CFDs are contracts for difference that offer leverage. Many traders are excited by leverage as it magnifies profits but forget that it also amplifies potential losses.

The reason that most traders lose when trading these products is due to a lack of understanding. This is further compounded by not having a clear strategy.

This article will explain how to use various tools and tactics in order to develop a profitable CFD trading strategy.

10 CFD trading strategies and tips for 2021

- Understand how CFDs work

- Backtest a trading strategy

- Check your CFD exposure

- Manage risk with stop and limit orders

- Use iceberg orders

- Keep a watch on trading liquidity

- Monitor your trades

- Do not add to losing trades

- Familiarise yourself with the demo account

- Keep a log of your trades

1. Understand how CFDs work

Before trading CFDs (Contract For Difference) it’s important to understand how CFDs work.

CFDs are leveraged products and so must be used with caution. The main differences between CFDs and spread betting is that unlike spread betting CFDs are subject to Capital Gains Tax (CGT), and CFDs benefit from Direct Market Access (DMA).

CFDs work by mirroring the underlying asset or financial instrument. For example, if we were to open a CFD on Vodafone plc then we would buy a contract instead of shares. If we were to buy 5,000 contracts in Vodafone at 200p then we would have an exposure of £10,000.

If we then closed our contracts at 210p then the difference in the opening and closing contracts would be 10p.

To calculate our profit then we would take the number of contracts (in this case 5,000) and multiply it by the difference (10p). We would then get a profit of £500 (this does not include opening and closing commission fees which are variable).

Buying CFDs of stocks is exactly like buying the shares only CFDs are traded on margin – meaning they are leveraged. We can also use CFDs to take a short position on a stock whereas with stock we can only go long.

A CFD trader can also trade bonds, commodities, and other securities – not just equities.

2. Backtest a trading strategy

It is essential to have a trading strategy before risking your hard-earned money in the market. Buying stocks because somebody else said so or because it’s in the news is gambling. If everyone is talking about the stock – who is left to buy?

“If shoe shine boys are giving stock tips, then it’s time to get out of the market”

Joe Kennedy

It’s best to find trades yourself and be independent from others. Most traders don’t make money because they aren’t prepared to do the work. If trading was easy, everyone would be doing it.

You can use software such as SharePad in order to backtest historical technical analysis data. You will be able to see how certain strategies have performed and potential pitfalls.

I use breakouts with CFDs for news trading and also use DMA to get in the uncrossing trade.

You can read about trading trend breakouts from my guide to trading breakouts and learn about the uncrossing trade.

3. Check your CFD exposure

CFDs are leveraged and so we must always check our market exposure. This is because we can become far too overexposed and then run the risk of having margin calls.

Margin calls are phone calls we receive from our brokers if we overstep the margin requirements for the positions we hold.

Retail investor accounts are protected from negative equity in leveraged accounts and so they don’t run the risk of losing any more capital than they deposited. However, if you decide to self-certify for a professional account then you have access to more margin and you are also responsible for all losses.

That means if you add an extra ‘0’ to your exposure and press the wrong button and lose £100,000 instead £10,000 – you are liable to repay the £100,000 lost.

Retail accounts have a minimum margin of 20% on all UK shares for CFDs (and also spread bets).

This means with a £50,000 deposit in the account we could have exposure of £250,000!

It’s worth noting that just because you can take such large positions does not mean that you should.

CFDs are excellent for short term trades such as scalping with larger positions using the direct market access capability, but strict risk management should always be employed.

You can use CFDs for long-term trading too, however this will incur an interest cost.

4. Manage risk with stop and limit orders

One way of managing risk is to use both stop and limit orders. As CFDs are leveraged products we can use stop losses on both SETS and SETSqx stocks.

This is an advantage over stock because the SETSqx trading platform is market maker driven and impossible to use stop losses because there is no electronic order book.

With CFDs, we can set price limit targets to bank profit and we can also set stop losses (including guaranteed stop losses with IG) in order to close out losses before they become large losses.

“Those who trade without stops eventually stop trading”

Mark Minervini

5. Use iceberg orders

One advantage of DMA that we can use over spread bets is that we have direct access to the live order book, meaning we can put our orders onto the bid or ask price.

An iceberg order is a specific order that places tranches into the market whilst keeping its fill priority at the set market price. This means that as each tranche is executed another tranche will instantly be reloaded and no other orders jump ahead.

Iceberg orders mean we can disguise our total order in the market. For example, if the average trade size was between 10,000-30,000 shares and we wanted to buy 100,000 shares, then this trade in one go would force the price upwards.

With an iceberg order we can split the order into five tranches of 20,000 and place this onto the bid on the order book. Therefore, nobody can see the true size of the order and we can work this on the book.

A good CFD broker will offer iceberg capability.

6. Keep a watch on trading liquidity

Liquidity is everything. The London market is not known for its liquidity and this can both be beneficial and a hindrance to UK stock traders and investors.

Companies that have market capitalisations of £200 million and above can be surprisingly illiquid. Checking liquidity is a necessity because if the average volumes are thin your trade may have an effect on the price before you’re out of the stock.

Selling into your own flow is going to affect your execution prices and harm your returns. It’s always worth checking the NMS (Normal Market Size) and average daily volume of the stock.

7. Monitor your trades

Monitoring your trades is essential when trading CFDs. This is because CFDs are highly leveraged and many traders lose when trading these products.

When the vaccine news was released into the market on 9 November 2021, I was at my desk and immediately went long a basket of hospitality, leisure, and airline names, which immediately ran into profit.

However, I had forgotten that I was long medical diagnostics stock EKF. Not only that, I had neglected to set a stop loss because I was watching the trade.

But when the vaccine news came I completely forgot about this and the stock slid costing me over £4,000 on the trade.

Here’s the intraday chart of the stock.

A simple stop-loss order would’ve got me out of this long position trade for a small loss and saved me several thousand pounds.

I made it all back and more by getting long the right sectors seconds after the announcement, but this was a needless loss that dented my gains.

Always monitor your trades and more importantly utilise stop losses.

8. Do not add to losing trades

Traders should never average down into losing trades.

If the price and momentum are going against you then that’s feedback from the market that you are wrong.

This can be especially devastating when trading on margin. Remember, leverage magnifies both our wins and losses.

I once averaged down on leverage several times and it was the fastest money I ever lost!

“I did precisely the wrong thing. The cotton showed me a loss and I kept it. The wheat showed me a profit and I sold it out. Of all the speculative blunders there are few greater than trying to average a losing game. Always sell what shows you a loss and keep what shows you a profit”

Edwin Lefèvre

Reminiscences of a Stock Operator

9. Familiarise yourself with the demo account

Demo accounts should always be opened first. This is because it’s important to understand how the platform works and to know your way around it. Before placing a trade with real capital you should always know how the buttons work and the various levers of the platform should anything go wrong.

However, don’t spend too much time on the demo account. Anyone can make money in a demo account because it strips out the emotion from the market. Remember, prices are driven purely on emotion and without putting any real money at risk you can’t experience the real market.

Once you’re comfortable with the platform and opening and closing trades, setting stops and limits, then it’s time to move into the deep end with your trading account and portfolio.

10. Keep a log of your trades

Keeping a log of your trades is important.

How can you expect to improve if you don’t know what you’re doing?

I recommend keeping a trading journal of several things, including:

- Your entry

- Your exit

- Your position size (number of contracts)

- Your stops and limits

- Your target and stop prices

- Your monetary risk

- How you felt when you closed the trade

You can do this using my free trading journal which you can download below.

Conclusion

I have said already but it’s worth repeating: CFDs are complex instruments and most traders lose when trading these products. That means CFDs are high risk.

However, for those that are profitable then it makes sense to take on more risk and leverage in order to magnify your gains.

Remember that transaction costs are typical higher in CFD accounts, and that any high volume day trading strategy will rack up significant commissions for the broker. You need to factor these costs into your strategy.

I use IG Markets as my spread bet and CFD provider, click here to open a free account.

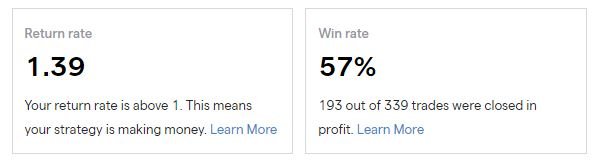

IG Markets offers Trade Analytics – statistics that show the reward ratios that swing traders and intraday traders (day traders) can use.

Here is a sample below.

My UK Stock Trading Course shows how I trade the markets, click the link for more information.