The Phillips Curve is a fundamental concept in the field of macroeconomics. It describes the relationship between inflation and unemployment and has been a subject of study for economists for decades. In this comprehensive explanation, we will delve into the origins of the Phillips Curve, its mathematical representation, the controversies surrounding it, its relevance in modern macroeconomics, and its future implications.

The Concept of the Phillips Curve

The concept of the Phillips Curve originated in the mid-20th century and holds a significant place in the history of economics. It was first proposed by British economist A.W. Phillips, who observed an inverse relationship between unemployment and wage inflation in the United Kingdom during the post-war years. This observation formed the basis for understanding the trade-off between inflation and unemployment.

At its core, the Phillips Curve suggests that there is an inverse relationship between the rate of unemployment and the rate of inflation in an economy. When unemployment is high, inflation tends to be low, and vice versa. This trade-off has crucial implications for policymakers and central banks when formulating economic policies.

Origin and Historical Context

The Phillips Curve emerged during a period of economic recovery and growth after World War II. Phillips’ original study focused on data from the United Kingdom between 1861 and 1957, a period marked by significant economic changes and labor market dynamics. His findings provided a fresh perspective on macroeconomic relationships and served as a basis for further research and analysis.

During this time, the United Kingdom experienced a shift in its economic landscape. The post-war years brought about changes in industrial production, technological advancements, and shifts in labor market dynamics. These factors contributed to fluctuations in unemployment rates and wage inflation, which Phillips keenly observed and analyzed.

Phillips’ study shed light on the relationship between unemployment and wage inflation, revealing that as unemployment decreased, wage inflation tended to rise. This finding challenged the prevailing economic theories of the time and sparked a new wave of research and analysis.

Basic Assumptions and Principles

In understanding the Phillips Curve, it is essential to consider the basic assumptions and principles that underpin its concept. At its core, the Phillips Curve assumes that inflation and unemployment are inversely related, assuming all other factors remain constant. This assumption allows economists to analyze the impact of changes in unemployment on inflation and vice versa.

However, it is important to note that the relationship between inflation and unemployment is not a fixed one. Economic conditions, policy interventions, and external factors can all influence the shape and dynamics of the Phillips Curve. For example, supply-side shocks, such as changes in oil prices or productivity levels, can disrupt the traditional trade-off between inflation and unemployment.

Furthermore, the Phillips Curve operates on the principle that there is a natural rate of unemployment in any given economy, commonly referred to as the Non-Accelerating Inflation Rate of Unemployment (NAIRU). This natural rate represents the level of unemployment that does not put upward pressure on inflation. Deviations from this natural rate can lead to shifts in inflation and substantial economic consequences.

It is worth noting that the concept of the Phillips Curve has been subject to criticism and further refinement over the years. Economists have debated its applicability in different economic contexts and the role of expectations in shaping inflation and unemployment dynamics. Nonetheless, the Phillips Curve remains a fundamental concept in macroeconomic analysis and continues to shape economic policy discussions.

The Mathematical Representation of the Phillips Curve

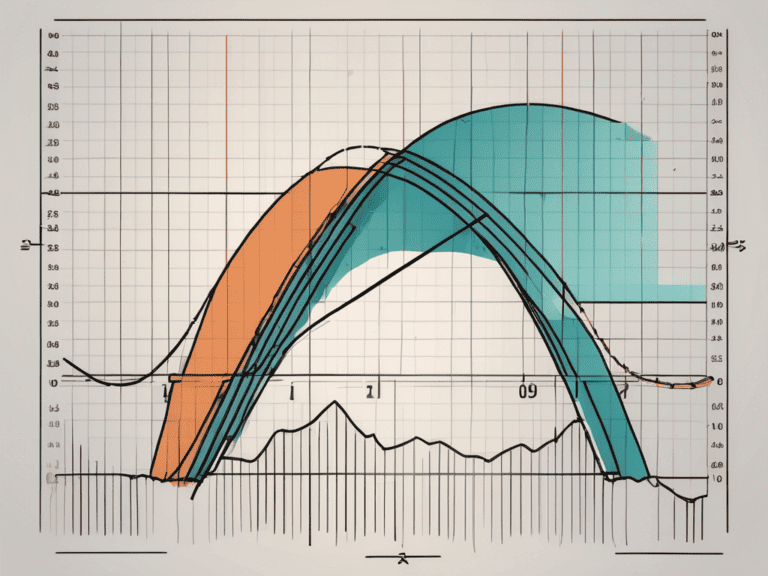

In order to truly grasp the implications of the Phillips Curve, it is crucial to understand its mathematical representation. The Phillips Curve utilizes a simple graphical model to represent the inverse relationship between inflation and unemployment. This model can be illustrated through the Short-Run Phillips Curve and the Long-Run Phillips Curve.

The Short-Run Phillips Curve posits that in the short-term, there is a trade-off between inflation and unemployment. When unemployment is low, inflation tends to be high, as the demand for labor outstrips supply, putting upward pressure on wages and leading to an increase in overall prices. Conversely, when unemployment is high, inflation tends to be low, as the demand for labor is weaker, resulting in downward pressure on wages and prices.

In contrast, the Long-Run Phillips Curve suggests that there is no permanent trade-off between inflation and unemployment. In the long run, the economy is believed to converge towards the natural rate of unemployment, implying that attempts to reduce unemployment through expansionary policies will only lead to temporary decreases in unemployment at the cost of higher inflation.

The mathematical representation of the Phillips Curve can be expressed as:

πt = πe + β(U – U*) + εt

Where:

- πt represents the current inflation rate

- πe represents the expected inflation rate

- β represents the sensitivity of inflation to the unemployment gap

- (U – U*) represents the difference between the actual unemployment rate (U) and the natural rate of unemployment (U*)

- εt represents the error term

The Inflation-Unemployment Trade-off

The Short-Run Phillips Curve provides a framework for understanding the trade-off between inflation and unemployment. It suggests that when the economy is operating below its potential, there is a higher level of unemployment and lower inflation. Conversely, when the economy is operating above its potential, there is a lower level of unemployment and higher inflation.

However, it is important to note that this trade-off is not permanent and is subject to various factors such as changes in expectations, supply shocks, and government policies.

For instance, supply shocks, such as an increase in oil prices, can disrupt the inverse relationship between inflation and unemployment. In such cases, the Phillips Curve may shift, leading to stagflation, a situation characterized by high inflation and high unemployment occurring simultaneously.

Additionally, the role of expectations plays a crucial role in influencing the Phillips Curve. If individuals and firms have adaptive expectations, meaning they adjust their expectations of inflation based on past trends, the trade-off between inflation and unemployment becomes less stable. Expectations of inflation can lead to shifts in the Phillips Curve and complicate the relationship between inflation and unemployment.

Criticisms and Controversies Surrounding the Phillips Curve

While the Phillips Curve has had a significant impact on economic thought, it is not without criticisms and controversies. One of the most significant criticisms is the existence of stagflation, a phenomenon characterized by high inflation and high unemployment occurring simultaneously. Stagflation challenged the traditional Phillips Curve model, as it seemed to defy the inverse relationship between inflation and unemployment.

Another criticism arises from the role of expectations in influencing the Phillips Curve. It has been argued that if individuals and firms have adaptive expectations, meaning they adjust their expectations of inflation based on past trends, the trade-off between inflation and unemployment becomes less stable. Expectations of inflation can lead to shifts in the Phillips Curve and complicate the relationship between inflation and unemployment.

Furthermore, some economists argue that the Phillips Curve may not hold in the long run due to factors such as changes in technology, globalization, and structural changes in the labor market. These factors can alter the natural rate of unemployment and impact the relationship between inflation and unemployment.

Despite these criticisms and controversies, the Phillips Curve remains a valuable tool for understanding the dynamics between inflation and unemployment in the short run, providing insights into the trade-offs faced by policymakers in managing these two macroeconomic variables.

The Phillips Curve in Modern Macroeconomics

As the field of macroeconomics has advanced, so too has the understanding and application of the Phillips Curve. The Phillips Curve, first introduced by economist A.W. Phillips in 1958, originally posited an inverse relationship between inflation and unemployment. However, over time, economists have refined and expanded upon this concept, leading to the development of the New Keynesian Phillips Curve.

The New Keynesian Phillips Curve is a more nuanced version of the original concept, taking into account the role of inflation expectations and nominal rigidities. It recognizes that individuals and firms form expectations about future inflation, which in turn influence their behavior and economic outcomes. This insight has proven crucial in understanding the dynamics of inflation and unemployment.

According to the New Keynesian Phillips Curve, there is a lag in the adjustment of wages and prices to changes in economic conditions. In the short run, this lag leads to trade-offs between inflation and unemployment. For example, if the economy experiences a surge in demand, firms may initially respond by increasing employment and production, leading to a decrease in unemployment. However, as wages and prices gradually adjust, inflationary pressures may build up, ultimately leading to higher inflation rates.

However, in the long run, these adjustments catch up, and the Phillips Curve becomes vertical. This means that changes in aggregate demand can only affect prices without impacting unemployment. In other words, in the long run, there is no trade-off between inflation and unemployment, as the economy returns to its natural rate of unemployment.

The New Keynesian Phillips Curve

The New Keynesian Phillips Curve incorporates the concept of nominal rigidities and the role of inflation expectations. Nominal rigidities refer to the idea that wages and prices do not adjust immediately to changes in economic conditions. Instead, there are frictions and obstacles that prevent rapid adjustments. These frictions can include factors such as long-term contracts, menu costs, and social norms.

By incorporating nominal rigidities, the New Keynesian Phillips Curve provides a more realistic depiction of the short-run dynamics between inflation and unemployment. It recognizes that it takes time for wages and prices to adjust, and during this adjustment period, there can be temporary trade-offs between inflation and unemployment.

Moreover, the New Keynesian Phillips Curve emphasizes the role of inflation expectations. It acknowledges that individuals and firms form expectations about future inflation based on their past experiences and other relevant information. These expectations then influence their behavior, such as wage negotiations and price-setting decisions. If individuals and firms expect higher inflation in the future, they may demand higher wages and set higher prices, leading to an increase in inflation.

Overall, the New Keynesian Phillips Curve provides a more comprehensive framework for understanding the relationship between inflation and unemployment. It highlights the importance of considering factors such as nominal rigidities and inflation expectations, which can significantly impact the dynamics of the Phillips Curve.

The Phillips Curve and Monetary Policy

The Phillips Curve holds particular relevance in the context of monetary policy. Central banks often use the Phillips Curve as a guide when formulating policies aimed at managing inflation and unemployment. By understanding the current position of the economy on the Phillips Curve, policymakers can make informed decisions regarding interest rates and other monetary measures to achieve desirable outcomes.

For example, if the economy is experiencing high levels of unemployment and low inflation, policymakers may choose to implement expansionary monetary policies, such as lowering interest rates or engaging in quantitative easing. These measures are aimed at stimulating aggregate demand and reducing unemployment. Conversely, if the economy is facing high inflation and low unemployment, policymakers may opt for contractionary monetary policies, such as raising interest rates, to cool down the economy and curb inflationary pressures.

However, it is important to note that the Phillips Curve is not without its limitations. Critics argue that the relationship between inflation and unemployment is not stable over time and can be influenced by various factors, such as changes in labor market institutions, technological advancements, and global economic conditions. Additionally, the Phillips Curve assumes a stable trade-off between inflation and unemployment, which may not hold true in all circumstances.

Despite these limitations, the Phillips Curve remains a valuable tool for policymakers in understanding the dynamics of inflation and unemployment. It provides a framework for analyzing the short-run trade-offs and long-run relationships between these two key macroeconomic variables, helping guide monetary policy decisions in pursuit of stable and sustainable economic growth.

The Future of the Phillips Curve

With the ever-evolving nature of the global economy, it is important to consider the future implications of the Phillips Curve. While its relevance and applicability have been challenged throughout the years, the concept of a trade-off between inflation and unemployment remains significant.

Relevance in Today’s Economic Climate

In today’s economic climate, the Phillips Curve continues to provide insights into the dynamics of inflation and unemployment. Policymakers and economists still rely on the concept to inform decision-making and formulate strategies for sustainable economic growth and stability. However, it is important to acknowledge the limitations of the Phillips Curve and consider additional factors and models when analyzing complex macroeconomic phenomena.

Potential Developments and Theoretical Advances

As research and understanding of macroeconomics progress, it is likely that the concept of the Phillips Curve will continue to evolve. Future developments may involve incorporating additional variables, such as technological advancements and demographic changes, to better capture the complexities of the relationship between inflation and unemployment. Theoretical advances in behavioral economics and finance may also shed new light on the dynamics of the Phillips Curve, providing a more comprehensive understanding of its implications.

In conclusion, understanding the Phillips Curve is essential for comprehending the intricacies of macroeconomics and the interplay between inflation and unemployment. From its origins in post-war economic analysis to its modern adaptations, the Phillips Curve continues to shape our understanding of economic dynamics. As the global economy evolves, so too will our understanding of this concept, informing policymakers, economists, and finance experts in their pursuit of stable and prosperous economies.