AIM Rule 26 mandates public websites for AIM-listed firms. This rule ensures businesses share info on location, operations, AIM securities count, and major stockholders. Non-compliance can lead to penalties. Nominated advisors must promptly report AIM Rule breaches for both firms and advisors

What is included in AIM Rule 26?

AIM Rule 26 includes information about the business and stock including:

- A description of the business activities and the location it operates in (for investing companies the investing policy is stated along with its investment manager/s)

- Any other stock market exchanges that the company is listed on (for example, some companies are dual-listed)

- The number of shares in issue with treasury shares noted

- A list of major shareholders

- Outstanding warrants, options, and other securities in the stock

- Names and biographical descriptions of the company’s directors

- Details of the company’s nominated adviser, PR agency, lawyers, accountants

- Constitutional documents such as the company’s articles of association

- All notifications the company has published (I use SharePad for this)

- Whether the company is subject to the UK City Code on Takeovers and Mergers and any other relevant legislation

For a full list of AIM rules including AIM Rule 26 in its entirety, you can see the London Stock Exchange’s AIM Rules for Companies.

How you should use AIM Rule 26

AIM Rule 26 is useful for both traders and investors. This is because AIM Rule 26 includes information about the company and is a good starting point for further research into the business.

Business activities and location

Just because a company is listed on the London Stock Exchange does not mean it operates in London.

For example, two mining companies may have similar valuations. But one operates in a mining-friendly country such as the USA and the other is in Mozambique.

AIM Rule 26 will tell you what exactly the business does and where. Companies that are listed in locations of instability or where there is a risk of the assets being appropriated trade on discounted valuations for these reasons.

Other stock exchanges the stock trades on

AIM Rule 26 will also tell you if the stock trades elsewhere. Many years ago, there were traders who would arbitrage opportunities whereby the stock traded on two exchanges at different prices.

One would simply buy the cheaper stock and short sell the more expensive stock. This works if the stock is fungible on both exchanges. The stock can be delivered against each exchange and the trader pockets the profit.

However, this trade is now harder to come by as the edge has been ironed out. But it is useful to see if the stock trades elsewhere as sometimes disparities can occur.

Even if the stock is not fungible, the fact that it is trading much higher on a different exchange can be a catalyst to the price on the exchange where the stock is trading on a lower valuation.

The number of shares in issue with treasury shares noted

The number of shares in issue is useful to know because if there are billions of shares in issue (or confetti as it is known) then it is likely a warning sign that the price performance of this stock has been poor.

Few shares list at IPO with billions of shares in issue as this is unattractive to institutions and private investors, therefore checking the number of shares in issue can give a quick reference to the previous performance (an even better way to check is the price chart).

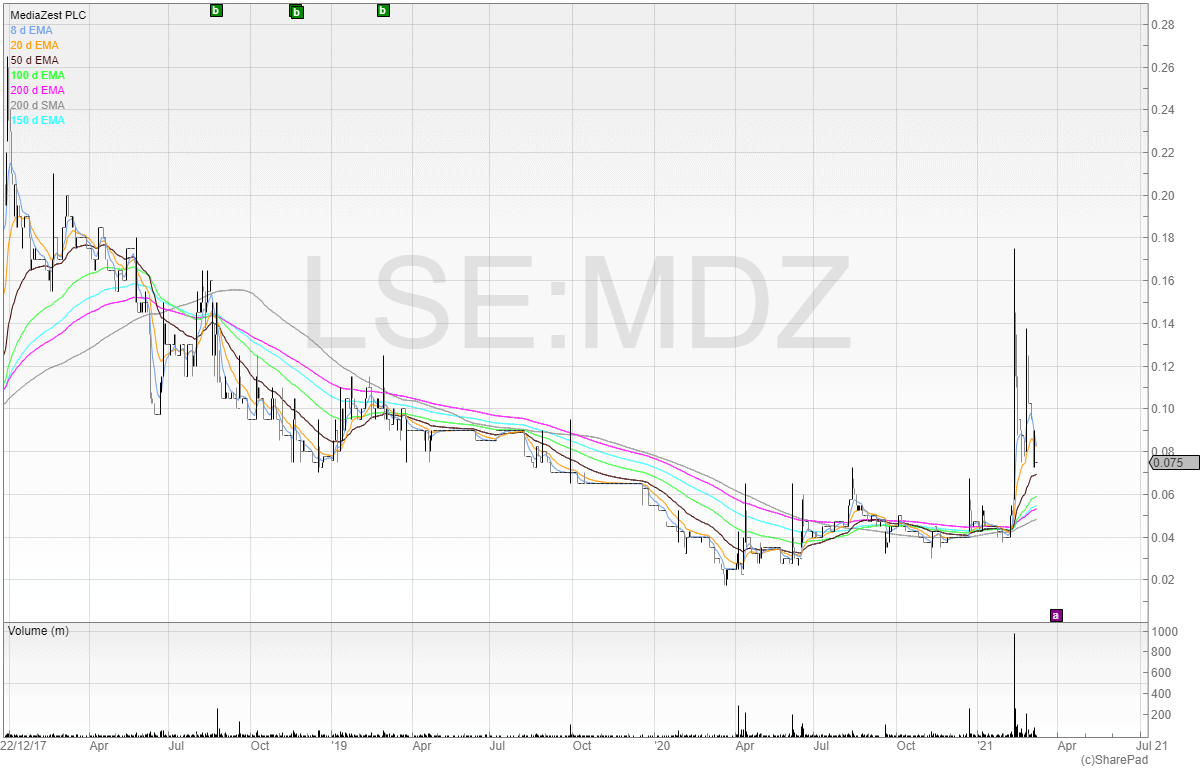

For example, below is an AIM listed stock, MediaZest’s AIM Rule 26 page. We can see the company has 1,396,425,774 shares in issue.

Here is the share price chart for MediaZest over the last few years.

Apart from a spike in early 2021, the share price has been going one way – down.

List of major shareholders in the stock

You can also see a list of major shareholders. It can be helpful to keep an eye out for successful funds and names as if they keep appearing on shareholder registers of stocks where the shares tend to appreciate in price.

Traders find AIM Rule 26 useful because it details the liquidity of the stock.

All major shareholders above the notifiable threshold of 3% are listed here and so we can see how much of the stock is in free float (though any of the listed shareholders could decide to buy or sell shares in an instant).

We can see which institutions are holders of the stock here too.

However, be careful. Not everything is always as it seems. For example, there have been cases where people were buying the stock thinking that it was a fund manager buying the stock, but a quick Google of the full name on the RNS revealed that it was the part of the business that looked after individuals.

Therefore, one person had transferred their holding to the institution, forcing the institution to announce the shareholding through RNS, then taken advantage of the excitement by dumping the stock into strength.

Outstanding warrants, options, and other securities in the stock

AIM Rule 26 is also useful because all dilutive securities need to be listed on here.

This means we can see any outstanding options and warrants and at what prices they will kick in.

The fully diluted market capitalisation is the market capitalisation once all outstanding dilutive securities have been exercised.

We may find an exciting opportunity to invest in but if there is a lot of cheap dilutive money ready to come in at a certain price this can significantly weaken the investment case.

Always check AIM Rule 26 before investing in a company and as a trader I find it helpful.

Names and biographical descriptions of the company’s directors

You can see a quick biography of the directors and their backgrounds – do they have much industry experience? Where were they previously? Was that business successful?

I recommend doing a search on the directors of the company when investing as outlined in my article on how to research stocks.

If you find that a CFO has a nice habit of jumping ship before something profit warnings or that certain board members previously milked the listed company teat for themselves it can be a red flag.

One example of what seems like taking advantage of shareholders is IG Design.

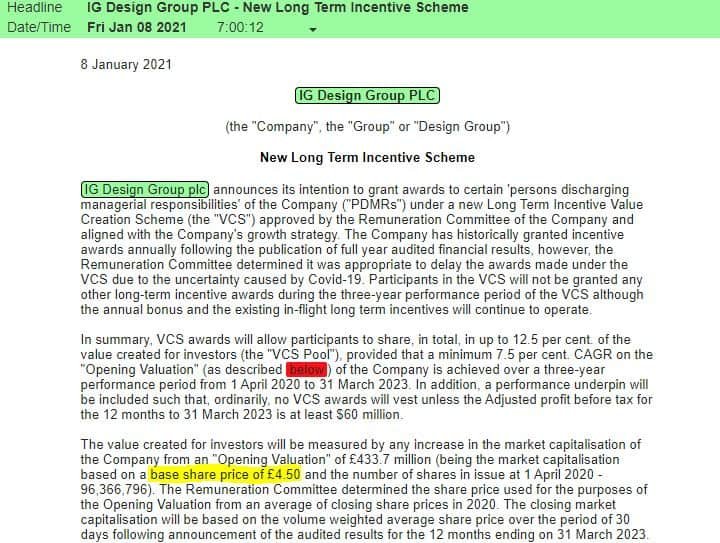

Below is an RNS from 8 January 2021 about the company’s new “Value incentive scheme”.

Notice the base share price of £4.50 that I’ve highlighted. At the moment, that number is meaningless.

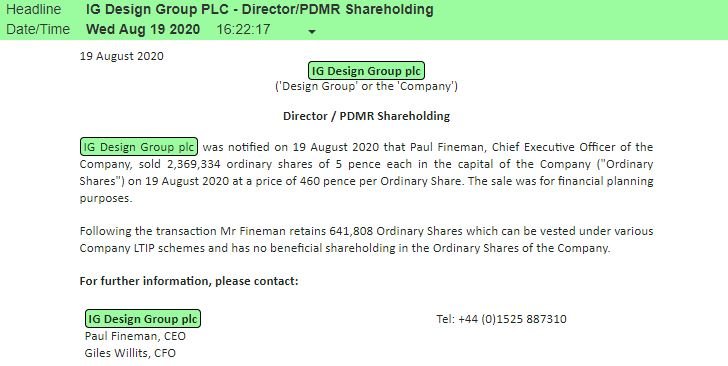

But look at this RNS below from 8 August 2020, where chief executive Paul Fineman sold all of his shares at £4.60!

That’s not all – in the following months up to the value incentive scheme RNS the directors of IG Design were heavy sellers of the stock.

You can see this as I use SharePad to colour code RNSs. Director dealings is highlighted in green.

It begs the question: are the directors creating a “Value incentive scheme” for shareholders?

Or a value incentive scheme for themselves?

Details of the company’s nominated adviser, PR agency, lawyers, accountants

It is useful to know these details because if you have questions about the business that you can’t ask the directors on LinkedIn (maybe they are not active, maybe they decline you) then you can ask the PR agency.

A good PR agency will respond to you promptly (that is, after all, what they are paid to do). However, most PR agencies prefer to act as a barrier between management and you.

I am not sure why this is because many private investors and traders have the ability to move the company’s stock price with just a single tweet, but if you have questions it is always worth calling them directly and leaving an email.

If they don’t answer, call them again until it is easier for them to respond to you to stop you calling rather than just ignore you.

Constitutional documents such as the company’s articles of association

I have never looked at a company’s articles of association but these are important if you are ever involved in corporate actions.

Back in 2018 a company called Management Resource Solutions was going through a rough patch and there were disagreements between management and shareholders.

An EGM request was submitted although the company referred to the articles of association which featured a loophole.

It’s better to stay clear of corporate actions such as removing board members. Directors can and will play dirty and they can dilute the existing shareholder register with available headroom.

All notifications the company has published

This section will show all announcements published through the company via the RNS feed. As described above, I use SharePad for this, as everything is in one place when using this.

Whether the company is subject to the UK City Code on Takeovers and Mergers and any other relevant legislation

Almost always the company will be subject to the UK City Code on Takeovers and Mergers. Therefore, it is best to assume that the company is subject to the code unless it explicitly states that it is not.

Conclusion

AIM Rule 26 is a useful port of call when looking at a trade or investment. You should now most know of the main features of AIM Rule 26 and how to use the information for your stock research.

To learn more about trading and investing on AIM successfully you can read my walkthrough on AIM trading.