Looking to grow your wealth through passive investing? With many index tracker funds on offer, it can be challenging to choose. FTSE 100, FTSE 250, S&P 500, Global All-Cap… Which is the best index tracker fund for you?

In this article, I will outline the three best tracker funds available in 2023. You will learn:

- Exactly what each fund is

- Why they are the best funds to invest in

- The potential returns you could make

- Where you can find the cheapest deals

But first, let’s explore what tracker funds are and why you should invest in them.

What are index tracker funds?

Index tracker funds are collective investments that track the movement of a broad market index, such as the FTSE 100 or the S&P 500. Tracker funds allow you to diversify your portfolio by spreading a single investment over many different companies and countries at once.

If you’re getting started in investing and not sure where to start, click the button below to receive my free my free ebook (and other bonuses) on consistently profiting from the stock market.

Why you should invest in an index fund

Investing in stocks and shares has been historically proven to build wealth and help people become rich. Many people mistakenly believe that they can get rich by saving prudently and cutting back on their expenses.

Whilst reducing expenses and keeping lifestyle creep in check does indeed help, there are only so many costs to be cut and doing so can lead to a very basic and simple life when taken to the extreme.

However, cost-cutting is limited, whereas the upside in investing is not limited at all. There is no maximum amount that can be made in stocks, and with compounding, this only serves to amplify our wealth.

Therefore, cash is not an attractive option for savers. The interest rate is currently below the rate of inflation, which means cash is slowly eroding year on year and becoming less valuable.

Savers are punished for keeping their hard-earned cash in a bank account, and the only other options are to either spend it or invest it. As spending cash doesn’t build wealth, the only real option is investing.

By investing, you are able to take advantage of the value created by some of the world’s best companies and beat the rate of inflation.

Cash in savings accounts is great for an emergency fund. But to fulfil a long-term investment goal like funding your retirement, consider buying stocks. The more distant your financial target, the longer inflation will gnaw at the purchasing power of your money.

Suze Orman

Choose your index funds wisely

One common mistake is to have lots of overlap between several funds. For example, someone buying a FTSE 350 fund and a FTSE 100 fund would be paying fees for two tracker funds that are greatly similar.

The FTSE 350 is heavily weighted towards the FTSE 100 and so having an extra FTSE 100 fund is not the most economical in terms of fees paid.

Below, we’ll look at three tracker funds UK investors should consider investing in. The two main ETF and index tracker fund providers are iShares (owned by Blackrock) and Vanguard – all three funds are from these providers.

Best index tracker funds to invest in 2023

- FTSE 100: iShares Core FTSE 100 UCITS ETF (ISF)

- FTSE 250: Vanguard FTSE 250 UCITS ETF (VMID)

- S&P 500: iShares Core S&P 500 UCITS ETF (CSPX)

Use the links above to jump to each index fund.

FTSE 100 tracker fund

The FTSE stands for the Financial Times Stock Exchange and is a share index of stocks in the UK. The FTSE 100 consists of the 100 largest UK stocks in terms of market capitalisation on the London Stock Exchange (LSE).

The market capitalisation is the total value of a company that is traded on the stock market, which is calculated by multiplying the total number of shares in issue by the current share price.

Many well-known companies are listed here, and the FTSE 100 consists of:

- Banks (Barclays, HSBC, Lloyds, Royal Bank of Scotland)

- Housebuilders (Persimmon, Taylor Wimpey, Barratt Developments)

- Pharmaceuticals (AstraZeneca, GlaxoSmithKline)

- Telecommunications (Vodafone, BT), and even

- Retailers (JD Sports, Kingfisher, Next).

Why should I buy a FTSE 100 tracker?

The FTSE 100 is an index fund that consists of ‘blue chips’ (the blue poker chip is the highest value chip on the table) that are mature companies and industry stalwarts. These companies are safe, stable, profitable, and often pay dividends to their shareholders.

Buying a FTSE 100 tracker is not going to make anyone rich overnight, but these stocks are well diversified and owned by institutions and pension funds. It is pedestrian growth but considered low risk.

By owning 100 companies, the impact of any stock going bust overnight is severely reduced. The FTSE 100 index also has a quarterly shuffle – where the three lowest value stocks are demoted into the FTSE 250, and the highest value stocks in the FTSE 250 are moved into the FTSE 100.

This is exactly the same as relegation from the Premiership and promotion from the Championship in football.

You should buy a FTSE 100 tracker if you want low risk returns, as these businesses are often solid with strong and dependable cash flows.

The FTSE 100 tracker is not an index to track for those willing to take on more risk in search of returns, as historically it has underperformed the US’s S&P 500.

Therefore, you should factor this in when making your own decisions as everyone’s investment goals are different and you must do what is right for you.

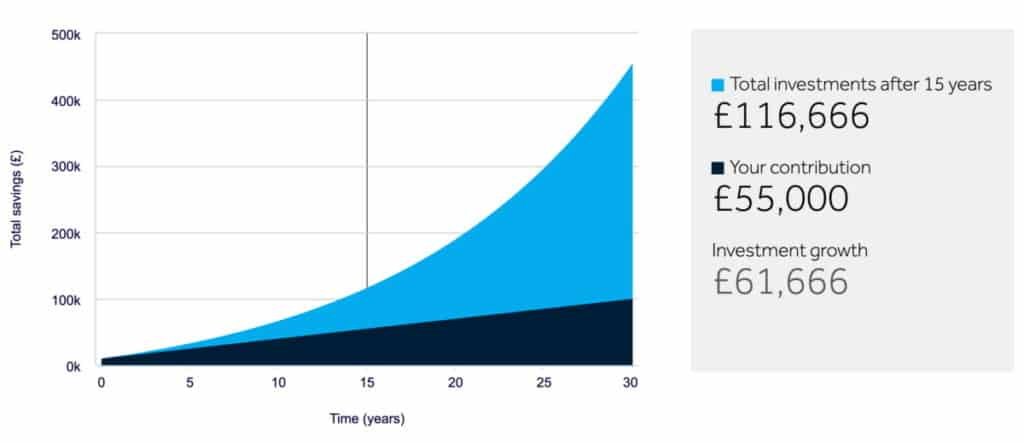

How much can I make buying a FTSE 100 tracker?

A study done by AXA Self Investor found that a passive investment over a 10-year period in the FTSE 100 had a 95% chance of success. The average return was 70% gain (assuming dividends were reinvested).

The study covered two decades from February 1996, and included two of the worst stock market crashes in history: Dotcom and the 2008 Financial Crisis.

The Dotcom bubble was a period when US technology companies rapidly rose due to the internet. Companies that did not make any profit or even revenue were valued at sky-high valuations on the assumption that the internet would make these companies rich.

After excessive speculation, eventually, the bubble burst, leading to one of the biggest stock market recessions in living memory.

The 2008 Financial Crisis was caused by the subprime mortgage market in the US, which spread into an international banking crisis with the collapse of Lehmam Brothers. It was considered the worst crisis since the Great Depression (Wall Street Crash of 1929).

The largest 10-year return in the FTSE 100 was 154%, and the lowest return was a loss of 14.5%. This was the period from February 1999 (just before the Dotcom bubble burst) and February 2009 (when the world was deep in recession from the 2008 Financial Crisis). However, out of all possible 120 periods – only six of them were losing periods.

None of these periods included additional deposits, such as dollar-cost averaging (DCA). This is an investment strategy that continues to buy the same monetary value on a regular basis in order to gain increased exposure and reduce the impact of volatility on the total purchase.

It also means that when prices are weak the investor is able to buy more units for the same amount of money.

Another strategy that can be used that wasn’t included in the study is a contrarian strategy. This is when an investor sees that prices are weak and decides to take advantage by purchasing more units than usual in order to bring the average cost down even further.

Though there is no guarantee of an index returning to a previous high, contrarians have often been handsomely rewarded for buying weakness in indexes.

Here’s a chart of the FTSE 100 since the start of 1998 taken from SharePad:

We can see the bursting of the Dotcom bubble in the early 2000s, and the Great Financial Crisis of 2007 with the market bottoming in 2009. The index has tended to trend sideways, but with dividends reinvested in the tracker this has compounded the gains.

Best FTSE 100 tracker to buy

The best FTSE 100 tracker to buy (in my opinion) is the iShares Core FTSE 100 UCITS ETF (ISF). This comes recommended by Investors Chronicle – a publication from the Financial Times).

This ETF’s annual fee is just 0.07%, and so investors can gain exposure to the top 100 companies in the UK for an extremely low cost.

The iShares Core FTSE 100 UCITS ETF (ISF) can also earn extra returns for investors because it lends out securities it owns to short sellers for cash.

Investors in this ETF also earn dividends generated from the FTSE 100 index, as this index is full of industry titans and the more stable businesses. However, dividends are never guaranteed and can also be cut in times where businesses are cutting costs.

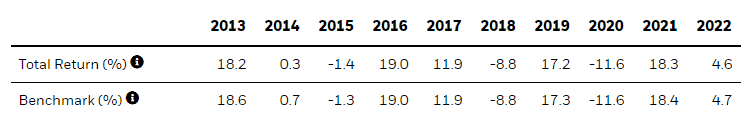

Here is the performance of the iShares Core FTSE 100 UCITS ETF, taken from the iShares website:

We can see that the ETF is only a few basis points either way of the benchmark, sometimes performing slightly better too.

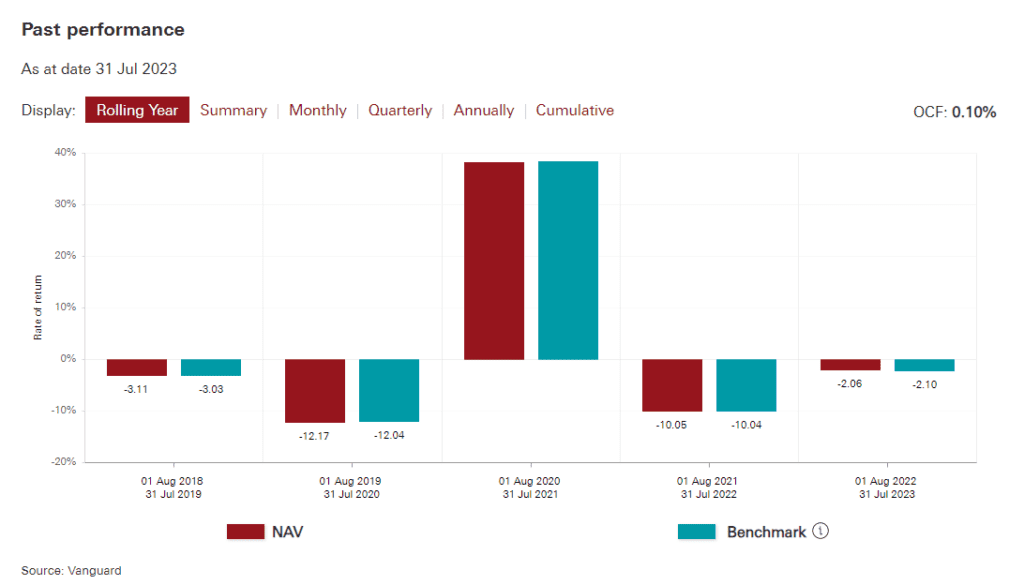

Here is the performance of its competitor, the Vanguard FTSE 100 UCITS ETF (VUKE), taken from Vanguard’s website.

Again, the fund is only a few basis points away from the benchmark FTSE 100 index, but the ongoing annual charge here is 0.09%. The iShares Core FTSE 100 UCITS ETF (ISF) is just 0.07%, hence why it is my top pick.

Both of these ETFs are available to buy in Individual Savings Accounts (ISAs) meaning that all profits realised from these ETFs are tax-free.

For my ISAs and investing platform, I use IG Index and Hargreaves Lansdown.

FTSE 250 tracker fund

The FTSE 250 is a stock market index that consists of the next 250 biggest stocks in terms of market capitalisation on the London Stock Exchange after the FTSE 100.

When a stock is demoted from the FTSE 100 it ends up in the FTSE 250, and vice versa.

The FTSE 250 is also a more domestic index than the FTSE 100.

Whilst there are many companies that operate globally and are multinational corporations (such as Aston Martin, Britvic, Dominoes, PZ Cussons), there are plenty of companies that operate solely in the UK with little to no international exposure.

Some examples of FTSE 250 companies are retailers (Dunelm, Dixons Carphone, WH Smith, B&M, Marks & Spencer), leisure businesses (Cineworld, Dominoes, Greggs, 888, Wetherspoon), food and beverage businesses (Britvic, Tate & Lyle, Barr), and many more.

The FTSE 250 has generally performed better than the FTSE 100 due to the amount of businesses that are smaller and therefore are able to grow quicker.

However, these smaller businesses are often less established than the FTSE 100.

Why should I buy a FTSE 250 tracker?

A FTSE 250 tracker is ideal for the investor wanting UK exposure who is seeking larger returns than the FTSE 100 and is willing to accept a higher risk in return for those potential profits.

The FTSE 250 has historically performed better than the FTSE 100. Although the past is no guarantee of future performance and returns, smaller companies are often quicker to adapt and grow.

They’re also more likely to run into potential problems, but the FTSE 250 index features many companies and so risk is well-diversified across 250 companies.

How much can I make buying a FTSE 250 tracker?

The FTSE 250 has tended to deliver higher returns to investors than the FTSE 100.

This is because smaller companies in the UK are featured and so are focused on growth rather than paying out dividends.

Here is a chart of the FTSE 250 index since the start of 1998 taken from SharePad.

We can see there is a much stronger upwards trend and a smaller trough in the Great Financial Crisis 2007.

Best FTSE 250 tracker to buy

The iShares FTSE 250 UCITS ETF has an ongoing charge of 0.4% and also benefits from lending out securities. However, this time it is its competitor product by Vanguard that is recommended by Investors Chronicle.

The Vanguard FTSE 250 UCITS ETF (VMID) has an ongoing charge of 0.1% which is the cheapest. Again, always look at the charges before buying an ETF or index tracker fund.

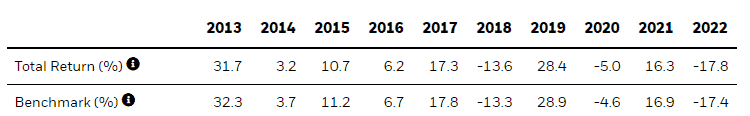

Here are the returns generated by the iShares FTSE 250 UCITS ETF, taken from the iShares website.

We can see that the returns are more volatile than the FTSE 100 both to the upside and downside. For those investors who are thinking long term, this may be an acceptable risk in search of higher rewards.

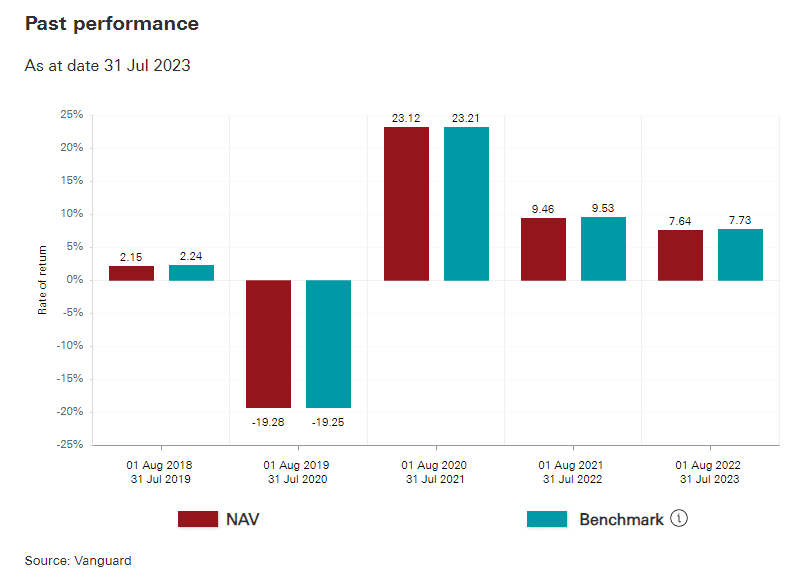

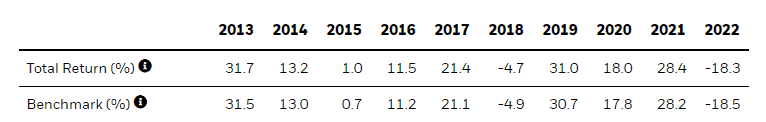

Here are the returns generated from the Vanguard FTSE 250 UCITS ETF (VMID)

The returns in comparison to the benchmark are very close for both funds; however, Vanguard has a 0.1% annual charge against the iShare’s ongoing charge of 0.4%.

S&P 500 tracker fund

The S&P 500, or the Standard & Poor’s 500 index, is a US stock market index of the largest 500 companies listed in the US.

The US has produced some of the best shareholder value creating companies on the planet, such as the FAANG stocks (Facebook, Amazon, Apple, Netflix, Google), and the S&P 500 is well diversified by holding 500 companies in the index.

Why should I buy a S&P 500 tracker?

Investing in the UK economy is a good idea for people who reside in the UK, but it is not the only place in the world to find quality shares and take advantage of the stock market’s wealth-building power.

The FAANG stocks are all listed here, alongside some of the world’s most iconic brands (American Express, The Coca-Cola Company, Walt Disney, Walmart, McDonald’s).

Any investor wanting exposure to global tech behemoths and quality global brands that have stood the test of time, as well as exposure to up-and-coming stock market winners that make the top 500 US stocks should consider buying an S&P 500 tracker.

How much can I make buying a S&P 500 tracker?

The S&P 500 has historically been the strongest performer out of the three indices in this article due to its heavy technology focus.

As mentioned, the FAANG stocks are listed here, as well as sector-dominating companies such as Microsoft, Mastercard, Proctor & Gamble, and Adobe.

Here is a chart of the S&P 500 since 1998 from SharePad:

We can see that after the US market bottomed in early 2009 the S&P 500 went onto triple in value and more.

The S&P 500 is a popular market tracker because of its historic performance as an index. Whilst that does not mean the future will be equally as bright, an investment into the S&P 500 is an investment in the best publicly traded companies in the US economy and stock market.

Best S&P 500 tracker to buy

For the 2023 selection of Exchange Traded Funds (ETFs), Investors Chronicle recommends the iShares Core S&P 500 UCITS ETF (CSPX).

This is the cheapest tracker at 0.07% and is the largest, most liquid, and also the best tracking ETF which follows the S&P 500 index.

Looking at the performance, we can see that the tracker has slightly outperformed the benchmark every year.

Frequently asked questions

What is an ETF?

An exchange traded fund (ETF) is a type of security that involves a collection of securities. An ETF tracks an underlying index.

For example, a FTSE 100 ETF would be an ETF that closely tracks the FTSE 100 index. However, ETFs can invest in any amount of sectors and use different strategies.

Are tracker funds safe?

All equities carry risk of loss. Risk is inevitable when seeking profits; however, this risk fluctuates depending on the security.

For example, an investment portfolio in a single stock carries a lot of unsystematic risk, or specific single company risk. This is different from a portfolio invested in a single ETF or tracker fund that tracks an index or a basket of stocks and sectors.

It would be wrong to classify any security as safe because it is a subjective term (property investors consider property “safe” – yet what happens when the housing bubble pops?), but tracker funds can be classified as low risk compared to single stocks because of the diversification.

To lose all of your money in a FTSE 100 tracker, then all 100 companies in the FTSE 100 would need to go bust at the same time.

Can you lose all your money in an index tracker fund?

Technically – yes. Although it would be difficult. If you own an S&P tracker fund then all 500 companies in the US would need to go bust at the exact same time. Is it possible? Definitely. But is likely? No.

In the event of a nuclear war or any other extinction level event, then it’s likely stocks would fall but that may not be the most pressing of your issues.

Are tracker funds worth the fees?

Absolutely! Most funds that are managed by a fund manager charge high fees with the goal of beating the market and their respective benchmarks. Sadly, most managed funds fail to achieve their goal (but they still collect their handsome fees).

Tracker funds are low cost because they aren’t managed, they’re passive funds (as opposed to active funds), and instead passively track the indexes they are supposed to track. This means one gets exposure to the stock market in a low risk manner without paying the expensive fees.

How much should I invest?

This is entirely up to you and your family’s situation.

Personally, I would not recommend anyone to invest if they thought they might need the money in less than two years.

This is because nobody can predict what the market will do in the short term, and anyone who finds they need access to capital at a time of market weakness may not receive an amount they’re happy with.

Investing money that you are certain you won’t need for five years is a good idea.

As Benjamin Graham, the father of value investing, famously said: “The stock market is avoting machine in the short term, but a weighing machine in the long term”.

The longer your timeframe, the higher your chances of profitable returns.

Which best UK index fund is the best?

I would go with the FTSE 250 because the FTSE 100 is full of low growth stuffy old economy stocks. The FTSE 250 has more growth companies and for this reason is a better option for those searching for capital growth (not income) in my opinion.

Therefore, I would go for the FTSE 250: Vanguard FTSE 250 UCITS ETF (VMID).

Where can I invest in stock market trackers and ETFs?

Trackers and ETFs can be bought in Stocks & Shares ISA accounts.

The benefit of utilising one’s ISA allowance is that all profits generated in the account are tax-free. Therefore, if you are fortunate enough to ever have profits of £1,000,000 in an ISA account – all of this money comes free from capital gains tax. UK taxpayers have a £20,000 annual allowance per tax year and this cannot be rolled over. Therefore, the first rule of ISAs is use it or lose it.

I use both IG Index and Hargreaves Lansdown for my Stocks & Shares ISA accounts.

Passive index fund investing (conclusion)

One of the great advantages of indexing is that to lose all of our money, all of the companies in the index would be required to go bust at exactly the same time.

Other countries have their own index, and plenty of ETFs exist (exchange traded funds) that offer exposure to certain sectors, global exposure, or commodity exposure. They will offer a basket of securities in order to diversify the fund and achieve their stated goal.

For example, a global income fund may have stocks that have strong and predictable cash flows from large companies across the world, and it may even include housing exposure in order to benefit from the rental income.

This ETF would prioritise income rather than capital appreciation. Debt may also be included as that offers a steady yield.

An oil-based ETF would include securities that are in or focussed around the oil sector. There are many to choose from and an ETF or tracker to suit everyone’s investment profile and risk.

It is worth noting that I am not a financial adviser and I am not regulated by the Financial Conduct Authority. I am not legally allowed to give financial advice and this post is for educational purposes only. It is not (nor should it be intended as such) investment research.

I trade and invest my own capital for a living and this website consists of my experience and opinions. Everyone has different risk appetites, investment horizons, and portfolio sizes, so what is best for me may not be best for you.

I also believe in full transparency and so there are affiliate links to products and ISA accounts that I use included in this article where I may receive a commission.