Welcome to the world of finance where we explore the intriguing concept of the Efficient Frontier. This powerful financial theory has revolutionized the way we think about portfolio management and investment strategy. In this article, we will delve into the depths of the Efficient Frontier, unraveling its significance and exploring its implications. So fasten your seatbelts and get ready for an enlightening journey!

Understanding the Concept of the Efficient Frontier

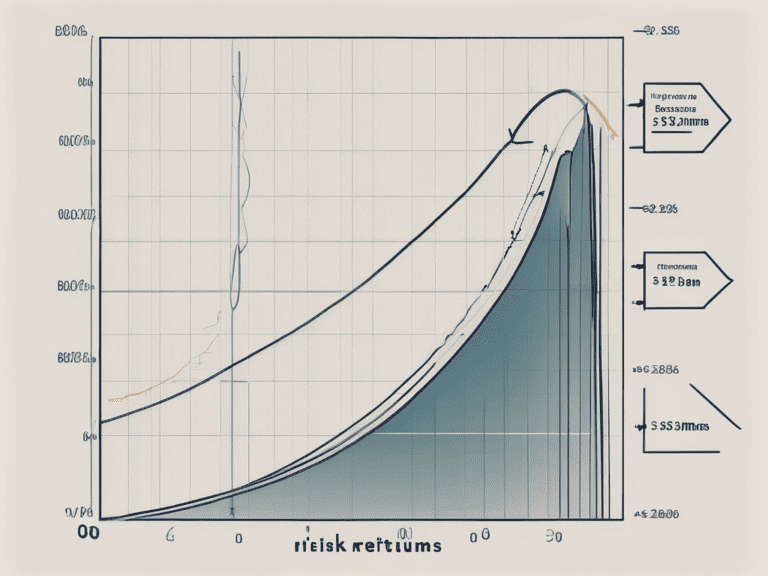

At its core, the Efficient Frontier is a fundamental principle in finance that aims to optimize the risk-return trade-off for a given investment portfolio. It provides a graphical representation of all the possible combinations of investments that can be used to construct an optimal portfolio. In simpler terms, the Efficient Frontier helps investors identify the ideal balance between risk and return.

When constructing a portfolio, investors are constantly seeking the highest return possible while minimizing risk. The Efficient Frontier enables them to visualize the portfolios that offer the highest level of expected return for any given level of risk or conversely, the lowest level of risk for a desired level of return.

Imagine you are an investor looking to build a portfolio that maximizes your returns while minimizing your risk exposure. The Efficient Frontier acts as a compass, guiding you towards the optimal combination of investments. It shows you the range of possibilities, allowing you to make informed decisions based on your risk appetite and return expectations.

Let’s say you have a moderate risk tolerance and are aiming for a balanced portfolio. By analyzing the Efficient Frontier, you can identify the portfolios that offer a reasonable level of risk while still providing attractive returns. This information can help you make strategic investment choices and allocate your assets accordingly.

The Role of the Efficient Frontier in Portfolio Management

In portfolio management, the primary goal is to diversify investments in such a way that the overall risk of the portfolio is reduced without sacrificing potential returns. This is where the Efficient Frontier comes into play. It helps portfolio managers identify and construct portfolios that lie on the optimal border, giving investors the highest possible return for a given level of risk.

Portfolio managers play a crucial role in ensuring that investors’ portfolios are well-diversified and aligned with their financial goals. They analyze the Efficient Frontier to determine the most efficient asset allocation strategy. By carefully selecting a mix of assets with different risk and return characteristics, portfolio managers can create a portfolio that offers a desirable balance between risk and reward.

Moreover, the Efficient Frontier allows portfolio managers to assess the impact of adding or removing specific assets from the portfolio. They can analyze how different investment decisions affect the overall risk and return profile of the portfolio. This information helps them make informed decisions and adjust the portfolio composition as market conditions change.

For example, during periods of economic uncertainty, portfolio managers may decide to increase the allocation to low-risk assets, such as government bonds, to protect the portfolio from potential market downturns. Conversely, during periods of economic expansion, they may increase exposure to higher-risk assets, such as equities, to capture potential gains.

The Mathematical Basis of the Efficient Frontier

Beneath its graphical representation lies a strong mathematical foundation. The Efficient Frontier is derived using various statistical measures such as expected return, standard deviation, and correlation coefficients. These quantitative metrics enable investors to assess the risk and return characteristics of different portfolios and make informed decisions.

Modern portfolio theory, pioneered by Harry Markowitz, provides the mathematical framework for constructing the Efficient Frontier. Markowitz’s groundbreaking research recognized that the risk of a portfolio is not solely determined by the risk of individual assets but also by the correlation between these assets. By accounting for correlations, portfolio managers can construct portfolios that offer superior risk-adjusted returns.

Markowitz’s work revolutionized the field of portfolio management by introducing the concept of diversification. He demonstrated that by combining assets with low or negative correlations, investors could reduce the overall risk of their portfolios without sacrificing returns. This insight paved the way for the development of the Efficient Frontier and laid the foundation for modern portfolio management practices.

Today, sophisticated mathematical models and optimization techniques are used to construct the Efficient Frontier. These models take into account not only the expected returns and volatilities of individual assets but also their correlations and other statistical properties. By leveraging these mathematical tools, investors and portfolio managers can make data-driven decisions and construct portfolios that are well-positioned to achieve their financial objectives.

The Importance of the Efficient Frontier in Investment Strategy

The Efficient Frontier plays a crucial role in shaping investment strategies across the financial landscape. Let’s explore two key aspects where the Efficient Frontier is of utmost importance: the risk-return trade-off and diversification.

Risk and Return Trade-off in the Efficient Frontier

In the world of investments, risk and return go hand in hand. Higher returns are generally associated with higher levels of risk. However, the Efficient Frontier allows investors to determine the optimal portfolio mix that maximizes returns while minimizing risk.

When considering the risk-return trade-off, it is essential to understand that different investors have varying risk preferences. While some investors may be risk-averse, aiming for a conservative approach with lower returns and lower volatility, others may be more risk-tolerant, willing to take on higher levels of risk in exchange for potentially higher returns. The Efficient Frontier provides the tools to find the perfect balance between these two extremes, based on an individual’s risk appetite and investment goals.

By analyzing the Efficient Frontier, investors can identify the portfolios that offer the highest expected return for a given level of risk. This analysis helps investors make informed decisions about their investment strategies and optimize their portfolios accordingly. It enables them to align their risk tolerance with their desired returns, ensuring that their investments are in line with their financial goals.

Diversification and the Efficient Frontier

No investor wants to put all their eggs in one basket. Diversification is a well-accepted strategy to reduce risk by spreading investments across different assets. The Efficient Frontier aids in constructing diversified portfolios by identifying the optimal allocation of assets that provides the highest expected return for a given level of risk.

When constructing a diversified portfolio, it is crucial to consider the correlation between assets. The Efficient Frontier guides investors in selecting assets with low or negative correlations, as this helps reduce the overall risk of the portfolio. By combining assets that do not move in perfect synchronization, investors can create portfolios that are less susceptible to systemic risks or market fluctuations.

Furthermore, the Efficient Frontier assists investors in diversifying their portfolios across a broad range of asset classes. It considers various investment options, such as stocks, bonds, real estate, and commodities, to ensure that the portfolio is not overly concentrated in a single asset class. This diversification across different asset classes increases the odds of achieving positive returns even in challenging market conditions.

In conclusion, the Efficient Frontier is a powerful tool that enables investors to make informed decisions about their investment strategies. By considering the risk-return trade-off and diversification, investors can optimize their portfolios and align their investments with their financial goals. Whether aiming for conservative or aggressive returns, the Efficient Frontier provides valuable insights into constructing portfolios that maximize returns while minimizing risk.

The Efficient Frontier and Modern Portfolio Theory

The Efficient Frontier is intrinsically linked to Modern Portfolio Theory (MPT), a groundbreaking concept that transformed the world of investment management. MPT recognizes the importance of diversification and takes it a step further by emphasizing the need for efficient asset allocation.

Assumptions of the Efficient Frontier in Modern Portfolio Theory

MPT is built on several assumptions that form the basis of the Efficient Frontier. These assumptions include:

- Investors are rational and risk-averse.

- Investments are evaluated based on their risk and return characteristics.

- Investors have access to perfect information and can make decisions accordingly.

- Investors can borrow and lend at a risk-free rate of interest.

These assumptions provide the framework for constructing portfolios that lie on the Efficient Frontier, optimizing the risk-return profile based on individual investment goals.

Criticisms and Limitations of the Efficient Frontier

Like any theory, the Efficient Frontier has its critics. Some argue that the assumptions underlying the theory are unrealistic or fail to capture the complexities of real-world financial markets. Others question the use of historical data in estimating future returns and correlations.

Despite these criticisms, the Efficient Frontier remains a valuable tool in portfolio management, providing investors with a systematic approach to construct diversified portfolios that can withstand market uncertainties.

Practical Application of the Efficient Frontier

The Efficient Frontier has practical applications in various aspects of financial planning and decision-making. Let’s explore two key areas where the Efficient Frontier is commonly used: financial planning and asset allocation decisions.

Using the Efficient Frontier in Financial Planning

Financial planning involves setting goals and developing strategies to achieve those goals. The Efficient Frontier can be a powerful tool in this process by guiding investors towards optimal investment choices that align with their financial objectives.

By understanding the risk-return trade-off implied by the Efficient Frontier, investors can make informed decisions about savings, retirement planning, and wealth management. This helps individuals and families secure their financial future and make the most of their resources.

The Efficient Frontier in Asset Allocation Decisions

Asset allocation is a key determinant of portfolio performance. The Efficient Frontier provides valuable insights into the optimal mix of assets that can maximize returns while minimizing risk.

Portfolio managers and investment advisors often use the Efficient Frontier to help clients construct portfolios that align with their risk preferences and investment goals. By diversifying portfolios across asset classes such as equities, bonds, and alternative investments, investors can enhance their chances of achieving long-term success.

The Future of the Efficient Frontier

As technology continues to evolve and market dynamics change, the Efficient Frontier is poised to play a pivotal role in guiding investment decisions.

The Efficient Frontier in the Context of Technological Advancements

The advent of sophisticated analytical tools and advancements in computing power has made it easier for investors to construct and analyze portfolios using the principles of the Efficient Frontier. This has democratized portfolio management, making it more accessible to individual investors and financial advisors alike.

Furthermore, machine learning and artificial intelligence have the potential to enhance the efficiency of the Efficient Frontier by incorporating vast amounts of data and identifying patterns that were previously unseen. This can lead to more accurate portfolio construction and better risk management.

The Efficient Frontier and Evolving Market Dynamics

Financial markets are dynamic and subject to constant change. The Efficient Frontier must adapt to these changing market conditions and incorporate new asset classes, investment strategies, and risk factors.

As alternative investments gain prominence and new risks emerge, such as climate change or geopolitical events, the Efficient Frontier will need to incorporate these factors to provide a reliable guide for portfolio construction. This adaptability ensures that investors can navigate the ever-changing financial landscape with confidence and make informed decisions.

In conclusion, the Efficient Frontier stands as a cornerstone of modern finance, revolutionizing the way we approach portfolio management and investment strategy. Its ability to optimize the risk-return trade-off and guide asset allocation decisions makes it an essential tool for both individual investors and institutional managers. As we venture further into the realms of finance, the Efficient Frontier will continue to shape the future of investment management, empowering investors to achieve their financial goals.