalities that may affect product quality. This allows them to take corrective actions promptly and maintain consistent product quality.

In summary, standard deviation is a versatile statistical tool that has practical applications in various domains. Whether it is assessing investment risk in finance or ensuring product quality in manufacturing, standard deviation provides valuable insights and helps make informed decisions.

Common Misconceptions about Standard Deviation

Despite its significance, standard deviation is often misunderstood or misinterpreted. Here, let’s debunk a couple of common misconceptions.

Misinterpretation of Standard Deviation

One common misconception is that a high standard deviation implies poor performance or instability. However, a higher standard deviation can also indicate higher potential returns. It is crucial to strike a balance between risk and reward based on individual investment goals.

Limitations of Standard Deviation

While standard deviation is a valuable tool, it does have its limitations. It assumes that the data follows a specific distribution, and extreme values or outliers can significantly impact its effectiveness. In such cases, alternative measures like semi-variance or downside deviation might be more appropriate.

Understanding standard deviation is essential for anyone aiming to navigate the complex world of finance with confidence. It helps investors assess risk, make informed decisions, and understand the volatility associated with various financial assets. By mastering this concept, you can enhance your analytical skills and gain a competitive edge in the dynamic and ever-changing financial landscape.