The key difference between fundamental analysis and technical analysis is that fundamental analysis relies on assessing the business’s fundamental qualities and prospects whereas technical analysis relies on studying charts to determine price action.

We’ll go deeper on both fundamental and technical analysis in this article allowing you to make a decision on which you believe is the most important.

What is fundamental analysis?

Fundamental analysis is the study of a company’s financial details. It’s used to determine whether a company would make a good investment based on an assessment of its financial health, potential for profitability, growth prospects, and the value of the company compared to the price of its shares. The focus of this type of analysis are the balance sheet, profit & loss statement, and cash flow statement.

Fundamental analysis can also include a consideration of a company’s ‘story’. To examine a company’s story you look at what it does, how it makes its money, and how it’s positioned to perform in the future given the current economic climate.

For example, you would likely look at the company’s fundamental statements, including the balance sheet, the income statement, and the cash flow statement.

Fundamental analysis example

Below is the income statements from a company called PCI Pal.b

Fundamental investors would look to see if revenue is improving, and if losses are going down/profits are going up.

Fundamental analysis is about how the business is performing and looking at the numbers to identify trends and understand the business’s prospects.

You can learn about valuing stocks and using some of the ratios needed to do so in my article here.

What is technical analysis?

Technical analysis is the study of a stock’s historical price and volume data. Its purpose is to determine which way stock prices are likely to move in the near future.

The stock chart is the weapon of choice for this type of analysis. There are a few different types of technical analysis, but generally speaking, it’s used to evaluate trends, identify significant price levels, and ultimately locate trade entry and exit points.

Technical analysis can also be used to select stocks to trade (these people are known as technical analysts). This is typically the method that most intraday traders (day traders) use when trading stocks.

It’s important to note that both fundamental and technical analysis can be used for long-term investments.

Technical analysis example

Here’s a chart of a stock that I traded purely on technical analysis.

THG gapped up and I bought the stock in the auction through the uncrossing trade. A few minutes later I sold the stock as it rallied into another auction.

INSERT LSE_THG (2)

I captured nearly 10% profit on this trade and I didn’t bother looking at the fundamentals of the business.

Fundamental analysis vs technical analysis

Pros of using fundamental analysis

- An advantage of using fundamental analysis is that it gives investors a good idea of what a company’s future prospects are likely to be and the value of a security. Large institutional investors like to buy shares in companies with good fundamentals.

Cons of fundamental analysis

- One disadvantage of using financial statements used with fundamental analysis is that they can sometimes appear too late. For example, if bad news comes out and the stock has already fallen 50%, you’re getting the news that others in the market clearly knew before you. Technical analysis would’ve given you a sell signal to get you out of the stock.

Pros of using technical analysis

- One advantage of technical analysis is that it’s based on objective data when looking for trading opportunities. You can look at a stock chart and various technical indicators to immediately see which direction the price is moving in, as well as support and resistance levels, and to get market trends and sell signals.

- Based on its volume characteristics, you can also see how popular the stock is.

- You don’t need fundamental analysis to make money in stocks (only technical analysis)

Cons of using technical analysis

- The disadvantages of using technical analysis isn’t interested in the company behind the stock. You may want to know the industry the company is in but apart from that the rest isn’t really significant.

- Technical analysis doesn’t concern itself with things like revenues, cash flows or debts.

- Technical analysis uses past data and present data and doesn’t predict future price movement and price trends can change overnight.

Key differences between fundamental and technical analysis

- Fundamental analysis is more likely to be used by investors

- Technical analysis is the province of traders

- The fundamental analyst will examine company financials, price/earning ratios, capitalisation and a host of other factors to determine what a company’s shares should be worth.

- Technical analysis deals with stock market action without much concern for the underlying causes, whereas fundamental analysis involves research into those causes which will indicate future prices and strength or weakness

The table below sums up the key differences between fundamental and technical analysis

| Fundamental Analysis | Technical Analysis | |

| Function | More suitable for investing | More suitable for trading |

| Used By | Long-term investors looking for intrinsic value in an asset | Traders interested in short term price movements |

| Objective | Determine whether the asset is overvalued or undervalued | Find the best moment to enter or exit the market |

| Application | Mainly stocks, but also works for bonds, derivatives & more | All asset classes |

| Information | Financial statements, balance sheets, press releases etc. | Price and trading volume |

| Analysed Time | Long periods (years or decades) | Short periods (hours, days, etc.) |

That said, some of my best trades over the course of six months to two years have been a combination of both fundamental and technical analysis.

Here’s the chart of XP Factory, where I made a return of over 400% by using both fundamental and technical analysis.

INSERT LSE_XPF (3)

Source: SharePad (1 free month worth £74 on me)

The business had raised money and therefore had enough capital for at least 12 months.

Everyone was terrified of Covid and so the stock was cheap – but if Covid stayed the same as everyone thought it would be during the first lockdown then I would lose 50% of my money at least.

But if not – then I knew the stock was a multibagger.

The model worked and was cash profit positive, and the job of the board was now to roll out of the business model nationwide.

Revenue grew, and the stock price started to move north. I averaged up into the trade several times and exited when the trend was over.

Is fundamental analysis or technical analysis better for day traders?

The answer is both. Good technical analysis will tell you ‘when’, good fundamental analysis will tell you ‘why’. You can use tools like SharePad (1 free month on me worth £74) to supercharge your research.

Technical analysis and chart patterns have the advantage when looking at what the market is going to do in the short term. Day traders look at the actual price movements that are happening and use them to anticipate the next moves.

On the other hand, fundamental analysis involves spending time researching a company’s financial statements. A fundamental analyst may be knowledgeable about a company’s true value after checking all the numbers. However, unless people who are buying the shares right now also share the same point of view, the share price may not reflect the true value that has been calculated.

Investors are prepared to wait out the market fluctuations whereas day traders don’t have the time. They usually rely on technical analysis to show them where to make their short-term profits.

Another advantage of technical analysis is that it’s flexible. It can be applied across different markets and different types of securities including stocks, futures and currencies (Forex). This essentially means that the trader can select what s/he feels are the best markets at any particular time.

An investor will usually want to ‘go long’ – i.e. buy shares of a company in anticipation of an uptrend in the stock. On the other hand, a trader, using technical analysis, may decide that a company’s stock is going to lose value in the short term, and ‘go short’ on the shares.

Technical analysis can be applied across any time frame and day traders typically use time frames that are measured in minutes.

Can they be used effectively together?

Fundamental analysis & technical analysis can be combined to provide a holistic trading strategy. Traders often compare the differences between fundamental and technical analysis. However, combining the two can have positive benefits.

Let’s look at some of the reasons below:

- You can gauge the direction of a trend by simply looking at the price chart. This will indicate whether the market agrees with your valuation or not.

- You can use fundamental analysis to help you build a watchlist of stocks you are interested in and then use technical analysis to decide if or when to buy them.

- Quantitative studies have found that a combination of value and momentum can be an effective method of stock picking. Essentially, stocks trading on low valuations but with strong momentum (you can use momentum indicators to find these) tend to outperform.

- Technical analysis can be used to find favourable entry levels for growth stocks that are in an uptrend. Companies that have high growth rates and trade on high valuations often experience large corrections. In such cases, technical analysis can be used to identify oversold levels. These are often the best opportunities investors will ever get to buy growth stocks.

- Stocks can continue trading higher long after they become overvalued. Selling a stock just because it is expensive often means missing out on a large percentage of a rally. By using price and volume trends you can continue to hold the stock until the momentum is exhausted.

- If a stock is trading close to its fair value, it makes sense for the price to consolidate or trade in its range. While the fundamental picture remains the same, you can use technical methods to trade within the range.

- Fundamental research can sometimes be used to determine which parts of a business cycle are most profitable for a company. Technical analysis can then be used to confirm anticipated trends

- Technical analysis can be an extremely informative technique to analyse markets, but it is important to note that fundamentals do play a role in the broader picture. The above content has provided real world scenarios of combining technical and fundamental analysis.

| Fundamental Analysis | Technical Analysis |

| Market valuation (undervalued/overvalued) | Trade timing (entry/exit points) |

| Good understanding of the market/industry | Can be used on most trading instruments |

| Geared at more longer-term trades | Favours shorter-term trades |

| Extensive research needed | Encompasses all current information |

Tools to use for fundamental and technical analysis

SharePad is the best tool to use fundamental and technical analysis due to the sheer amount of data it contains and its technical suite.

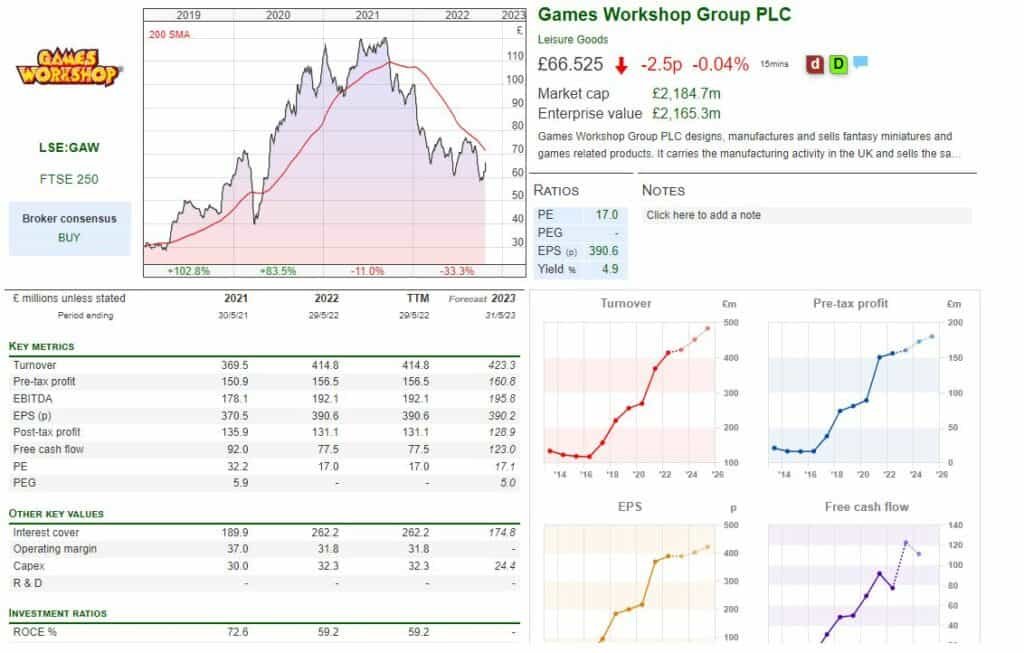

For example, you can look at financial ratios and results, as well as recent news and customise everything. Below is a screenshot of the Single Page Summary for Games Workshop.

You can also filter for stocks based of fundamental and technical factors, set alerts and alarms, and I use it daily because it houses everything I need under one roof.

GREYBOY You can take a risk-free trial of SharePad worth £74 through me here

Fundamental analysis vs technical analysis: conclusions

When it comes to fundamental analysis vs technical analysis, blending the two approaches to some extent has been done with success when it comes to making investment decisions. Obviously, if the fundamental and the technical factors support your decision, then the chance for a profitable trade has more going for it.

Long-term traders might use technical analysis to determine the right moment to get into a longer-term trend they’ve identified with fundamental analysis. Contrarily, day traders might use fundamental analysis to get a value of a company and the underlying business but focus on technical analysis for their individual trades.

Some of the most successful traders in the world use both these two methods to analyse securities and the markets to make accurate trading decisions for better market timing.

Try experimenting with a combination of both before settling on your individual trade strategy.

GREYBOY Sharpen up your fundamental and technical analysis skills with SharePad (1-month worth £74 free here)