Selling stocks and shares in an investment portfolio is an age-old problem for everyone who deals in financial markets.

Fear and uncertainty constantly play with emotions, forcing us to ask ourselves if we should sell shares in a stock. This is further exacerbated by the scarcity to miss more of the move, selling at a loss, and watching the stock rise and fall.

This article goes through when to sell stocks and how to deal more efficiently.

Why selling stocks is hard

Selling stocks is hard because our decisions are always driven by fear and regret.

- Fear of missing out (FOMO)

- Regret because you sold too early

- Fear of selling for a loss and watching the stock rise

- Regret because you sold too late

Some investors become attached to their stocks as if it is a part of their identity. They can become drunk on the narrative and only awaken from their stupor when the party has already ended and the stock price is crashing.

Luckily, there are some tell-tale signs of when to sell a stock and we can also create a strategy that we can follow.

How do you know when to sell a stock?

- Check for signs of problems appearing

- Balance sheet deterioration

- Watch for a chart breakdown

- Profit warning

- Extreme overvaluation

- Rising interest rates

Check for signs of problems appearing

You need to keep on top of your trades and investments.

If your investment can be seen, for example, if it’s a business on the high street, then you can frequent the shops and see if you notice any change in footfall.

You also need to set up RNS alerts so you’re updated when any piece of price-sensitive news comes out.

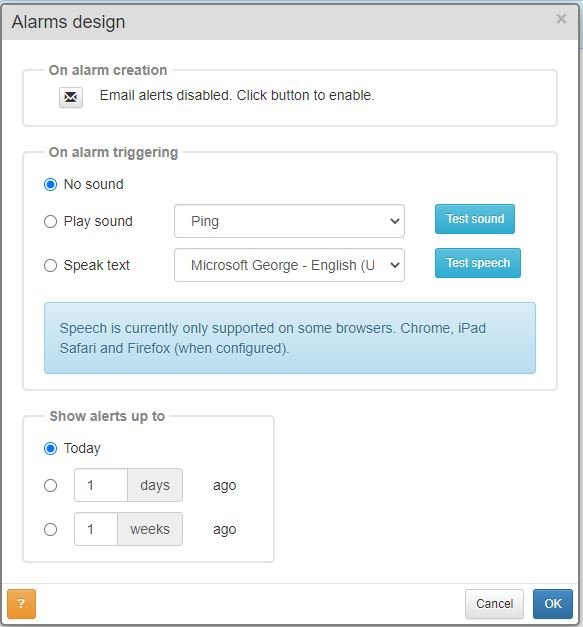

I use SharePad for this and you can set email alerts like the below:

This will mean that I get an email every time a specific stock releases an RNS.

Balance sheet deterioration

Another sign of when to sell is to look out for weak balance sheets and deterioration of the balance sheet.

A weakening balance sheet can mean a cash injection coming in the form of a placing – these are usually at a discount to the share price and mean more shares in issue.

You can check the company’s balance sheet by heading to the company’s corporate website and going onto the results.

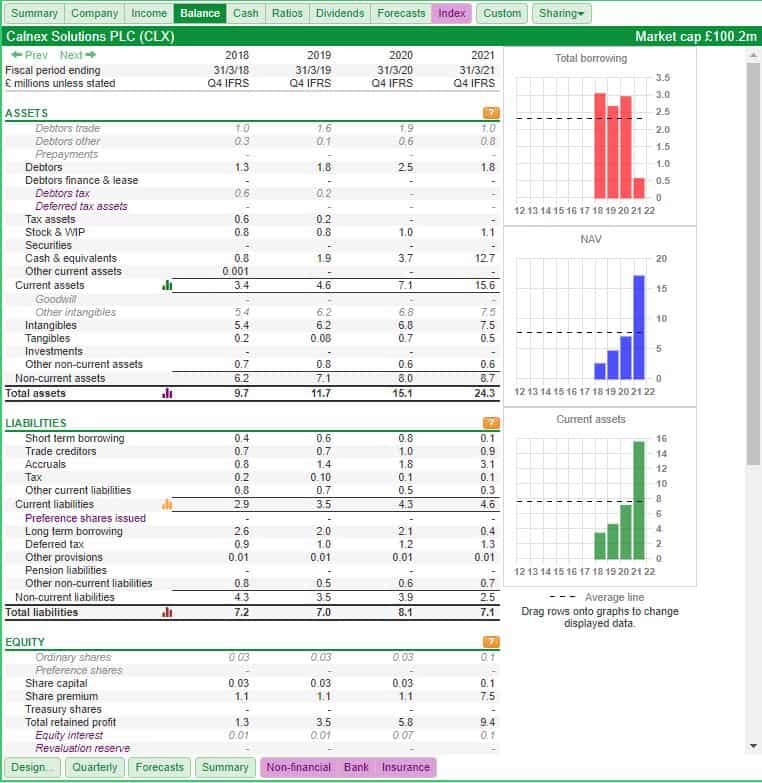

You can also use SharePad to search for the company, click “Financials”, then click “Balance sheet”.

We can see in the above example that Calnex’s cash position has been steadily increasing year on year.

However, it’s important to check the six-monthly report to see the cash position at that time.

It’s no good viewing the yearly balance sheet when there is an interim balance sheet that is more recent. You always want to be reviewing the most recent information.

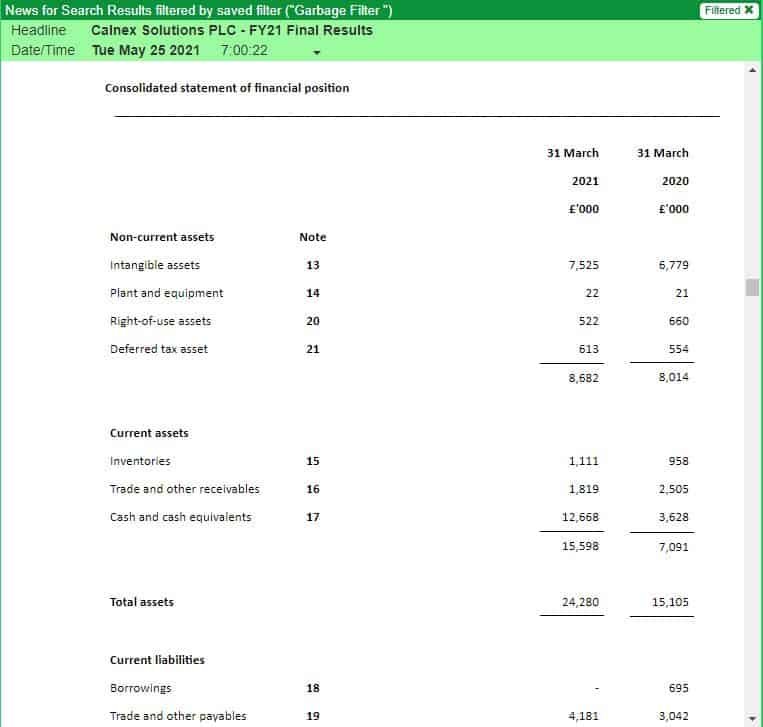

You can simply head to the company’s RNS announcements and go to the most recent results, and scroll down to the balance sheet (often called the Consolidation statement of financial position).

From there, you can get the most recent information about the company.

When looking at balance sheets, we want to see if the company’s cash position is healthy.

We also want to look at trade receivables. Are they growing year-on-year with cash balances declining? This could be an issue that the company is not collecting its cash fast enough and could lead to a cash flow problem in the future.

Watch for a chart breakdown

The chart is the ultimate indicator for when to sell because price doesn’t lie.

I use charts to time exits.

Follow the trend until the end when it bends.

Here’s a chart of Fevertree Drinks:

Notice how it trends upwards above all of its moving averages.

However, in the autumn of 2018 it falls heavily and fails to make a new high in the spring of 2019.

It was clear that the trend had broken and Fevertree fell to a low of 895p.

Watch out for charts where the price is rolling over and falling.

Profit warning

Whenever there is a profit warning in your stock then it’s usually best to just sell.

Profit warnings mean there has been an unexpected shortfall in making up the company’s consensus expected numbers. This can be for a variety of reasons but it’s never good news.

These problems can take months or even years to fix and the stock is likely to drift lower as nobody wants to buy damaged merchandise.

If I ever get a profit warning on my stock I take the hit, sell, and move on.

There are so many stocks out there and it’s not worth holding onto stocks where you could easily find better risk/reward opportunities.

Lots of investors are tempted to hold onto the stock until they get to ‘breakeven’ – but ask yourself two questions:

- Is this one of the best stocks to buy out of all the other stocks available on the market?

- If you weren’t holding this stock, would you be buying it now?

If the answer to either of those two questions is no then you know what to do. Sell.

Extreme overvaluation

This one is a contentious issue.

The best stocks will often trade on high valuations richer than your Gran’s Christmas cake – this is because they’ve earned their premium earnings multiples as star performers.

I remember looking at Fevertree back in 2016 and its financial ratios. The PE was incredibly high and so I decided to leave the stock in hopes of finding something cheaper.

However, the stock was clearly cheap for another two years at least because the stock showed it deserved its valuation.

The issue with extreme overvaluation is that stocks are priced to perfection. If something goes wrong, there can be an almighty collapse.

Below is a picture of THG (formerly known as The Hut Group, owner of MyProtein and other e-commerce brands).

It floated in September 2020 at a high earnings multiple.

But recently, shares of stock in THG were being sold off heavily by a shorter and that sparked a selling frenzy in the company’s shares. There was speculation of all sorts running rampant, and the stock took a bath of over 50% in little over a month.

It’s true the general market was not optimal at this time but shows how extreme overvaluations can sometimes be a reason to sell.

When there is plenty of greed in the market, nobody questions high price to earnings ratios. It’s human nature to run in the crowd the same way as your peers.

But when the price changes for the worst and the hype is removed, these stocks and the company’s valuation can tumble quickly.

Rising interest rates

Individual investors should pay attention to interest rates.

This is because it can make a change to the company’s business model or intrinsic value.

In bonds, rising interest rates means the rate of return goes up.

And if the rate of return goes up in bonds, then equity prices may fall lower in order to reflect that risk.

A stock’s value is only based on investor sentiment and outlook, and so selling your losers when rates rise may be something to think about.

Bonus reason: To take a tax loss

In the first place, everyone buys a stock to make a profit.

But not every scenario works out profitable, and sometimes when a stock hits a certain price it makes sense to take the tax loss if you have a large taxable total profit riding at the end of the tax year.

When to sell stocks at a profit

There is never a guaranteed method that will tell you exactly when to sell a stock.

You will never print the ding dong high or low.

Even following big director sells is not a reliable indicator of a stock topping out. It turns out directors are just as bad at timing the market as everyone else.

However, it is sensible to have a target price that you can sell at when the stock reaches the target price. You can set an alert or a limit order to sell on the SETS exchange.

One good method is to adopt the connoisseur method, named after the group of successful fund managers from the book The Art of Execution.

The ‘Connoisseurs’ believed that a good stock was much like a fine wine, and took small sips (small profits) along the journey, rather than gulping it down quickly (selling the lot too soon).

One advantage of being a connoisseur is that if there is ever bad news that quickly unravels much of the stock price’s progress, you will already have banked profits along the way.

One criticism of this method is that sometimes you can sell a good stock far too soon.

But it’s better to sell too early than too late!

Should you sell stocks at a loss?

As humans, we don’t like selling stocks at a loss. This is because we then have to admit to our egos that we were wrong.

However, selling stocks at a loss is an occupational hazard of dealing in the stock market and sometimes it is best to sell a stock at a loss before it becomes bigger.

The bottom line is that selling stocks for a loss is something you need to get used to doing.

If a business’s prospects are going downhill, it makes sense to sell the stock rather than holding onto a stock with a bleak future. Even if this is at a loss!

Warren Buffett once owned shares in Tesco and admitted he was wrong. He sold this for a loss but put the capital into a better opportunity elsewhere.

There is never a guarantee of success when you buy a share; you need to manage your risk/reward on the investment accordingly.

When to sell stocks at a loss

You should have a pre-defined exit in mind before you enter the stock. This is standard risk management.

You should know your exit by looking at the chart and picking a point where you will exit because your trade idea is wrong.

You can use my position size calculator to work out your total exposure in the stock by entering your entry price, stop loss, and amount in £ that you wish to have exposed to the stock.

If you’re getting slippage then you need to investigate this. Why is your broker slipping you? Are you trying to deal too much size in poor liquidity?

There is no shame in selling stocks at a loss. It’s part of the job and these costs should be expected.

“In this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”

PETER LYNCH

However, there is shame in knowing you’re wrong and staying wrong.

When to sell dividend stocks

Dividend stocks are bought for different reasons than growth stocks.

That means you’ll be selling them for different reasons too.

For example, people buy growth stocks for capital appreciation and the main focus is on the stock price and not the dividends it does or does not payout to its shareholders.

However, when investing in dividend stocks investors do care about the dividends the stock pays out to its shareholders. This is because investors buy dividend stocks as a source of income.

When looking to sell a dividend stock you should consider if the stock is able to cover the dividend several times over from its operating cash flows. You can work this out by looking at the cash flow statement of operations in the financial statements of the company.

Is it better to hold or sell stocks?

The big money in stocks is made by finding stock market winners and holding onto them. But you need to be holding the right stocks.

It depends entirely on your strategy. Are you a buy and hold investor? Are you a trader?

Beware of being a trader that doesn’t cut their losses and ends up turning a short-term trade into a long-term investment.

Pick your strategy and stick to it. If you’re a trader, then you sacrifice longer-term gains in the hope of short term profits.

And if you’re an investor then you sacrifice short term profits in the hope of longer-term gains.

Do stocks sell instantly?

Stocks are bought and sold instantly electronically through the Retail Service Provider (RSP) network and also on Direct Market Access (DMA) through the electronic order book.

The stock is then cleared through a clearinghouse and usually settles after a period of three days.

If the stock was a derivative such as a CFD or a spread bet, then there is no need for the stock to settle and the money is available to be withdrawn instantly.

Can I sell a stock for a gain and buy it back?

In the UK there is access to tax-free ISA accounts and spread bet accounts. An ISA account is a share dealing account with a tax-free wrapper.

Therefore, you can sell stocks for a gain as many times as you like and buy them back without needing to worry about tax.

The only way you would need to worry about Capital Gains Tax is if you’re dealing in a share dealing or CFD account (both of which are not tax-free).

There is a rule that you can’t buy and sell a share within the same 30 days in these accounts (this was to prevent bed and breakfasting during the new tax year where people would close positions and reopen them the next day).

What is the best time of day to sell stock?

There is no definitive best time of the day to sell a stock. However, spreads can be much wider at the open of the market meaning you may get a poorer price than later on in the day.

But if there is a profit warning and a reason to sell, then often it’s the sooner the better!

Can you sell stocks at any time?

You can sell stocks at any time when the stock market is open.

This is from 08:00 until 16:30 on the London Stock Exchange.

You can also deal in the uncrossing trade which will often be at 16:35 and a random number of seconds up to 30 for the uncrossing. This prevents people from gaming the book.

Become a better trader with SharePad. Use SharePad’s technique analysis suite and filtering to find stocks to trade. SharePad gives me an advantage over the market and you can take a risk-free trial through me. Find out more