Many investors want to know the best stocks to buy right now in the UK. However, many lose money because they don’t know what to look for when investing on the London Stock Exchange. This is made worse because people follow the wrong advice and end up compounding mistakes.

In this article, you’ll learn what you need to know to identify and buy the best UK stocks for profitable investing. But first, let’s dive into UK stocks I’ve been been watching recently.

Best UK stocks I’m watching right now

The stock ideas below are from my newsletter, Buy the Breakout. You can subscribe below and join 12,000+ traders and investors to get the next edition in real-time, for free.

Animalcare (ANCR)

Animalcare has been building a base throughout almost all of 2023 and that has continued into 2024.

According to SharePad, Animalcare is a generic veterinary medicines company. It caters for vets who treat companion animals as its only operating segment.

It has a reasonable presence, sside from several EU countries and the UK, it operates in Asia, the Middle East, and Africa.

Source: SharePad (1-free month worth £74 through me)

Source: SharePad (1-free month worth £74 through me)

The stock price went up because of the Covid lag of pets. They get older, and require more treatment. That was the narrative.

It’s a far cheaper and quicker to bring drugs into the pipeline than human pharmaceuticals, so progress here speedier (although the drugs aren’t as lucrative), and Animalcare has got rid of plenty of marginal drugs. It now focuses on the top 40 that are more profitable.

There’s also better protection on animal drugs, so unlike human drugs the revenues don’t collapse overnight when the patent expires.

One exciting drug deals in arthritic canines, however that is several years down the pipeline and not my concern.

Sales are also normalising here, but one key area that may drive growth is the chipping business Identicare.

This currently gives a £3 million revenue run rate as a SaaS business and can be scaled.

Here’s a closer look at the chart.

The Big Round Number of 200p is clearly resistance here, with the stock now above all moving averages and the 200 EMA pointing upwards. The stock pulled back 15% to 170p and has bounced off there twice.

Ideally, I’d like a tighter stop, but I think this could be a nice entry for a swing trade.

eEnergy Group (EAAS)

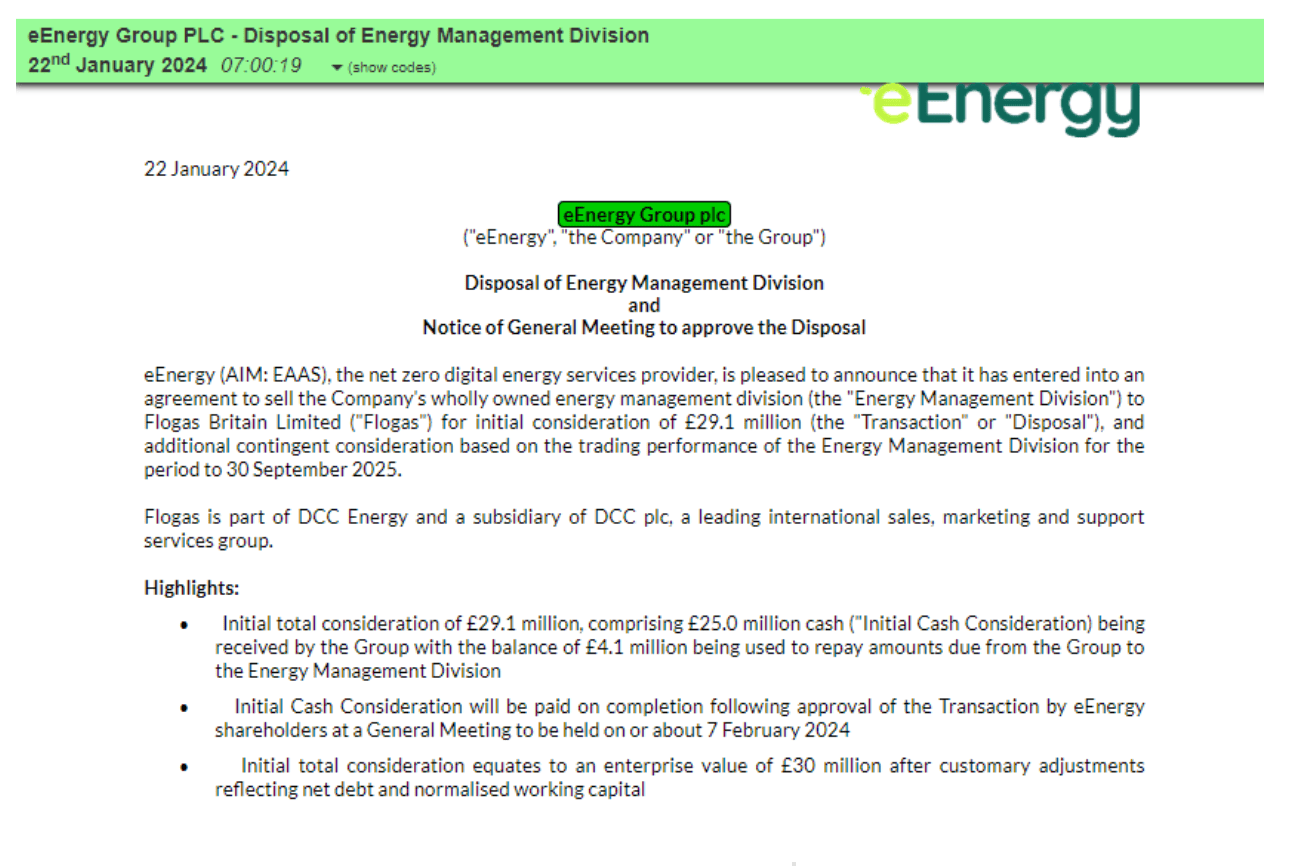

eEnergy came onto my radar recently with news of the disposal of the energy management division.

This is for an initial consideration of £29.1 million, which consists of £25 million in cash with the rest being used to repay the divisions’ amounts due.

However, there’s also the potential to earn out another £8-£10 million should the division continue to perform strongly (meaning that eEnergy could potentially earn £39.1 million from the sale over time).

At the time, eEnergy’s market cap was less than (and still is!) £30 million.

I missed the Tombstone trade here as the news was expected, gapped up by the market makers, and heavily dumped into.

That was one opportunity missed. But the stock dropped from almost 10p down to 6.3p and traded below the price where it was trading when it was previously expected.

I’ve picked some stock up at those levels (and dumped some into the Simon Thompson rally) but having had the time to research further I intend to buy more in the future.

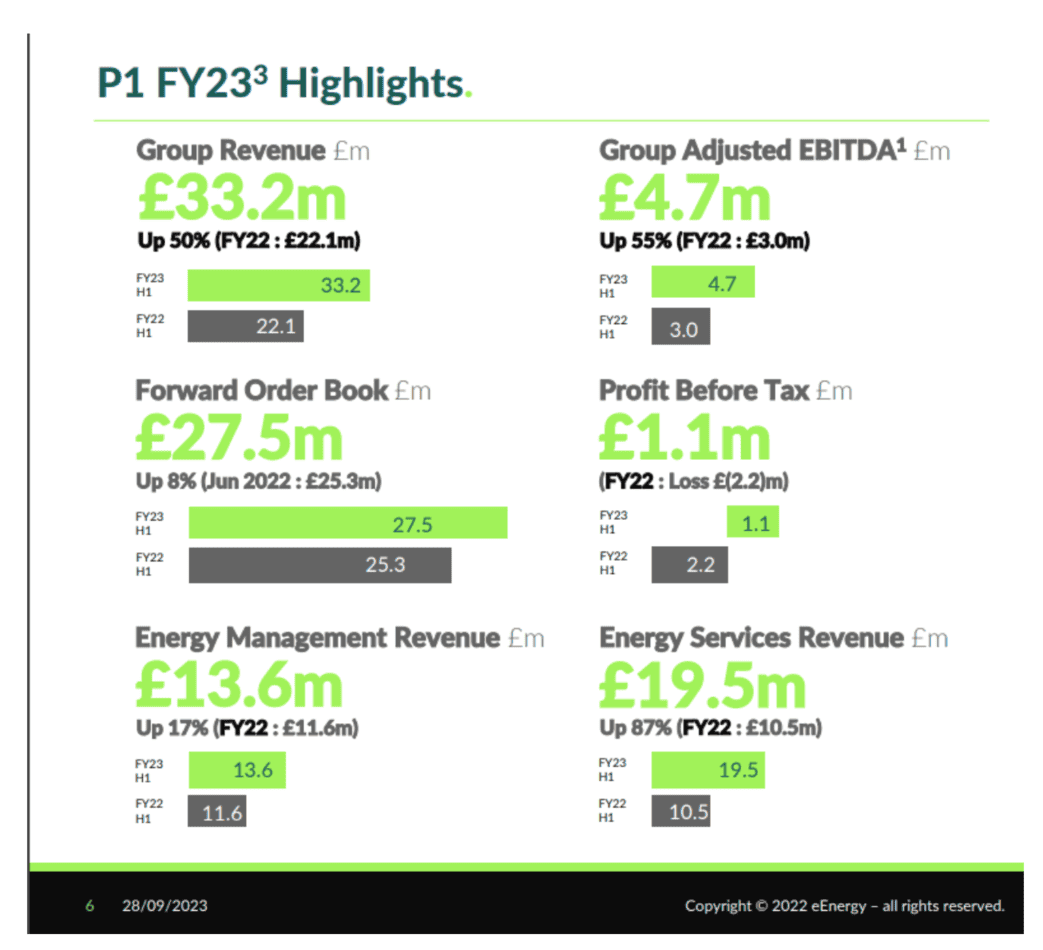

The Energy Management division is growing but slowly.

We can see that Energy Services (ES) grew 87% last year and management believe that by divesting the Energy Management (EM) division it can focus on growing ES even faster.

This is because ES requires cash upfront to invest in the deal before it sees returns, and with a constrained balance sheet this has hampered growth, especially when it comes to bigger clients looking to do bigger deals.

The disposal completion also means eEnergy sees a nice return on the £23.4 million invested in EM since December 2020.

It also means (according to Canaccord Genuity) that the company will have around £18 million in net cash (circa 5.2p per share).

The company was expected to deliver £4.8 million in adjusted profit before tax in 2024. However, the disposed assets make up around 50% of the broker’s EBITDA, so these could be reduced. That said, management believe focusing on ES will deliver better value for the company’s shareholders.

ES primarily installs energy reduction solutions through the deployment of LED technology and solar photovoltaics (PV) for Small Medium Enterprises who buy into long-term power purchase contracts. eEnergy then carries the initial install on its own balance sheet and so it can take some time to pay off – hence the cash constraints meaning the company previously struggled to service some of the bigger clients in the pipeline.

The company works with schools, hospitals, and universities. By switching aging lightbulbs and investing to increase overall efficiency, the client doesn’t pay money upfront but instead eEnergy take a cut of the savings generated, and so the deal can be profitable over time.

I see 8p as resistance here and I’m looking to increase my holding here.

I’m thinking of reaching out to management to do a call and ask questions (the results of which would be included here), so if you have any please post them in the comments below.

One final thing I like about this business is that it’s ran by an entrepreneur.

You can see Harvey Sinclair’s experience here: https://www.linkedin.com/in/harvey-sinclair/details/experience/

He founded what he calls the UK’s largest student/temporary job site in 1999, before floating on AIM in 2002 becoming The Hot Group.

This then grew and acquired eight online niche job sites (so he says – remember people lie!) and The Hot Group was sold to Trinity Mirror Group (now Reach) in 2006 for £55 million.

He was also he Chairman of Kukui Clubs which was sold to Brighton Pier in 2011.

There are other projects he’s been involved in, before becoming a co-founder and CEO of eLight (which became eEnergy) in April 2013.

He also holds 6% of the business, so is more than motivated to see an increase in the price with a 20.8 million shareholding.

However, and I’m sure I’m not the only one who feels this way, the risk/reward is now stunted a little as management have announced a new share options scheme that potentially gives the directors an extra 14% of the business in three years time.

The minimum share price vesting is 9.32p and we’re told these terms were agreed in principle when the price was below 5p. Further vestings are at 13p, 15.8p, and 18.4p.. all of which are nicely above the current level of 7.3p.

I also doubt I’ll still be holding in three years’ time, and if the prices gets to 18.4p I wouldn’t complain.

Huddled (HUD)

Huddled Group is the old Let’s Explore (LETS) which is the old Immotion (IMMO).

It’s previously been featured in Buy The Bull Market before when the company announced the disposal of the Location Based Entertainment business for an enterprise value of $25.2 million.

At the time, the company intended to deliver ~£13.5 million to shareholders which equalled 3p per share, plus retaining £6.5 million on the balance sheet for strategic acquisitions.

Given the company had additional cash on the balance sheet, it made no sense when the company gapped up and traded in the low 3p per share range when the cash on the balance sheet was clearly going to be around 4p should the disposal be voted through. Those who also did their research and joined in the trade did nicely!

The company then changed its name to Let’s Explore to reflect the new business, however only six months later it changed its name again to Huddled to reflect the acquisition of the entire issued share capital of Huddled Group, which owns the online business Discount Dragon.

Discount Dragon is an ecommerce business that sells either surplus, mispackaged, or items close to their best before date for significant discounts when compared to the mainstream grocery market.

These are often dry goods and alcohol, priced around 30-50% and sometimes even more than the usual prices.

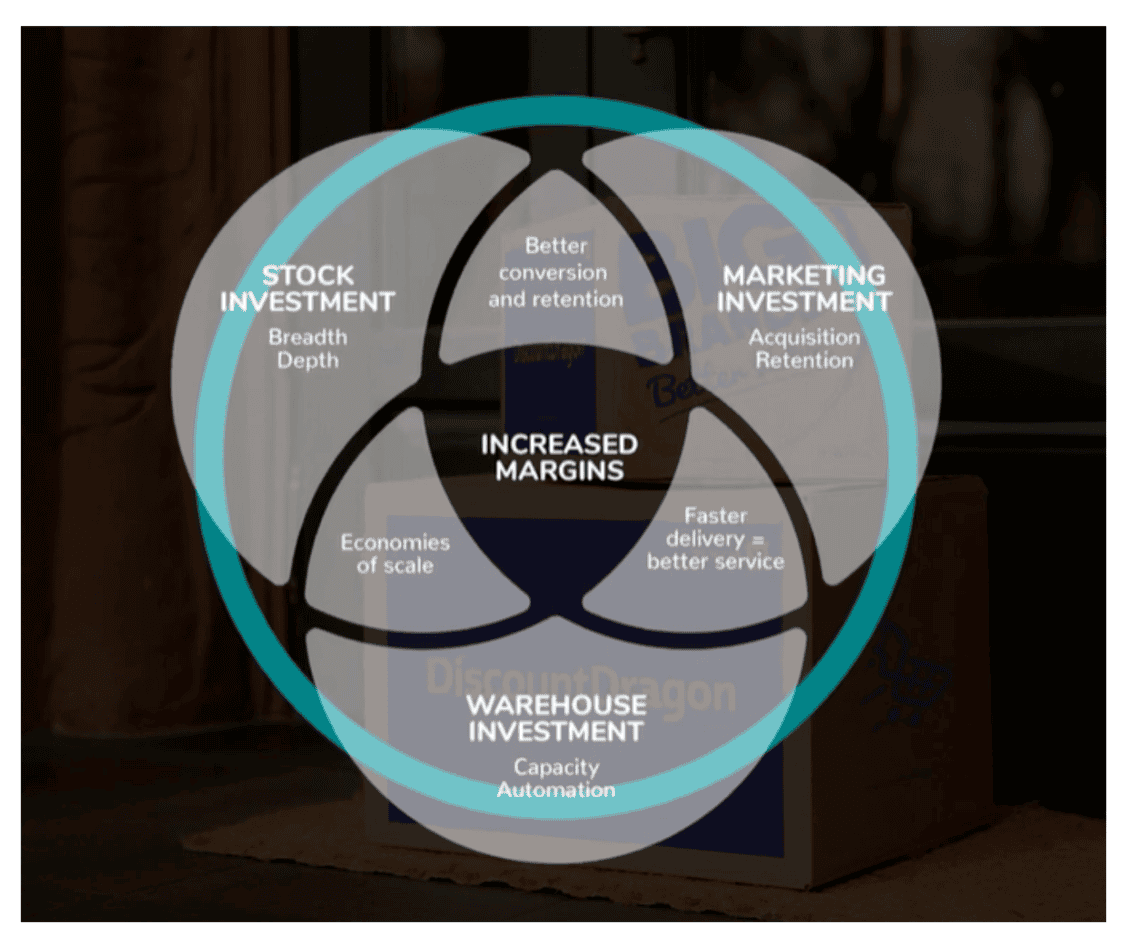

What’s exciting is that this is a nascent business priced on a low EV in the corporate structure.

Revenue growth went from £75k in August 2022 to £450k in August 2023, a 600% increase.

We also know from the trading update that Q4 revenue had increased to £1.8 million from £1.3 million and that the early performance of Discount Dragon had exceeded management’s expectations.

n an interview, Martin Higginson says they’ve not done much marketing yet and it’s all been organic. I’ve started seeing Facebook ads for Discount Dragon so I guess the business is now testing.

We don’t know what the payback period for ad spend is here so it would be worth asking management what the criteria are. Is Discount Dragon measuring on ROAS (Return On Ad Spend) or LTV (Life Time Value)? For example, for every £1 in ad spend could be an investment because management believed the customer will come back three times and then become profitable to be acquired, or the business might be spending £1 to see £1.50 in profitable orders.

As the business scales, the savings come down. Processing fees with credit card companies reduce, warehouse efficiency kicks in, deliveries as a percentage of costs go down.

This is certainly an early stage business, but for a growing business on an EV of ~£5 million, if the business does scale then the price could be multiples in the future.

I’d like to see the price break through 4p and start to gain momentum.

But it’s worth flagging to put on your watchlist.

- Comptoir (COM)

- Eleco (ELCO)

- Eco Animal Health (EAH)

Comptoir (COM)

I wrote about Comptoir two months ago.

I concluded:

“Chart wise, I don’t see the point of getting involved until the price is 9p. That’s nearly 50% from here, and could take some time. Or it could never get there.“

Since then, I’ve been to eat there at the Wigmore Street location in London

It looked a little fatigued, but then probably hasn’t been done since before Covid, which is coming up to at least four years ago.

Food was fine – not sure I’d go back given the choice in London but the lamb wraps were a rock solid 10/10. Noted for Deliveroo.

Service was great, people were friendly, lots of tables booked with reservations (but then so they should be on a Friday night).

My goal was basically to see if there was anything to stop people coming. And I couldn’t find a reason.

Since then, we’ve also had news that the company is finally expanding.

It’s been four years but the company is now ready for growth.

There’s also been a significant change in management too.

Tony Kitous, founder of Comptoir, sent a letter to the board calling for a resignation of the Chairman and Chief Executive.

As could be expected, the directors (at the time) didn’t believe it was in the best interests of the company for two of them to be removed. And it’s for sure not in the best interests for themselves to see their salaries taken away from them.

However, after the AGM both the Chairman and CEO stepped down and two other directors joined.

Two directors joined who appear to have significant experience in the sector.

And two months later a new CEO joined – a former Managing Director of Leon and leadership roles at RTN (although given how poor RTN is I’m not sure if that’s a good thing).

So, the founder of the business has done a clean sweep of the old guard and brought in the new.

Here’s the chart.

Notice how there was a big volume spike in August – then a few days later a fund announces it has gone to 5.86% from 2.45%.

And since then, we can see that volume has remained elevated.

If you’re a swing trader, and don’t mind the illiquidity of the stock, I think the risk/reward on this trade is looking highly favourable given that the founder has exercised some control, put in a new board, and also the business’s large cash pile.

Eleco (ELECO)

One possible stock I’m watching for a breakout is Eleco.

Here’s the chart.

The chart made a bottom in October last year – similar to where the FTSE 250 made a bottom.

It’s also been transitioning to a SaaS model from its legacy business.

It sold Eleco Software GmbH, the German ‘ARCON’ architectural CAD business in H1 2023.

And because of that, the revenue growth rate and mix is changing.

“The move by our customers from upfront and one-off perpetual licences to high-quality subscription and SaaS licences where revenues are recognised over time, set against an operating cost base subject to current inflationary factors, impacted profitability, as anticipated. Nevertheless, with the benefit of the profit on disposal of the ARCON business, Adjusted Profit Before Taxation of £1.8m, adjusted for acquisition costs and share based payments was as anticipated (H1 2022: Adjusted Profit Before Taxation of £2.0m.”

Rather than taking a one-off perpetual license and taking money out of a customer’s pocket once, it aims to repeatedly do so with a subscription.

This is like Netflix not offering us a lifetime subscription, because the amount they’d need to offer us to make it attractive would need to be relatively low, and then the business stunts its upside.

I’ve been signed up to Netflix since early 2016, so if I’ve on average paid £10 a month then that’s £960. Not bad, and I’m classed as repeatable revenue.

It’s a nice business model, because it allows you to calculate the Customer Lifetime Value (CLV) on average.

Then, you know that if you spend 50% of the average CLV on Customer Acquisition Costs (CAC), then over the duration of the customer’s lifecycle you can expect that on average you’ll get a 100% return because the CLV is double the CAC.

However.. the CLV and CAC will constantly be changing. As Naked Wines (WINE) found to their detriment.

It was all going well during Covid, when CACs were low and CLVs were calculated to be high.

But then the Cost Of Living Crisis hit, and people started cancelling because they want to save money and not spend it on wine.

That meant CLVs fell, and ad costs exploded, and suddenly WINE couldn’t spend the money to acquire customers at anywhere near the returns they’d calculated.

So be careful when companies are trumpeting a high CAC/CLV ratio. It could change tomorrow. It did for WINE.

That said, this business (assuming normalised conditions – but what’s normal anymore?) model can be attractive to investors because of the recurring revenue and the churn rate can be measured.

Look at Eagle Eye (EYE) – not only is the business not churning but it’s actually increasing. This is because it lands and expands.

The ‘net revenue retention rate’ is defined as the improving in recurring AIR revenue excluding new wins in the last 12 months.

So, it wins business, but that business then spends more and more with EYE each year. Not every business will be like that, but the NRR number is 137% which means, on average, it’s winning more and more business from its customers each year.

But back to ELCO.

Here are the forecasts:

Given the current market cap of £68.2 million at a price of 82p, the company doesn’t look as if much has been priced in. That’s good.

Growth rates are decent, and the company is cash generative. So far, no red flags.

I’d need to look further into this business but the chart looks attractive here.

A break of 83p on the chart with the moving averages all now pointing up could be make for a nice swing trade. However, the stock is illiquid, and the spread is wide. It’s definitely not one for a short-term trade.

Eco Animal Health (EAH)

Eco Animal Health has had problems in China. It’s correlated to Cranswick (CWK) due to similar operations in China (though Cranswick is a much bigger business).

Here’s the EAH chart.

Looking at the two year chart, we can see that the stock has fallen around 75% from peak to trough, and since October 2022 the price has stabilised.

130p seems a good breakout level, assuming the stock tightens up.

In terms of fundamentals, I can’t see any red flags here.

The business is cash generative, and has cash plenty of cash available, plus a £10m Revolving Credit Facility that is available and undrawn.

Director commentary also sounds reasonable.

The strong performance in the second half of the year has continued and we are delighted that this momentum is evident in buoyant trade currently and, notwithstanding challenges in certain markets, we look forward to the rest of the current financial year with cautious optimism.

I don’t know exactly what the business does but it is reliant on Chinese pork prices. As we may have guessed from the name, it’s involved in animal health products, with its flagship product being Aivlosin – a macrolide antibiotic for the treatment of respiratory and enteric diseases in pigs and poultry.

This seems like a huge risk to me because I have no idea about the Chinese pork market, or what many of the above words mean, and the amount of work I’d need to do to thoroughly understand the drivers of this in order to understand the business fully is likely to be extensive.

Therefore, I’d only ever make this a swing trade based on the chart and a quick red flag check up than anything with any conviction.

But if you’re an expert on the Chinese pork market – feel free to let me know in the comments!

4imprint (FOUR)

Last week 4imprint released a trading update… at 08:47:12

And I’m glad it did, because it offered a trading opportunity that doesn’t come around everyday.

Now, if we assume that the market is efficient, then this £1.3 billion (at the time) market cap company would’ve instantly rerated to its new price.

That wasn’t the case.

And it’s worth remembering that the only people who say the market is efficient are the people who want an excuse because they can’t make money in it.

If the market was efficient, then it wouldn’t be possible for people without the biggest bankroll, the biggest teams, and the biggest computers to achieve any scraps of alpha. It would be gobbled up instantly.

But check this out..

The company announced it was trading “materially above the current consensus of analysts’ forecasts”.

The stock did move quick as algos and I managed to buy within the first minute candle.

But it then took another 17 minutes for the stock to break out of that high.

So what we had here was a stock saying it was “materially above” yet trading around 2% higher than before the news.

And yet the price had barely moved.

This meant that even if you were late to the trade, you could buy knowing that your stop could be either:

-

At the LOD conservatively, or

-

Below the price before news dropped

The upside if you were correct was multiples of your risk.

Which is exactly exactly what happened.

Slowly the news started to filter through the market.

And the stock started printing higher throughout the day.

Looking back, I ought to have been aggressive here and loaded up.

Thinking in terms of Expected Value

There was a more than 50% chance in my view that the price would rally, and not trade below the pre-news price. Let’s say 60%. I think in reality probably closer to 80%, as intraday news rarely closes below the pre-news price unless it was expected, and this appears not to have been given its weakness in the chart.

I also thought it likely I could see a 6-10% gain on this trade for a max 3% risk.

Therefore, if we calculate the EV:

Losing trade: 40% multiplied by 3%

Winning trade: 60% multiplied by 6%

That is -0.4 × -3 = -1.2 for the losing trade.

And 0.6 × 0.06 = 3.6 for the winning trade.

Now we need to add both the outcomes and we get an EV of 2.4 (positive) for the positive trade.

So this clearly was a great trade, and I’d priced it 60%. The optics of a 20% chance of loss and an 80% chance only increased the EV.

I went on the bid when I realised this was a potential great trade, but I should’ve just paid up. I had the time to.

I was fully out by 5,000p, but this could’ve and should’ve been a bigger winner for me.

Rolls Royce

Rolls Royce is a FTSE 100 company and not a company I’d ever trade unless there’s news.

This is because these stocks are not volatile unless there is something big happening either in the stock or in the world (it moved like a penny stock during Covid).

And this was significant news.

When you see a FTSE 100 with materially above or materially below expectations, you need to trade it. Or at least consider it.

Here’s the chart for this year:

The first arrow is when Rolls Royce put out surprise good news. Notice how the stock gapped up, traded below the opening price with the extended wick, but closed the day near the top of its high. This was a bullish signal for swing traders and the stock continued to print higher for the next 11 sessions consecutively.

This is the classic PEAD (post-earnings announcement drift) – a phenomenon where a stock’s price continues to move and trend after the earnings release. It takes time for the market to digest new information and as efficient as FTSE 100 companies are, we can clearly see that the stock didn’t open at its correct market price in the uncrossing trade on the day of the earnings release.

If the market was purely efficient, then all of the information would’ve been digested within that hour, the stock would open up, and then there’d be no volatility.

This is why as an intraday trader I’m looking for earnings surprises. This is where the reported earnings per share (EPS) or profit after tax differs significantly from the market’s expectations or analysts’ forecasts.

Sometimes the company will explicitly say the business is performing ahead of or below these expectations, but sometimes you have to check for yourself.

You can do this by creating a new layout on SharePad.

Once you’ve done this, change the left green screen to Financials > Forecasts and have the right green screen on news.

This way, you can scroll through the news as you would using the arrow keys and tab to jump in and out, as well as pg up and pg down to move up and down, but once you find a stock worth investigating you can then move to the left green view, click, and enter that stock.

So for example, if I’m reading PFC’s RNS and want to check the forecasts, I move the mouse, click, type PFC, then enter, and the consensus forecasts show up on the screen instantly.

This has the advantage of

-

Saving time

-

Moving efficiently

I’d recommend setting this up, as well as my colouring and filtering system on RNSs.

Anyway, I digress.

Back to Rolls Royce.

The second arrow is when the stock announced it was trading in line with expectations.

It looks like the market expected more as the stock sold off on the open.

But since then, the stock had traded in a range for several months.

This was a sign of consolidation, and then we had the catalyst of the news.

Here’s what happened.

This is why I say you want volatility after the move and not before it.

We can see that the market was completely surprised by this because there was no rally into the results, and it was still trading within range.

Therefore, the evidence suggested this was a surprise ahead and not an expected ahead. A surprise ahead has genuine upside, whereas an expected ahead often gaps up and gets sold into. News that is expected is often priced into the stock, hence the old adage “buy the rally, sell the news”.

My view was that the stock was highly likely to print higher, and that the uncrossing trade would be one of the most competitive prices of the day.

However, I always thought there is a risk that it moves slightly lower, and if it goes a few pence away from the uncrossing them I’m out instantly.

As Rolls Royce is extremely liquid, it doesn’t matter that I’m not Blackrock and so liquidity isn’t an issue.

I got filled in the uncrossing trade, put what I call a ’snake in the book‘, which is a bid further down the book that you would like to get filled but it doesn’t matter if it doesn’t, and then the stock responded by ralling.

I was all out by 180p, which in hindsight was far too early, but this was a scalp trade and my risk was tight. If I’d wanted to swing trade this, my risk would’ve been wider and as well as my reward.

I talked about this trade in more detail here.

To conclude on this stock:

-

Material aheads and material belows are great but only if they’re surprise aheads and belows

-

FTSE 100 stocks with surprise news give plenty of liquidity and tight spreads

-

Always check the chart before you decide to trade the stock

Any questions? Let me know!

Argo Blockchain

I wrote about Argo Blockchain last month:

“My view: Placing likely. Being long here is a risky bet that might pay off if there’s a crazy Bitcoin rally, but realistically:

-

The company’s Bitcoin reserves are depleted

-

The Halving is happening in April 2024

-

Hash rate needs to double fast and not just increase by 12%

-

As of 31 December 2022, the company had £46 million in debt

If this is the beginning of the bull run in crypto, then Argo may’ve done enough to survive and attract new investment. But it cost it its entire Bitcoin reserves.

I also don’t see how a placing isn’t going to be required here.

I’m short here because I think after this rally, the risk/reward is in my favour.

There is a risk that Bitcoin price rises and punters get excited and pile in.

The two prices are correlated (see my SharePad chart below).”

Well, that’s exactly that happened.

There was some news that weekend that fluffed the price up to 18p allowing me to average up (my feeling was that it was an exhaustion gap) and a placing at 10p announced soon after.

However, I don’t think this is anywhere near enough.

The company raised gross proceeds of £5.75 million.

After commissions, the company would be lucky if it cleared 10% of that debt.

And the July update sucked too.

The company has 46 Bitcoin left, and hash rate grew to 2.6 EH/s. It’s a start, but not enough.

This placing buys the company two months at best? I expect another placing at some point, and will watch for any spikes to short into.

- Abingdon Health (ABDX)

- Kooth (KOO)

- Eagle Eye (EYE)

Abingdon Health (ABDX)

Abingdon Health listed in December 2020 and was pretty much a flop from the start.

However, the situation may be changing.

I’ve no idea what a CDMO is, so I Googled it:

“A CDMO is a contract development and manufacturing organization, meaning they not only handle the outsourced manufacturing of drug substances, but also all of the innovation and development work that occurs prior to manufacturing one. This includes development, production and analysis, and pharmaceutical companies no longer need to build and staff dedicated innovation and manufacturing facilities.”

It sounds like it’s a development and manufacturing lab for hire. A picks and shovels play.

Then last month this happened:

It’s easy to get excited about the TAM here. It’s estimated over 12 million pregnancy tests were used in the UK in 2022. So there’s a big market to go after.

But having a big market and selling are two different things.

I remember reading a story about one investor who wanted to see if a product sold. He had someone go to several stores and make a mark on the last product on the shelf. Every week he’d go back and for several weeks the marked product was still there.

The product was a flop!

The company posted a trading update earlier this month and revenues were set to be 42% higher than 2022 at £4 million.

Cash is mentioned to be circa £3.2 million which is in line with the board’s expectations.

Here’s the company’s interim results and cash flow statement.

I remember there being a settlement last year with the govt. Here it is, in July.

As this is classed as a debt, I take it means it was a trade receivable (money owed but not yet paid).

That means that big £7 million is flattered heavily by this one-off payment.

And that the real cash generation number by the business is negative and the business was actually burning cash.

I think cash may be tight and so for that reason it stays on the watchlist as a potential breakout but not until the financing risk is removed.

Here’s the chart.

Some positives I can see here:

-

15p is confirmed resistance and there’s the potential for a cup and handle set up

-

Notice how volume increases in May as the stock starts moving up from 5p

-

Potential catalyst as the business has changed strategy for the better

Abingdon has the potential to be a nice winner in future.

There are a lot of ifs. But there’s plenty to keep me interested here and it’s worth following.

Kooth (KOO)

Kooth plc is a company that came out of the blocks strongly in September 2020 as a digital mental health provider to the NHS for children and young people. It provides individuals free access to mental health support which is funded by healthcare systems, insurers, businesses, and charities.

It nearly doubled then shed 75% of its value in 2022.

It’s primarily UK based but has started making inroads into the US too.

A California contract has put some life into the stock.

The first arrow is the California contract mention, and the second arrow is the confirmation and undertaking of a premium fundraise at 300p per share to raise approximately £10 million when the closing price was 260p.

Premium fundraises are rare (although there are now two in this issue!). But this one is being backed by the directors who put in for 110,666 – which is £331,998.

Here are some excerpts from the “$188m four year contract in California” RNS:

· The Contract has a minimum total contract value of $188m through to June 2027. Kooth’s service is expected to launch in January 2024, with platform development underway in readiness for this.

· As a result of this contract win, the Group now expects a material upgrade to 2023 revenue guidance, to not less than £34m (FY2022: £20.1m).1

· The Contract is also expected to have a highly material impact on revenues and ARR from 2024 with the timing of revenue linked to usage, promotional activity and product development. There is potential revenue upside from increased usage, and a minimum expectation of service levels and product milestones.

It’s clearly a game-changing contract for the company. But it doesn’t tell us anything about profit – only revenue.

Anyone can sell tenners for a fiver so unless we have an idea on this it makes the company difficult to value.

SharePad has this for forecasts.

It looks like these have been updated given the company mentioned 2023 revenue guidance was not less than £34 million. The company is forecast to move into profit next year with 2025 guidance not supplied.

I have the all-time high at 404p and whilst the company would be classed as richly rated given its 2024 PE, if the company is growing rapidly then the shares could rise further.

Eagle Eye (EYE)

Eagle Eye updated the market to tell us there was “Strong revenue and profit growth ahead of expectations”.

However, the stock is currently priced with a PE of around 45. So this is definitely an expensive earnings multiple stock.

But it’s also one of the few companies on the London Stock Exchange that has a scalable proposition, is growing rapidly, and has sticky customers.

It could be that the shares trade sideways for another year and earnings grow, bringing the PE down. But any profit warning here would see a huge collapse in the share price.

It’s an exciting growth story and has held up well in recent times.

- Arrow Exploration (AXL)

- Watches of Switzerland (WOSG)

- Cake Box (CBOX)

Arrow Exploration (AXL)

Arrow Exploration is a clear stage 2 stock.

It’s uptrending.

Here’s the chart:

We can see the ideal entry was the breakout of 9p.

However, we’re now seeing a base in play since the stock topped out in June.

Notice how the stock has put in higher lows and has now reclaimed a space above the 50 EMA.

But it’s clear that the 20p mark is proving resistance.

Arrow is actually producing, and has a five well program in Q4 of this year.

I have no idea on the fundamentals of this company but this is a chart I can get behind if it breaks out.

Notice how those wicks extend above 20p showing that the stock rallied and got sold into.

That means sellers are keen to close positions above 20p.

But all sellers come to an end – so I think it’s worth watching this batle between the bulls and the bears play out.

Positives:

- Stock uptrending with a nice chart

- Oil & gas sector sector

Negatives:

- SETSqx so can be illiquid

- Drill risk in Q4

Watches of Switzerland (WOSG)

Watches of Switzerland has been a great stage 2 stock in the past.

However, the trend has now reversed and the stock is now clearly in a downtrend.

The recent results show the company is still growing revenue with constant currency at +25%.

However, one thing caught my eye in the results.

Of course registration of interest lists continue to extend. It’s free to register.

What that means is that people can register with no obligation to take up their statement to buy.

It’s a great trade.

If you don’t sign up, you can’t buy.

If you sign up, you can buy but you don’t have to.

Watch prices (especially Rolexes) have been going crazy over 2021 but that’s not so much the case now, with prices well off their peak.

What’s more important though is the chart:

That 750p level is getting sorely tested.

It’s been hit repeatedly and bounced back – so far.

The price is not exorbitantly expensive here with forecast EPS of 53.5p against a share price of 771p.

That gives a PE of 14.4.

But any hint of a slowdown in growth or even a warning suddenly makes the stock a lot more expensive.

There are two types of people who buy watches:

Those that can afford them, and those that can’t.

Those that can afford them will likely not skip a beat when thinking of their next watch.

But those who can’t will certainly be thinking twice. And maybe not taking up their option to buy.

I tested a short last week and closed this quickly.

But a breakdown of 750p and I want to be selling.

Positives:

- Not expensive (but also not cheap)

- Company growing (especially in the US)

- SETS so more liquidity available

Negatives:

- Sector demand likely to diminish?

Cake Box (CBOX)

Cake Box is a capital light business model that is scalable.

The issue is though Cake Box succeeds when its franchisees succeed.

And recently, they’ve been struggling.

Remember when I said macro themes take time to play out?

Well, Cake Box issued a profit warning last week which saw the stock fall nearly -40%.

Franchisees have seen LFL sales decline 2.8% in the first half to date. That means growth is now reversing.

The company boasts about a strong pipeline of potential new franchisees but everyday it seems we see another pub or café has gone bust because their energy price has multiplied several times.

My belief is that it would be a big gamble to open up a unit until there is certainty on the situation.

Shore Capital has updated forecast EPS for 10.9p.

A PE of 13.8 seems expensive for a stock that is now in reverse growth and facing significant headwinds.

And that’s assuming it doesn’t warn again.

Here’s the chart:

The gap from the profit warning has now closed, and 150p is a big round number.

I want to add the second lot to my position at 155p.

I’ll close the trade if I’m wrong around 165p.

There was a big director buy on the day of the warning which has fluffed the price up given the size.

And in fairness, it’s relatively meaningful (though he did sell a chunk a lot higher).

Let’s see what happens.

I can’t imagine people are going to be rushing for personalised cakes during the COLC but I could be wrong.

I do notice though that 39% of all reviews on TrustPilot are 1-star reviews.

Quality and taste are regular mentions.

These are both subjective, and people only ever write reviews after a bad experience, but I’ve flagged this before because it’s unusual to have so many disgruntled reviews.

Positives:

- Big CEO buy

- Strong balance sheet (for now)

Negatives:

- SETSqx so illiquid

- Could take time to play out

- IG Design (IGR)

- Jadestone Energy (JSE)

- Dr. Martens (DOCS)

IG Design (IGR)

IG Design is the old International Greetings. Stock market darling turned stock market pariah.

It started with the Value Creation Incentive Scheme.

Which was basically the directors dumping their stock then reloading by giving themselves nil-cost options.

Nil-cost options are just the transfer of money from your pocket as a shareholder to their pocket as a director.

This was almost the top. Then in October the stock announced a profit warning.

I managed to get some borrow here and repeated the trade earlier this year (profit warnings rarely come in ones) however I’m now looking at the stock as a potential long.

Here’s the chart:

It’s too early to say if this is a stage 2 stock.

But it has the hallmarkets of a stage 1 – even if it’s brief.

By zooming out a little we can see the stock appears to have bottomed, for now, at least.

The lowest price it printed was around 45p so the stock is over 100% up from the lows.

Now, that doesn’t mean it can’t go back there. But if the selling pressure at 45p was that intense it would’ve held the stock down.

Clearly, there are more buyers below this level than above as otherwise the stock wouldn’t have been able to rally.

I don’t know much about this company but it operates in an industry that I wouldn’t expect to be terribly high margin.

And there has been some director buying, but nothing that strikes me as conviction buying straight away.

But if there is one thing I’ve learned in seven years of doing this for a living, it’s that the chart doesn’t lie.

It’s the money-weighted sum of market opinion and sentiment.

This is what I’m seeing.

The stock has rallied and is now building a small base below 100p.

I’d be interested in trading this if the stock broke out of this range and I’d keep my stop nice and tight below the base and out of the stop loss liquidity.

The recent low was 89p, so 85-86p is likely where I’d be wanting to cut the trade.

There’s some potential resistance at 113p but after that the next logical resistance point would be at 180p where the stock opened after its last profit warning.

I’d be wary of holding this trade into earnings, but as it reported on 28 June there should be some time away yet (unless trading has significantly deteriorated ).

It’s worth having a read of the outlook in the results but for me this would be a technical trade only.

Positives:

- Stock appears to have found a bottom

- Building a shallow base

Negatives:

- SETSqx so can be illiquid

- Recent warner

Jadestone Energy (JSE)

Jadestone Energy is an independent oil and gas production and development company focused in the Asia-Pacific region.

The price came off a lot recently because production at Montara was halted with the expectation of recommencing within four weeks.

It took almost exactly that, and production resumed on 4 July.

However, the company acquired an interest in the North West Shelf, with an effective date of 1 January 2020.

These assets are expected to generate $40 million of EBITDA in 2023 assuming a realised oil price of $100.

There’s also potential to add incremental reserves through infill drilling.

Here’s the chart:

The issue here is that the stock runs up too quickly.

When this happens, traders look to bank and provide supply at the breakout price.

It’s why I like stocks that have long and shallow bases. Low periods of volatility often see greater volatility once the range expands.

For now – I want to see what happens.

But 110p is the place to go long if the price consolidates before first.

Positives:

- Uptrending chart above the 200 EMA in a weak market

- Strong fundamentals and growing

Negatives:

- Can sell off quickly if there is a small production blip

- SETSqx traded so not easy to get in or out

Dr. Martens (DOCS)

These shoes are no longer for skinheads.

Apparently, they’re now fashionable, which is probably why I don’t own a pair.

And if I extrapolate how many people in Soho wear them to the rest of the country, then maybe I should be filling my boots (sorry, couldn’t resist).

The issue here though is that whilst I have scuttlebutt that these shoes are popular, and we have confirmation in the RNS, there is little edge to be gained in a £2.5 billion company.

It was a gift from private equity, and surprise surprise, the stock tanked not that long after listing.

But things appear to be turning around.

Market expectations were upgraded and several metrics are going in the right direction.

The chart also looks better.

It looks to me like a scruffy cup and handle.

However, the stock is still below both of the 200 moving averages (EMA and MA).

I’m interested in this stock because of the pattern, and how the stock has found support twice at the 50 EMA.

Positives:

- SETS traded

- Expectations upgraded

- Next earnings event is November so low reporting risk

Negatives:

- Fashion is fickle but this is a short term trade

- Below the 200 EMAs

- Stock has been weak until recently and this is a weak market

- Kistos (KIST)

- Ocado (OCDO)

- Restaurant Group (RTN)

Kistos (KIST)

Kistos is Andrew Austin’s new venture.

Well, I say new, but it listed in November 2020.

And it’s done fantastically well since.

The IPO price was around 100p and it current trades around 400p.

I turned down the IPO, and traded the breakout at 200p.

I’m now looking to buy if the stock goes through its all time high.

Gas prices are rising and therefore Kistos is in a sweet spot.

Here’s the chart.

Source: SharePad (1 month free data worth £69 here)

This is a textbook stage 2 stock.

It’s above the 200 EMA and has a reason for the move.

I like this stock and will trade it if it breaks out.

You could’ve said months ago that the stock had a reason to move and you’d be sitting on dead money.

This is why buying a the point of least resistance works best for me.

Positives:

- Stage 2 uptrend

- Gas prices have risk to the upside

Negatives:

- SETSqx so can be illiquid

- No guarantee of higher gas prices

Ocado (OCDO)

Ocado is an online grocer.

It did spectacularly well during Covid.

But ever since the start of 2021 it’s fallen nearly -75%.

What’s incredible is that the company decided to raise money the week before last.

Now, if I was the CEO and my company’s stock was frothy, I know what I’d be doing: raising as much money as possible.

If the company had decided to take advantage of market hype when the price was 2800p, even if it could only raise at 2000p (a steep discount) that would’ve still been nearly 3x the current price.

Of course, it’s easy to say in hindsight.

But it’s not as if it was a secret that the market was on fire.

When that happens, it’s a good idea for companies to capitalise and bolster the coffers.

For whatever reason, Ocado didn’t.

And it’s also trading around strong support.

When the Kroger deal was announced in 2018 the stock opened at 700p, then squeezed over 1000p as shorts rushed to cover.

Here’s the chart.

The stock bounced off 700p recently.

I’ve marked this area as support and if the stock breaches it I’d like to go short.

Positives:

- Downtrending in a weak market

- SETS traded so better liquidity

Negatives:

- Just raised capital so no urgency to raise

Restaurant Group (RTN)

Restaurant Group owns Frankie & Benny’s, Chiquito, and the Wagamama brands.

I intensely dislike this stock, mainly because of F&B’s. It’s truly awful.

It’s not exactly high class food either, so it’s exactly in the firing line for those looking to cut back.

Here’s something I found interesting in the AGM trading update.

Source: SharePad (risk-free trial and 1 free month on me here)

The company has a covenant of minimum liquidity of £40m.

The current cash position is £220m which is great.

But long-term borrowings is £318m – so it’s not net cash.

Couple that with a forecast PE of 19 that makes for an expensive stock.

I shorted this at 60p already but I’m now looking at 40p as another level.

It’s a significant area of support – and everyone is going to be watching this.

The stock may have no issues this summer as everyone has a last hurrah before they bunker down for winter.

But there’s been no shortage of signs that people are already spending less in restaurants and eating out.

If I was a big time hedge fund instead of some dude pressing buttons at home, this would be a stock I’d want to investigate.

Plus, the trend is already in favour.

I think it’s worth keeping an eye on this company and I’ll be looking to get short if the stock breaks that 40p support.

Positives:

- SETS traded

- Going with the trend

- High earnings multiple

Negatives:

- Already fallen a lot

- Strong cash position

- Petra Diamonds (PDL)

- Atome Energy (ATOM)

- CentralNic (CNIC)

Petra Diamonds (PDL)

Petra Diamonds has been a feature here before given that it had been building an extended stage 1 base.

The stock is now firmly off the lows which tells me it’s now likely to be in a confirmed stage 2 uptrend.

The fundamentals for this company continue to improve, with the diamond price remaining elevated.

Here’s the chart:

Source: SharePad (1 month free data worth £69 here)

Zooming out the fall is even steeper.

We have to remember that due to the recapitalisation of the business this effectively wiped the previous equity owners out, so it’s unlikely the price will ever reach anywhere near those highs.

But looking closer, I’d like to re-enter this stock if it takes out the recent high at 135p.

Positives:

- Stage 2 uptrend

- SETS traded so can place orders onto the book

Negatives:

- Still a lot of debt (though this is coming down)

- A potential falling diamond price damages the fundamentals

Atome Energy (ATOM)

Atome Energy is a new list which, unlike most new lists, is actually positive.

According to the company’s website, it’s the first green hydrogen and ammonia production company listed in the UK market. It’s a spin-out from President Energy.

I missed a breakout trade in the stock recently as my alert went off and I decided not to trade it as it looked illiquid and therefore no driver for volatility.

For a few day, it seemed like I’d made the right decision. Then the stock shot up +50% in three sessions!

I’ve marked the arrow where my alert went off.

The top line marks where I’ve made a new alert.

Note the stock is still above the 50 EMA and is nicely above all of the moving averages.

It’s showing strength despite the overall market taking a pounding.

Positives:

- Uptrend in a weak market

- Sector first which can excite buyers

Negatives:

- SETSqx so can be illiquid

- No revenue

CentralNic (CNIC)

CentralNic is involved in domain name services and strategic consultancy.

What that actually means I don’t claim to have any idea – but the recent RNSs have been interesting.

Source: SharePad (risk-free trial and 1 free month on me here)

The company is starting to grow rapidly through acquisitions but also organically.

Organic revenue is up c. 53% and the company is profitable.

It’s trading on a PE of around 8 despite the growth.

Here’s the chart:

A break out 150p sees the stock move into all-time highs.

Notice how the price has battled with the 200 EMA but trading above it. This is a sign of strength and that this support is holding (for now).

I think it’s worth keeping an eye on future RNSs from this company and I see this as a potential breakout trade.

Positives:

- SETS traded

Profitable and growing - Low earnings multiple

Negatives:

- Steep pullback from highs

- Choppy price action

- Deliveroo (ROO)

- Brave Bison (BBSN)

- Pebble Beach (ADF)

Deliveroo (ROO)

Deliveroo – or Deliveroops as it was known when it first listed due to its flop – is a company of which I’m a regular customer.

I hate going into physical shopping stores, and between a big shop from Tesco and the speedy top ups from local express stores through Deliveroo, I’m thankfully never dragged to one by Mrs Taylor.

But the mark-ups here are insane. It’s actually way cheaper to go out to eat than eat in (assuming you don’t overdo it on the drinks).

Someone looking to cut back who sees Deliveroo appearing on their bank statement nearly every day will start to question it.

There is an argument that as Deliveroo takes a percentage cut from the total order that its revenues will actually increase as supermarkets and restaurants put their prices up.

But that also means the price through Deliveroo will also rise more in proportion to the actual cost rises.

Obviously, the best time to short this stock was near 400p, and not when it’s taken a near 75% bath to 103p.

But I like the chart here, and 100p is also a big round number.

These are always key levels as they’re psychologically strong.

Obviously, if the market was efficient then big round numbers wouldn’t be a thing, but the market is not efficient, and so big round numbers are a real thing.

I’ll be looking to get short if it breaks through 100p.

Source: SharePad (1 month free data worth £69 here)

It’s a classic stage 4 downtrend, so I’d be trading with the trend.

At a market cap of £2 billion, it’s also nice and liquid so you can get in and out with relevant ease.

Positives:

- Stage 4 downtrend

- SETS traded so can place orders onto the book

Negatives:

- Revenues growing quickly still

- May’ve missed the easy short trade already

Brave Bison (BBSN)

Brave Bison is a stock that has been through a carousel of boards all of whom were useless (in terms of creating shareholder value; I assume they were useful at something, at least).

However, the company now appears to be turning itself around.

It’s made an actual profit for what I believe is the first time ever.

It’s also been a cash generator and bolstered the coffers by +75%.

Source: SharePad (risk-free trial and 1 free month on me here)

The new chief executive (and who I assume is his brother) own 22% of the stock – so they’re surely motivated to drive returns in the business.

There is, of course, the issue of directors having too much stock. But I don’t see that being an issue here as they’ve proven with the acquisition of Greenlight that they can do value accretive transactions.

The company also acquired another business last week for a £350k EV that generated a profit before tax of £310k. On the face of it, the deal looks attractive.

Let’s take a look at the chart.

I’d be interested if the stock can break out, and this is a stock I intend to do more research on. I’ve bumped it up my priority list.

One thing to be aware of is that there is a potential seller. I’ve noticed that often on good results the stock rallies and pulls back on heavy volume.

Last week was no exception.

Positives:

- Strong director ownership

- Profitable and cash generative

- Seller could be artificially depressing the price

Negatives:

- SETSqx so highly illiquid

- Execution risk on the buy and build

Pebble Beach (ADF)

I was sure I had traded this company before when it came up on my filter.

It turns out I did – I made over 200% in a single day when the company was no longer going to go bust.

Source: My Twitter

That was over four years ago now, and the company has come a long way.

It’s now a £16m market cap company (although I don’t know how much dilution it needed to get there).

The company develops and supplies automation products for TV broadcasters and TV service providers.

It has an impressive client base across the world, and churn is low due to the high quality of its offering.

I was interested in learning more about this company, but my emails were ignored. So it’ll only ever be a small trading chip!

That said, the chart looks interesting, like an early stage 2 stock.

We can see that the spike in April 2018 when the RNS was announced that the company was no longer going bust.

Given that this was near the all-time low and I was the first buyer on the bell (it didn’t gap up), it’s quite possible I actually paid the lowest price ever in this stock.

It’s done well since, generating multibagger returns from the lows.

The stock is now rangebound from July 2020 and trading sideways.

I’d be tempted with a long should the stock break out from 14p and intend to keep an eye on the next set of results.

- Bushveld Minerals (BMN)

- FTSE 250 (MCX)

- Facilities by ADF (ADF)

Bushveld Minerals (BMN)

I’ve taken a starting position in Bushveld Minerals. Why? The fundamentals have changed significantly and the price has not.

Now, there is never any guarantee that the disconnect closes but my belief is that ferrovanadium will continue to rally and drag Bushveld’s price with it.

If you’ve been around a while then you’ll know that Bushveld had a huge rally in 2018 only to come back down to earth with a bang.

Basically, for whatever reason, the commodity went from $22 to as high as $128 in less than a year.

Naturally, when the commodity a stock produces more than quintuples, then the stock will often follow.

I traded Bushveld several times as it was showing all the signs of a stage 2 stock.

But again, for whatever reason, the price of ferrovanadium collapsed and so did Bushveld.

Here’s the chart:

Source: SharePad (1 month free data worth £69 here)

Notice how the recent price action shows signs of heavier volume.

And ferrovanadium is on the move too at $62 – levels not seen for over three years.

Bushveld is increasing its production of vanadium too – and at these levels it’s delivering strong cash flows.

The company is aiming to produce between 4,200 and 4,400 mtV for 2022, with the production goal rising next year to around 5,000 mtV as described in the interim results.

Production cash costs for both Vanchem and Vametco were $30.6 and $24, so at these levels Bushveld has a healthy margin.

I’m looking to add to my position on the breakout at 15p.

Positives:

- Looks like an early uptrend

- Fundamental strength with risk to the upside on ferrovanadium prices

Negatives:

- Already a tight market – reduction of supply could see demand destruction

- Reliant on a high ferrovanadium price

FTSE 250 (MCX)

This is the first index to be featured in Buy The Breakout.

The FTSE 250 contains more domestic companies and less commodity companies. It’s more of a bellwether for UK stocks, I believe, as the FTSE 100 is heavily weighted towards stocks like BP and SHEL.

I’ve noticed that on the FTSE 250 the 200 EMA has historically been support.

We’re trending below that now.

Source: SharePad (risk-free trial and 1 free month on me here)

If the FTSE 250 rallies towards the support-turned-resistance, I’d wait for the stock to get above it then open a small short.

The advantage of shorting an index is that you can the short exposure yet the risks are much lower. For example, if you’re short a company and a bid comes in, or a piece of sector news comes to lift the stock up, you can be on the wrong side of a big move quickly.

By shorting the index, you’re shorting a basket, so this risk is mitigated.

I’ve not much of an indices trader, but I noticed that instead of shorting 30+ stocks in the Covid crash, I could have added to my returns greatly just by shorting the FTSE 100/FTSE 250.

So I now watch the main indices each night just to see if the chart ever looks ripe.

Buying above the resistance means I’m closer to the point at where I’m wrong – the danger zone.

Positives:

- Small spread

- Decreased risk of getting stung

Negatives:

- Not reliant on any one stock

- No idea what drives the FTSE 250

Facilities by ADF (ADF)

Facilities by ADF is one of the few recent floats that has come strong out the blocks.

The company is a provider of premium serviced production facilities to the UK TV and film industry.

By hiring out facilities it provides its services to some of the world’s biggest traditional and on-demand content production companies.

The client list is relatively prestigious (although this is a vanity metric – big names don’t always pay well and on fair terms): Netflix, Sky, BBC, ITV, Disney, HBO, and Apple, amongst others.

However, it’s a strong chart:

I’d be interested in taking a small long position for a trade if the stock can break out of the 83p level.

I’ve not yet researched the company in huge detail, but I’ve added the company to my watchlist having spotted the chart.

Positives:

- Already uptrending

- Trading ahead of expectations as per recent trading update

Negatives:

- It’s SETSqx so market maker driven

- Recent float so untrustworthy

- Dekel Agrivision (DKL)

- Pharos Energy (PHAR)

- Shorting punter favourites that will need capital

Dekel Agrivision (DKL)

Dekel Agrivision has featured in Buy The Breakout before. But the buy case has now materially changed and the stock is right below resistance.

Therefore, I’m including it again so it’s on your radar.

I’m long this stock having bought last week, and the reason for this trade is simple.

CPO prices.

These are pushing close to €1,800 – double Arden’s forecast for the year of €900.

With prices starting at €1,242 in the year my belief is that Dekel Agrivision is on track to beat these forecasts comfortably.

It’s true that the international CPO price is not the price that DKL gets.

However, the drivers for palm oil are clear.

The lack of sunflower oil supply from Ukraine has sent buyers to panic buying palm oil instead.

And even though the CPO market is almost 4x bigger than the ~$18.5 bn a year sunflower market – the key is that 75% of the world’s supply comes from Ukraine.

That means there is now a huge deficit in the market.

This is Economics 101.

Supply and demand.

When supply tightens, demand must increase.

Dekel is already trading on an expected EV/EBITDA of 4.8.

It’s growing, and the chart is now backtesting a breakout.

Basically, we’ve had a year of consolidation for the placing to digest.

Anyone who took the placing and wanted to sell has had plenty of time to do so.

Plus, there was a record volume day last week and the number of shares swapping hands is still high.

I am long and hopeful we see a breakout and a trend begin.

I could be wrong, but with the stock being cheap and there now being a material driver I think the risk/reward strongly favours the upside.

Positives:

- Clear uptrend

- Fundamental strength

Negatives:

- Illiquid

- Reliant on a high CPO price

Pharos Energy (PHAR)

I don’t know much about this company other than it operates in some exotic locations: Egypt, Vietnam, and Israel.

Most of the company’s revenue comes from Vietnam.

However, this to me would be a pure chart play.

The stock is breaking out of a long base built in 2021.

If the stock retraces, then you can get a far better trade entry than you can on the breakout.

Why?

Because buying the breakout retrace means you can buy closer to the danger zone.

The danger zone is the point at which we’re wrong on the trade.

Think about it.

If you buy at 30p (OK – only amateurs buy round numbers but bear with me) and your stop is 27p that means you’re risking 3p on the trade.

But what if you’re buying at 28p and your stop is 1p?

That means you’ve just decreased your risk by 66%.

And you’re getting more bang for your buck.

This is why you absolutely should be looking into the breakout retrace if you’re trading breakouts.

I don’t hold but it’s worth keeping an eye on.

Positives:

- SETS traded

- Strong oil and gas prices

Negatives:

- Poor history

- Operates in far away places

Shorting punter favourites that will need capital

Any stock that isn’t cash generative is reliant on funding.

And that funding is entirely dependent on sentiment.

When market sentiment drops, companies find it difficult to raise money and generate interest.

Naturally – when everyone is having fun and stocks are going up – companies don’t have any issues.

But spook the market and suddenly this is a problem.

Even though that the market has fallen – if you know a company needs cash then shorting it can be a good strategy.

However, most of these companies can be promotional.

So be careful.

All a stock needs is one good promotional RNS to get a spike.

If you’re going to short stocks like this then you need to keep an eye on liquidity.

And if you have any good short ideas – message me!

Positives:

- Catalyst for price to move down

- When punters get scared they all run for the exit

Negatives:

- Most of these stocks are illiquid

- One promotional RNS can cause a spike

- Some punters will never sell which sees prices stay elevated

- The Works (WRKS)

- R. E. A Holdings (RE.)

- OnTheMarket (OTMP)

The Works (WRKS)

The Works is an omnichannel retailer with its main presence in the UK. It sells books, jigsaws, and a whole range of other stuff that’s always reduced.

You never know what you’re going to get in The Works, which I suspect is part of the magic. It’s a treasure trove of goodies – a bit like the middle aisle in Aldi where you could find almost useless garden tools or a brand spanking new coffee machine at 50% off.

The company has been on my radar since November 2020.

It put out a great RNS in the backdrop of an uncertain environment.

The stock saw a quick jump and rally, but notice how the volume was much higher after the RNS than before it.

This was a sign of interest from other players in the market.

Since then, the stock has been in a stage 2 uptrend, offering plenty of breakout trades on the way.

I’m now looking for another trade here on the breakout of 52-week highs.

The stock recently posted an update where the company announced it’s trading ahead of expectations and pre-pandemic levels.

That last part is key.

The stock was a dumpster before the pandemic – so has something changed?

If the business is ahead of what it was doing prior to the pandemic, then there could be more to come from The Works.

The stock gapped up on that recent trading update and the price has stayed elevated.

So regardless of what I think, it’s clear the market is taking a view on this.

I think there could be another trade once the stock breaks out of that 73p high.

Stocks are for buying and selling, and that’s all I’m interested in for The Works.

This is not a high-quality business. It’s unlikely it ever will be.

But if the setup presents itself then I’ll trade it.

Positives:

- A clear stage 2 uptrend

- Stock trading ahead of expectations and pre-pandemic levels

- Relatively strong balance sheet with no funding required

Negatives:

- It’s a retailer that struggled pre-pandemic – what has changed?

- Reasonably illiquid

R. E. A Holdings (RE.)

R E A Holdings cultivates palm oils in Indonesia with the production of crude palm oil (CPO) and crude palm kernel oil (CPKO).

It’s a company similar to Dekel Agri-vision (DKL) but unlike DKL which is trending sideways, RE. is already on the move.

Here’s the chart.

We can clearly see the stage 4 downtrend, transitioning into a long stage 1 base, before breaking out and beginning its ascent into a stage 2 uptrend.

This is why zooming out on the chart to see the bigger picture is always helpful. Small moves that look significant are shown to be noise in the grand scheme of things.

Here’s the base in more detail.

The stock traded sideways for well over a year, and prior to breaking out it was trading above all moving averages.

I should’ve done better here, because my alert for the breakout went off and I didn’t trade the stock because the spread was too wide.

The stock is up over 100% from this level and recently we’ve seen a pullback.

I’ve not looked too deeply into the company but CPO prices are significantly higher (which is also why DKL is on my watchlist).

The company logged average CPO selling prices of $696 in 2020 in the half-yearly report from last June.

Prices are currently in the $1,000-$1,200 range and so I would expect EBITDA to be significantly higher.

As for profit, it doesn’t matter to me.

The stock is clearly moving because of a catalyst. Whether the stock is profitable or not isn’t what’s important.

Remember what Paul Tudor Jones said: “At the end of the day your job is to buy what goes up and sell what goes down, so why does anybody give a damn about PEs?”

Paul Tudor Jones has done all right for himself. So I think I’ll listen!

Positives:

- Cup and handle forming

- SETS traded so can leave orders on the book

Negatives:

- Operates in a faraway land

- Reliant on high CPO prices

OnTheMarket (OTMP)

I’m pretty sure OnTheMarket featured in January 21’s Buy The Breakout.

And I’m still waiting for it to hit break out of its range.

Here’s the chart.

We can see it’s spent the entire year going nowhere.

This is why you need to have a damn good reason for buying stocks that haven’t broken out.

If you bought it in January 2021, you’ve now been holding it for an entire year, are probably bored to tears, and had your capital tied-up.

Timing your buys is important. Buy too early and you could be sat waiting around or even lose money because the stock isn’t a high probability setup.

It’s far better to buy right than buy cheap.

I know this triggers lots of people but in trading, you need to remove yourself from your emotions and commit to something that works.

And look, if you’ve found buying stocks that are going nowhere works – great! Keep doing it. I’m not telling people what they should do. I’m simply sharing my opinion and what works for me.

I’ve been hugely critical of OTMP in the past (and for good reason).

But with the new chief executive a turnaround has well and truly begun.

Average Revenue Per Advertiser is growing, as is traffic visits and average monthly leads. This should help with the declining number of average monthly advertisers listed.

If enough people check the OnTheMarket website, then this increases the attraction for listings.

And more listings brings more people checking the website, which again sees even more attraction for listings.

It’s a flywheel that works well – if the company can grow it without burning through cash for marketing.

The company’s cash position has actually increased to £10.7 million from £8.7 million – which suggests this is not the case.

That said, what matters to me is the chart.

I’ll let the analysts do the number crunching and I’ll buy the breakout.

Positives:

- Cash flow positive

- Green shoots appearing

Negatives:

- SETSqx traded so illiquid

- Reliant on a vibrant housing market – are people still willing to sell after the Stamp Duty holiday ended?

- Harvest Minerals (HMI)

- FTSE 250 UCITS ETF

Harvest Minerals (HMI)

Harvest Minerals is a Brazilian remineraliser company that produces a product called KP Fertil.

KP Fertil has shown to be a cost effective and superior alternative to fertiliser in various tests and is certified by the Brazilian Ministry of Agriculture, Livestock, and Supply (MAPA).

This is the gold standard and back in 2018 it was expected that this would open the floodgates to sales.

The problem was these sales didn’t materialise.

Around that time, the company raised money at 18p on the basis of a 50kt order of KP Fertil.

I entered this stock in a prior placing at 10p and liquified my entire position into the liquidity created from the MAPA certification news above 20p.

I believed that the company would need to place in order to ramp up production.

At the time, this seemed a fair price backed heavily by Brian McMaster.

But the sales didn’t appear and the price started a long fall.

I’ve marked an arrow from the day of the placing.

It also appeared that despite Brian’s vote of confidence, he was able to recoup this plenty of this investment through excessive consulting fees paid directly to his company.

Nice work if you can get it!

Unlike other stock commentators who get paid by the company, I don’t accept money from anyone which means I’m free to say anything I like.

And the truth is I don’t trust Brian McMaster.

Not only has he been earning a handsome wage for not delivering but the expectations set by the company were so out of whack with the reality delivered that it’s difficult to believe a word he says.

On a recent podcast, he’s suggesting that in 12 months the company could potentially be paying a dividend.

The problem is we heard that four years ago.

And whilst it’s fair to say that the company lost a year due to a Covid still the trust is now non-existent.

The good news is though that this is reflected in the share price and offers a potential opportunity.

The market was heavily excited about the 50k order at 20p yet Harvest announced in October 2021 that it had beaten its 80kt sales target two months ahead of schedule.

Here’s the chart from the start of 2019.

The stock fell 90% from the placing at 18p but since then has built a base.

The stock has now pushed through into prices not seen since 2019.

I’m long a small position here because I see this as a significant breakout.

McMaster says that no placing is needed (although I can’t reconcile that statement with the accounts) and that the company is profitable at 40kt of product sold.

I would expect this to be cash earnings and net profit, but McMaster has said the company is targeting at least 100kt next year with the official numbers due to be confirmed this month.

The product sells at 200R$ per ton.

100,000 tonnes is $3,548,618 in revenue.

Looking at the 2020 income statement, I struggle to see how even at 100kt the company will be profitable.

The gross margin is 63.6%.

Apply that to 100kt and we get $2,256,921.

If we assume all costs are the same and don’t increase (unlikely) then that leaves the company loss-making by more than $2 million.

This contrasts quite differently to McMaster’s own words: “We’re selling in excess of breakeven [40kt]. We’re making profit. Full stop.“

He also says that it’s difficult to get a true picture of how the company is performing from the audited accounts, so who knows?

Maybe I’m wrong here as McMaster did say only last month that the company doesn’t need funding, but I think there is a placing risk here.

I’m long because of the chart but I think caution is needed.

Don’t forget the currency risk either as the Brazilian Real Harvest operates in has performed poorly against the US Dollar that the company reports in.

Positives:

- A simple product that is dug up and bagged

- Over a 100 year life of mine at 400kt of production

- The company is making inroads with increasing sales

Negatives:

- Board that has failed to deliver what it promised

- Executive Chair that can’t lose due to remuneration

- Potential placing coming

FTSE 250 UCITS ETF

You’re probably surprised to read about an ETF in a trading article.

But I’ve had a few questions recently regarding funds.

Personally, I don’t buy funds.

I prefer to actively manage my own capital.

But if I wanted to outsource my investing, here’s what I would do.

- Open a Vanguard Stocks & Shares ISA

- Buy FTSE 250 UCITS ETF

- Consider buying S&P 500 UCITS ETF

- Drip feed through direct debt all year with my ISA allowance

These funds charge low fees because they’re passive.

That means you’re not paying someone a high fee for them to mostly fail to do the job they’re supposed to do and beat the market.

It’s odd because financial services seem to be the only place where you can fail and still get paid well.

That’s because so many people want to beat the market, they’ll take the risk and pay a lot to try and do it.

But the best thing to do is not to buy actively managed funds but to just buy trackers and sit tight.

Back in 2008, Warren Buffett made a $1m bet that over ten years the Vanguard S&P 500 index fund would beat a portfolio of high-cost hedge funds picked by Ted Seides.

Seides conceded defeat a year early – here are the results.

Not a single fund bested the index.

Buying your own stocks is fun. But buying your own stocks takes time.

Owning a tracker fund is less time-consuming, less stressful, and potentially the more profitable option for some people.

How to find the best stocks to invest in right now?

To understand the best UK stocks to invest in we need to understand that there are two markets in the UK.

There are FTSE stocks (Main Market) and also the Alternative Investment Market (AIM).

Main Market stocks have tighter regulation and can be considered safer, but this can be a hindrance for growth. This market contains the largest companies in the UK and these tend to be companies with strong business models and established cash flows. Stamp Duty is paid on Main Market stocks.

The market capitalisation for companies on AIM tends to be much smaller as these are typically small-cap companies. Retail investor accounts are more attracted to these because of the higher upside. However, these companies often do come with high risks.

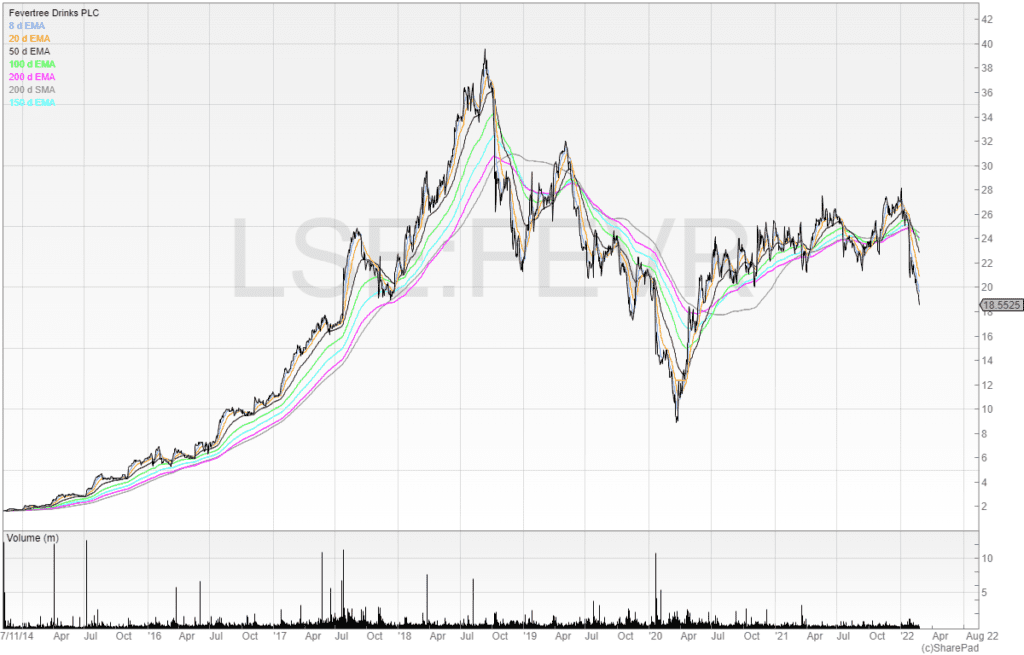

Here is a company that was a successful investment from its IPO: Fevertree.

Fevertree is an asset-light company because it’s a brand. The company outsources all of its production and instead invests capital in marketing and selling the product.

This means that there are no large capex expenditures on purchasing and maintaining machinery and profits were reinvested for growth.

We’ll look at finding hidden winners later on in this article.

Should I invest now?

Investing is a long term business and the best time to start was yesterday. However, the next best time is now to give yourself as much time in the market as possible.

That said, investing depends entirely on your own personal financial situation and goals.

If you might need the capital within five years, then investing may not be suitable for you. This is because financial markets including stocks can go up and down. Needing to withdraw the money when the market is weak could mean you get back less of what you originally invested.

Many markets can appear overvalued and make it difficult to commit.

One way of getting around this is to use a method called ‘Dollar Cost Averaging’.

What is Dollar-Cost Averaging?

Dollar-Cost Averaging is an investment strategy whereby investors divide up the total investment across a specific period of time. This has the advantage of reducing volatility on the investment.

For example, if we were to buy a stock all in one go and then the stock fell -20%, we would not be able to take advantage of the dip.

However, if we used dollar-cost averaging, then we’d be buying the stock every month regardless of the stock’s price and smoothening our average.

Dollar-Cost Averaging is effective for long term investment strategies such as committing a portion of your salary to the stock market. It means you don’t need to time the market because every month you’re investing the same amount of money.

Dollar-Cost Averaging is popular with index tracker fund ETF investors.

How to find stable investments?

Investing in stocks can be a tricky business. This is because there are an endless amount of mistakes one can make if you don’t know what you’re doing.

However, we can reduce our investment risk by finding stable investments.