If you’re looking for a savings account that will give you a decent return on your investment without the risks posed by other forms of investment, a Cash ISA is a great option to consider. In this comprehensive guide, we’ll take you through the ins and outs of Cash ISAs, including what they are, how they work, and the benefits they offer.

Understanding Cash ISAs

If you’re looking for a safe and reliable way to save money, a Cash ISA is an ideal place to start. Personally, I don’t like them as I’m an investor and so Stocks & Shares ISAs are my preference. But a Cash ISA is a type of savings account that is designed to let you save money on a tax-free basis. This means that you won’t have to pay any taxes on the interest your savings earn throughout the year. Cash ISAs are available from a range of providers, including banks, building societies and credit unions.

Definition of a Cash ISA

A Cash ISA is a savings account that allows you to save money and earn interest tax-free. The interest rate you earn is variable, which means it can go up or down over time. You can save up to £20,000 tax-free each year in a Cash ISA. However, there are different types of Cash ISAs available, each with its own unique features and restrictions.

If you’re looking for a savings account that offers a tax-free way to save money (but not invest), a Cash ISA is a great option. With a Cash ISA, you can save up to £20,000 each year without having to pay any taxes on the interest you earn. This can be a great way to earn extra money on your savings without having to worry about losing a portion of it to taxes.

One of the benefits of a Cash ISA is that the interest rate you earn is variable. This means that it can go up or down over time, depending on the market conditions. While this can be a disadvantage if interest rates drop, it can also be an advantage if they rise. This means that you could potentially earn more money on your savings over time.

How Cash ISAs Work

Cash ISAs work just like regular savings accounts, with the added benefit of tax-free interest. The process for opening a Cash ISA is straightforward, and you can do so online or in-person with the bank or provider of your choice. Once you’ve opened your account, you’ll be able to deposit money into it as often as you like. You can also withdraw money from your Cash ISA, but there may be restrictions and withdrawal penalties.

When you open a Cash ISA, you’ll need to provide some personal information, such as your name, address and date of birth. You’ll also need to provide proof of identity, such as a passport or driving licence. Once your account is open, you’ll be able to manage it online, by phone or in-branch.

It’s important to note that there may be restrictions on how much you can withdraw from your Cash ISA. Some providers may charge a penalty if you withdraw money before a certain date, while others may only allow a certain number of withdrawals each year. It’s important to read the terms and conditions of your Cash ISA carefully before opening an account.

Types of Cash ISAs

There are different types of Cash ISAs available to suit a range of financial goals. Standard Cash ISAs allow you to save up to the maximum allowance each year, with some allowing you to make withdrawals without penalty. There are also Help to Buy ISAs, which offer an additional government bonus to first-time buyers, and Lifetime ISAs, which are designed to help people save for a first home or retirement.

If you’re a first-time buyer, a Help to Buy ISA could be a great way to save money for a deposit on your first home. With a Help to Buy ISA, the government will add a 25% bonus to your savings, up to a maximum of £3,000. This means that if you save £12,000, you’ll receive a bonus of £3,000, giving you a total of £15,000 to put towards your first home.

If you’re saving for retirement or a first home, a Lifetime ISA could be a good option. With a Lifetime ISA, you can save up to £4,000 each year and receive a 25% bonus from the government. This means that if you save the maximum amount each year, you’ll receive a bonus of £1,000. You can use the money in your Lifetime ISA to buy your first home or to save for retirement.

Overall, Cash ISAs are a great way to save money on a tax-free basis. Whether you’re saving for a rainy day or for a specific financial goal, there’s a Cash ISA out there to suit your needs.

Benefits of a Cash ISA

When it comes to saving money, there are a lot of options available to you. One of the most popular options is a Cash ISA, or Individual Savings Account. Cash ISAs are a type of savings account that allow you to earn tax-free interest on your savings. They’re a great option for anyone looking to save money and grow their wealth over time. Let’s take a closer look at some of the benefits of a Cash ISA.

Tax-Free Interest

One of the biggest benefits of a Cash ISA is the tax-free interest that you can earn on your savings. This means that you get to keep more of the money you save, increasing your overall return on investment. Unlike other savings accounts, you won’t have to pay tax on the interest you earn in a Cash ISA. This can make a big difference over time, especially if you’re saving a significant amount of money. By earning tax-free interest, you can grow your wealth faster and achieve your financial goals sooner.

Flexibility in Withdrawals

While some Cash ISAs have restrictions on withdrawals, many allow you to access your money whenever you need it. This means you have more flexibility and can easily access your savings in the event of an emergency or unexpected cost. This can be especially important if you’re saving for a specific goal, like a down payment on a house or a child’s education. With a Cash ISA, you can save for the future while still having access to your money when you need it.

Saving for the Future

If you’re looking to save for a long-term goal, like buying a house or retiring, a Cash ISA can help you do so in a tax-efficient manner. By taking advantage of the tax-free interest on offer, you can make your savings go further and achieve your goals sooner. Cash ISAs are a great option for anyone who wants to save for the future without taking on too much risk. Whether you’re just starting out or you’re a seasoned saver, a Cash ISA can help you achieve your financial goals.

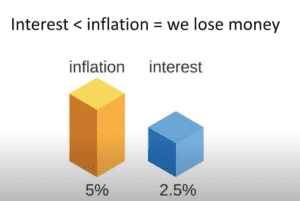

However, be aware that if interest rates are higher than the savings rate, then you’re losing money.

Low-Risk Investment

Cash ISAs are considered a low-risk investment because they’re backed by the Financial Services Compensation Scheme. This means that if your Cash ISA provider goes bust, you’ll be protected and compensated for any losses up to a certain amount. This can give you peace of mind and help you feel more confident in your savings strategy. While there’s always some risk involved in investing, a Cash ISA is a relatively safe option that can help you grow your wealth over time.

In conclusion, a Cash ISA is a great option for anyone looking to save money and grow their wealth. With tax-free interest, flexibility in withdrawals, and low-risk investing, a Cash ISA can help you achieve your financial goals and secure your future. So why not consider opening a Cash ISA today and start saving for the future?

How to Open a Cash ISA

A Cash ISA is an individual savings account that allows you to save tax-free. It’s an excellent option if you’re looking to save money and earn interest without paying tax on your savings. In this guide, we’ll walk you through the process of opening a Cash ISA.

Eligibility Criteria

Before you can open a Cash ISA, you need to meet certain eligibility criteria. To be eligible, you must be a UK resident and over the age of 16. You also need to ensure that you don’t exceed your annual contribution limit, which is currently set at £20,000 for the 2021/22 tax year. Additionally, you cannot hold more than one Cash ISA in the same tax year.

It’s worth noting that if you’re a non-UK resident, you may still be able to open a Cash ISA, but you’ll need to check with your chosen provider to see if they offer this service.

Choosing the Right Cash ISA Provider

Choosing the right Cash ISA provider is an essential step in the process. There are many providers to choose from, each with their own features, benefits, and drawbacks. When selecting a provider, it’s essential to consider the interest rates they offer, any fees they charge, and their reputation for customer service and financial stability.

Some providers may offer introductory offers, such as bonus interest rates or cashback incentives, so it’s worth shopping around to find the best deal for you. You can compare different providers online or speak to a financial advisor for guidance.

Application Process

Once you’ve found the right Cash ISA provider for you, the application process is relatively straightforward. You can apply online, over the phone, or in person, depending on the provider’s options. The provider will guide you through the process step-by-step, and you’ll need to provide some personal information and proof of identity.

Once your application has been processed, your account will typically be set up within a few days, and you can start saving tax-free. You’ll be able to manage your account online, and some providers may offer mobile apps for added convenience.

In conclusion, opening a Cash ISA is a simple and effective way to save money tax-free. By following the steps outlined above, you can ensure that you choose the right provider and meet the eligibility criteria, making the most of your savings and earning interest without paying tax.

Cash ISA Rules and Regulations

Annual Allowance

The annual Cash ISA allowance is currently £20,000 per year, which means that you can save up to this amount without paying any taxes on the interest earned. You can split this allowance between different types of ISAs, such as stocks and shares or innovative finance ISAs.

Transferring Cash ISAs

If you already have a Cash ISA, you can transfer it to another provider if you find a better interest rate or more favourable terms. It’s important to follow the correct transfer process to avoid losing any tax benefits. You can transfer all or part of your Cash ISA, but be sure to check with both providers before making any moves.

Withdrawal Restrictions

While many Cash ISAs allow withdrawals at any time, some have stricter withdrawal rules in place. For example, some ISAs may require a minimum balance or charge a penalty for early withdrawals. Be sure to read the terms and conditions of your account carefully to understand any restrictions or penalties.

Conclusion

Overall, a Cash ISA is a great option for anyone looking to save money in a low-risk, tax-efficient manner. Whether you’re saving for the short-term or the long-term, a Cash ISA can help you achieve your financial goals and make your money go further. Be sure to do your research, choose the right provider for you, and make the most of the tax-free interest on offer.